So few companies have changed as fast, and as quickly, as Zoom did between $1B and $3.5B ARR … which it did in just 1 year (!!) during peak pandemic… and then again $3.5B and $4B ARR, when Zoom radically changed once more.

At $3.5B ARR, Zoom was an SMB powerhouse, with Enterprise growing but still not the dominant engine. At $4B, everything’s been flipped around. SMB is now saturated at $4B ARR and not growing, but Enterprise is picking up the slack and growing faster than ever.

Growth has for now slowed to 12% overall during the “Covid Hangover” — down from a crazy 396% during Peak Covid — but Enterprise is growing 31% and leading the charge going forward.

5 Interesting Learnings:

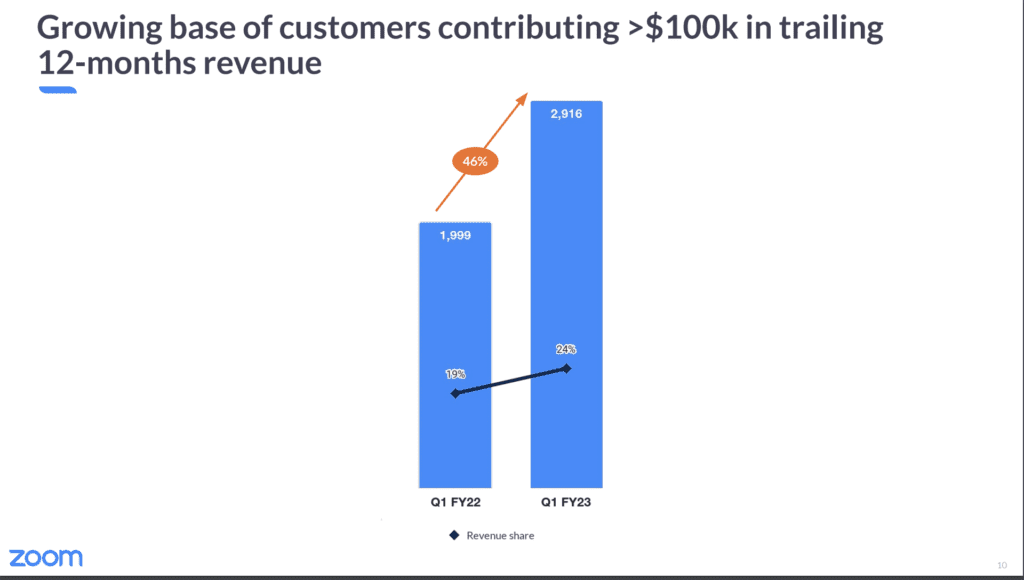

#1. $100k+ customers are now the engine, not self-serve SMBs. These 2,900+ customers are growing 46% year-over-year. This trend started several years ago, but even in 2021, 63% of Zoom’s revenue was still from 10 seat or smaller customers. That doesn’t look to be the case going forward:

It looks like Zoom finally saturated the SMB market, at least to a large extent, albeit not until $3B+ in ARR.

#2. Sales & Marketing Spend Is Still Tiny at 25% of Revenue, But Up From 20% As Zoom Goes More Enterprise. Zoom still spends half what the average public SaaS company does on sales & marketing — just 25% vs. 50% of its revenue as do most public SaaS companies. But as one might expect, that’s finally going up as it builds out its enterprise sales team and motions further.

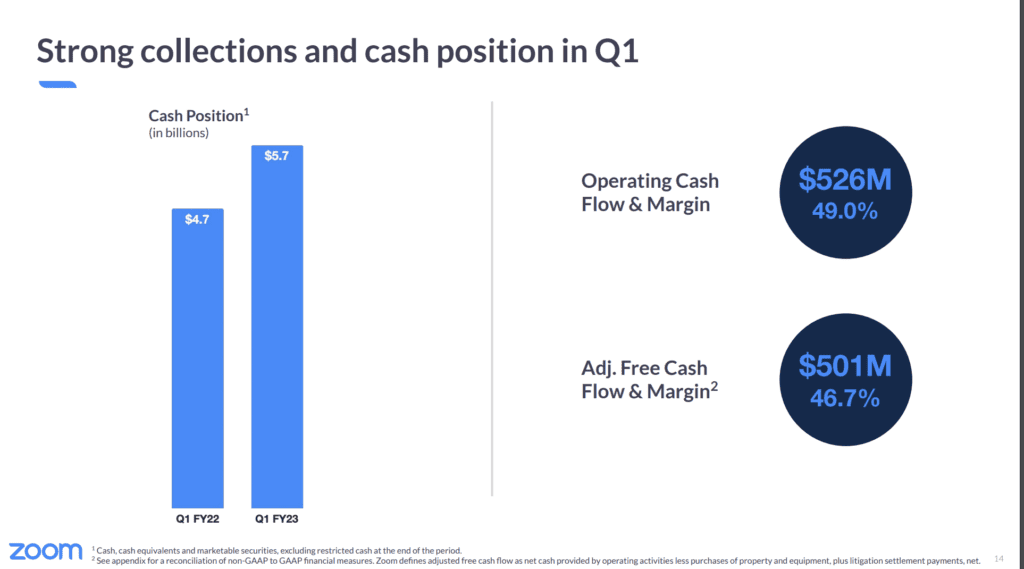

#3. Generating a jaw-dropping $2B of adjusted free cash flow per year. Even with slightly higher sales expenses, Zoom is a cash-generating machine. The greatest PLG engine of all time, at least up to $4B in ARR. Almost half of every dollar they take in turns into pure cash.

#4. Enterprise NRR is now 123%, but than means SMB is now well under 100% for the first time. It seemed like Zoom could defy the churn we see with so many SMB self-serve apps, but in the end, it couldn’t as it approached $4B ARR. Still, with so much change, we’ll see where NRR stabilizes at. It was 130% for so long. It may well get back there, even for SMBs.

#5. Multi-product expansion is in full force now, although probably a little late. Zoom has one of the best teams in the world, and the fact that the crazy Covid growth couldn’t last forever was clear to them. So they tried to aggressively expand its platform by buying contact center leader Five9 for $14.7 Billion. But at the time, the price didn’t clear, and Five9 shareholders turned it down. Zoom’s phone product has been a material contributor for some time with 3 millions users, but it’s now pushing its own enterprise contact center and conversational intelligence products which are still early in their revenue ramp. They’ll have success, but they got started too late to have a material revenue impact at $4B ARR. It will take some time.

Wow, just a crazy ride for Zoom. They grew faster than any other SaaS company in history after $1B in ARR. But probably too fast, as CEO Eric Yuan often pointed out. It wasn’t natural. It was probably too much. Zoom the app held up incredibly. But they went from $1B to $4B ARR so fast, now they’ve got a little catching up to do as they move more enterprise.

It will be fascinating to watch.

Zoom CRO Ryan Azus shares a lot of that recently journey here: