Dear SaaStr: Will Peloton Be Filing Bankruptcy or Selling Within 2022?

Bankruptcy: No.

Almost Run Out of Money: Probably. They are already running out now.

Sell: 50/50 chance

…

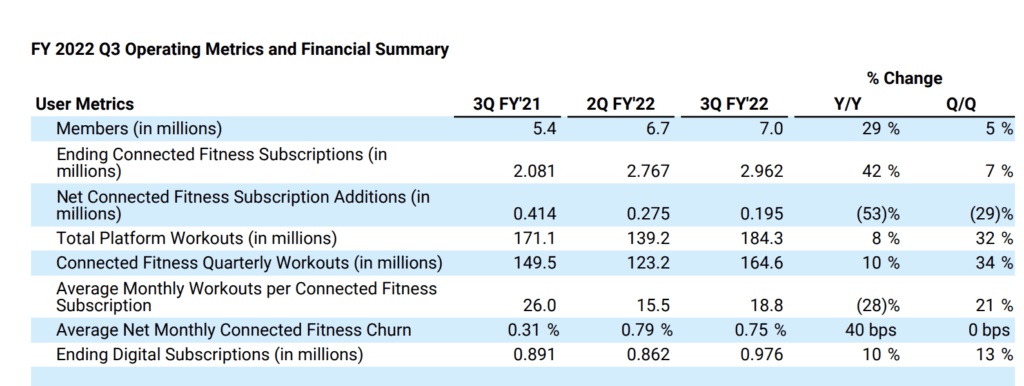

Peloton has built an epic fan base and a strong subscription business. In fact, as a SaaS business, Peloton would be in a pretty strong position today, albeit one with a bit of a “Covid Hangover” like Zoom. Even now, its subscriptions are still growing, albeit with some churn and other headwinds:

But the hardware side is just hemorrhaging cash:

The balance sheet challenge has been managing inventory. We have too much for the current run rate of the business, and that inventory has consumed an enormous amount of cash, more than we expected, which has caused us to rethink our capital structure (more on this in a moment).

Right now, the company is burning $500 million a quarter — and negative $750m in free cash flow last quarter — and even after a recent (and expense) debt raise, it “only” has $1.6 billion in cash on hand. That’s not even a full year. They are arguably not a “going concern” at the moment and on paper have insolvency risk:

But the core business is just too established and strong. Peloton will pull it out, lower its burn, raise more cash, and/or sell itself.

As we begin to sell down our excess inventory, the current cash flow headwind should become a tailwind in FY23. Our goal is to restore the business to positive free cash flow in FY23.

Bankruptcy though, while theoretically possible given the cash reach, in practice isn’t likely.

Its current market cap is only $4 Billion. This is arguably a bargain for a top tech leader to pick up.

https://seekingalpha.com/article/4509478-peloton-down-80-percent-in-6-months-but-dont-buy-this-dip-avoid