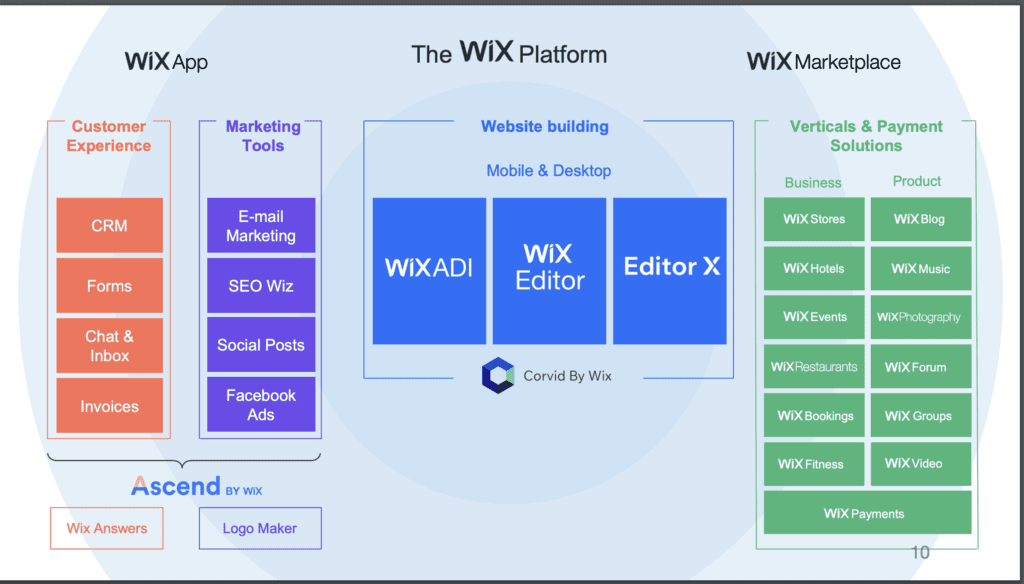

Remember when it seemed like websites were just a commodity? Well, it turns out, people care. They want a slick site that does more, from eCommerce to payments to marketing and more. And SMBs are back in SaaS. Especially post-Covid.

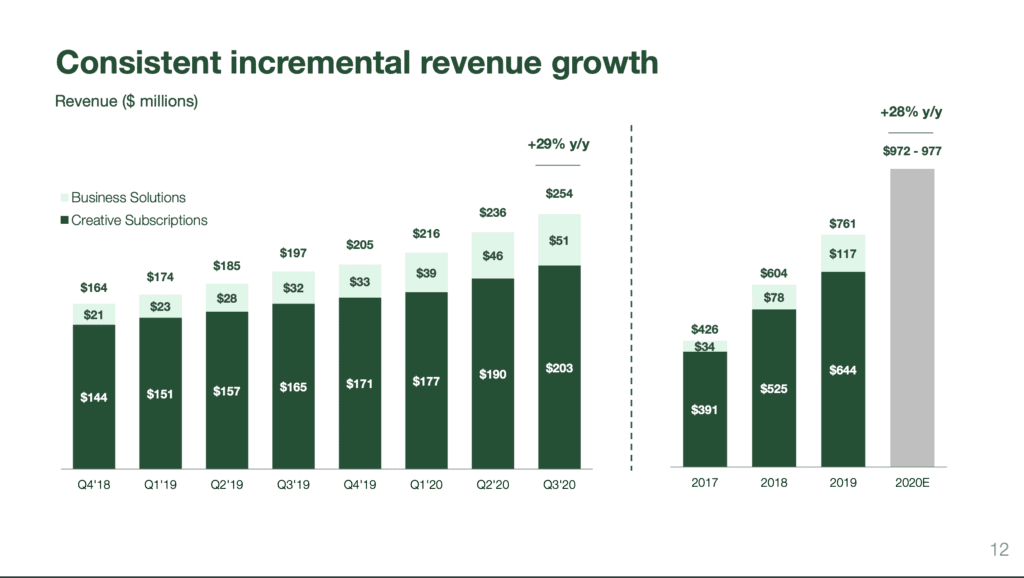

Wix has benefitted from those trends, not just crossing $1B in ARR, but growing a very impressive 29% year-over-year at $1B in ARR! And a $15B+ market cap!! An incredible journey from a fairly simple product at founding in 2006.

5 Interesting Learnings:

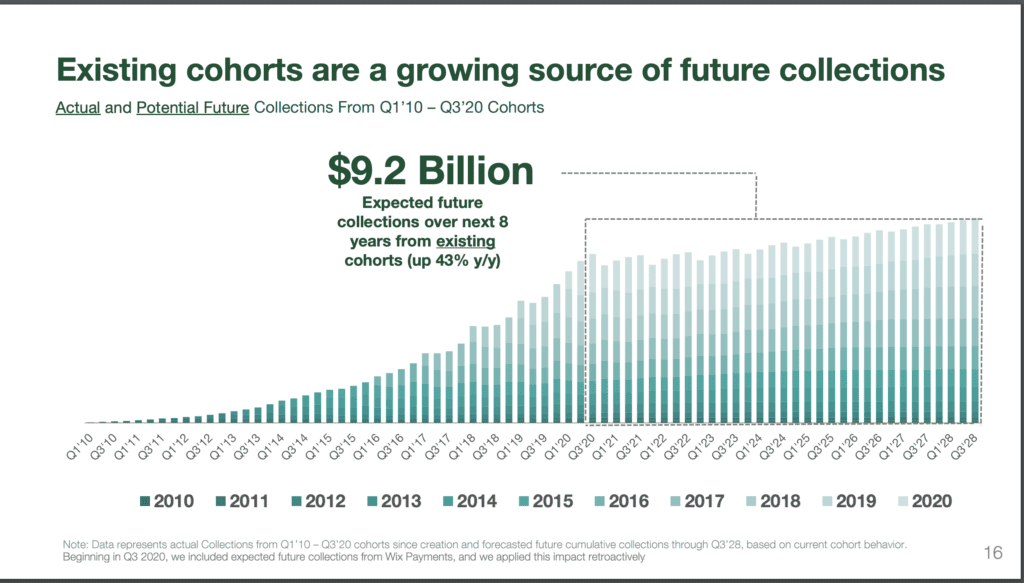

1. Existing $1B in Customer ARR is Worth $9.2B Over Next 8 Years. While Wix’s actual churn is a bit unclear, this is a super interesting presentation of CLTV. Wix sees its existing $1B of customers generating $9.2B over the next 8 years. That’s the power of recurring revenue. Almost $10B of power:

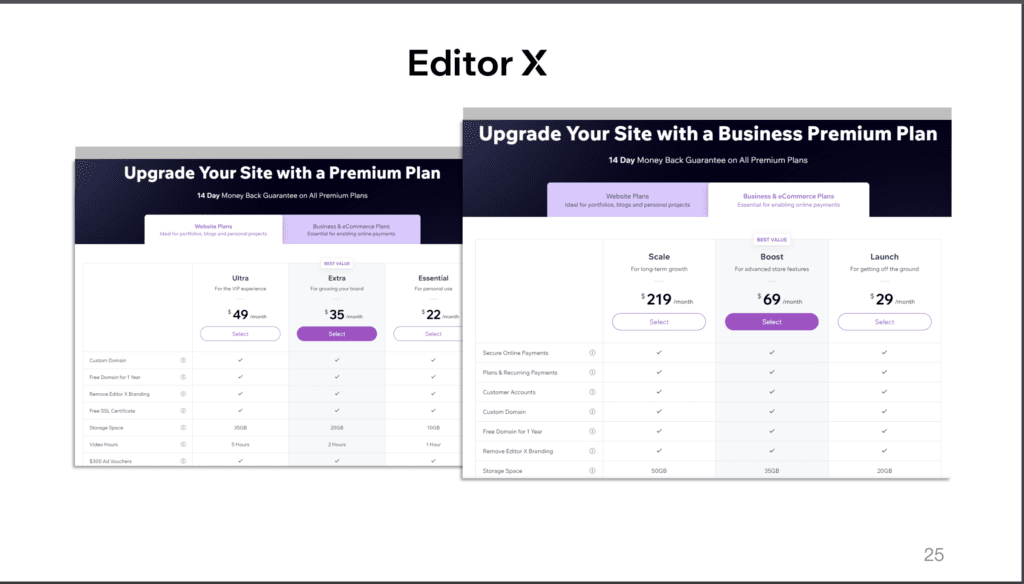

2. eCommerce and Business Tools Are Key Drivers to Accelerating Growth. Not surprisingly, Wix has benefitted from the eCommerce explosion since Covid. While their core website “Creative Subscriptions” are growing at a still impressive 23% year-over-year, their Business Solutions segment with e-commerce and more are growing 60% year-over-year at $200m in ARR.

To repeat 🙂 … Wix’s e-commerce+ products, its business segment, is growing 60% at $200m ARR.

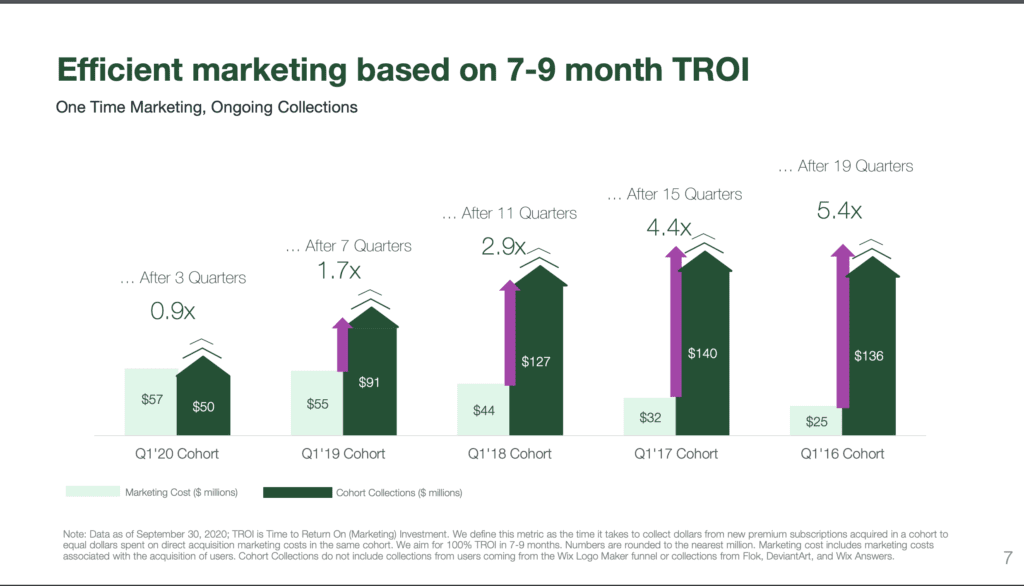

3. Efficient at SMB marketing — an ~8 month CAC. We saw in this series other SMB leaders like GoDaddy and Xero need to get well into Year 2 to go profitable on a new customer, but Wix gets there in just 7-9 months. Impressive.

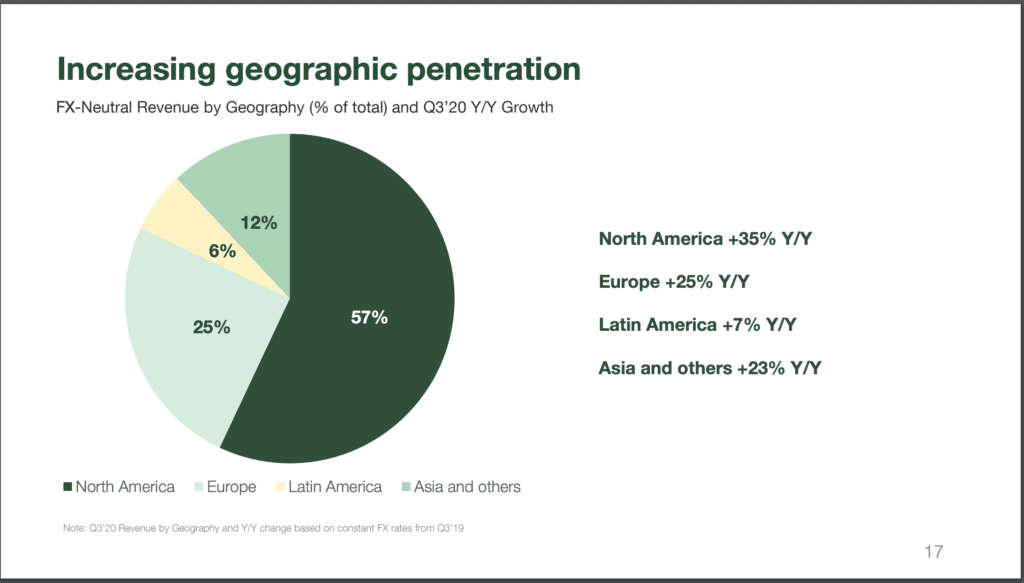

4. 43% of Revenue Outside the U.S / North America. This may be in part due to Wix’s original Israeli roots, but an impressive 43% of revenue is outside the U.S. / North America. A reminder to really lean in when you find yourself being pulled outside of your core market. Go where your customers are.

5. 70% Gross Margins — and that’s OK. But much lower in Payments. Wix’s overall costs are higher than some SaaS leaders, and its fast-growing Business Solutions segment has only 29% gross margins, due in large part to Wix Payments costs Wix can get away with lower margins in this segment for now given the 80% margins in websites. Blended together, margins are still 70%. But they’ll need to be careful to keep margins at the 60%+ level expected of software companies as Business Solutions revenue grows.

A huge congrats to everyone at Wix. Quite an incredible SMB success story!

And a few other great ones in this series:

- 5 Interesting Learnings from Zendesk. As It Crosses $1B in ARR

- 5 Interesting Learnings from HubSpot as It Approaches $1 Billion in ARR

- 5 Interesting Learnings from RingCentral. As it Approaches $1B in ARR.

- 5 Interesting Learnings from Palantir at $1 Billion in ARR.

- 5 Interesting Learnings from Slack at $1B in ARR

- 5 Interesting Learnings from PagerDuty, as It IPOs

- 5 Interesting Learnings from Zoom at IPO

- 5 Interesting Learnings from Bill.com at IPO

- 5 Interesting Learnings from Asana at $250,000,000 in ARR

- 5 Interesting Learnings from Qualtrics at $800m+ in ARR

- 5 Interesting Learnings from Xero. As It Approaches $1B in ARR

- 5 Interesting Learnings from Snowflake at $600,000,000 in ARR

- 5 Interesting Learnings from New Relic at $650,000,000 in ARR

- 5 Interesting Learnings from Box At $800,000,000 in ARR

- 5 Interesting Learnings from Atlassian at $2B in ARR