So the story of the past few years has been the explosion of SaaS and Cloud unicorns. With upwards of 400 SaaS and Cloud startups now valued at $1B+ now (out of 1,200+ total Unicorns), times are good.

But … but … it’s not that simple. VCs and investors in unicorns need to make money. They need them to become … decacorns. Especially the later stage investors do.

So what are late-stage investors expecting?

- Well early-stage (seed, Series A) investors are hoping at least 1 investment per fund does 100x or more. You can do 100x as a seed investor on a unicorn if the valuation isn’t too high, but even there it can be hard if the entry price and/or dilution was high. A Series A investor will need a decacorn to do 50x-100x on the first check into the top investment in a fund,

- Late-stage investors are hoping for a few decacorns per fund ($10B or higher outcome). Late-stage investors, by contrast, are hoping that at least a few do 10x.and a bunch that do 2x-3x (maybe a $3B-$4B outcome on a $1B valuation), some at 1x-2x, and a few that do worse. To do 10x on an investment or two, they need decacorn+ outcomes.

This is harder to see happening these days.

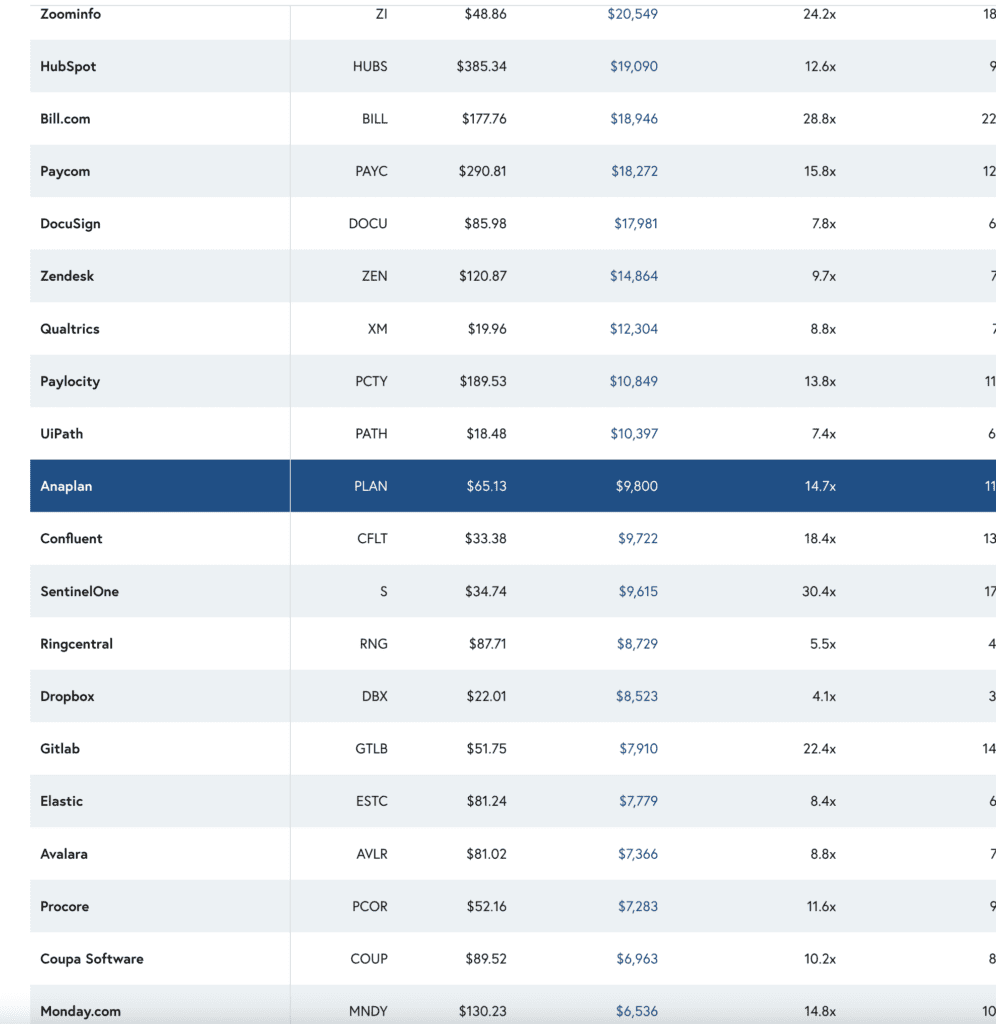

With the fall in valuations, it’s just a lot harder to be a decacorn. The decacorn “line” is Anaplan as of the day I type this. Everything from Anaplan down … isn’t a decacorn. At least, not anymore, not for now:

So to raise money at $1B, that means at least today, at least for now, you’re saying you’re better (or at least, will be) than Monday, better than Coupa, better than Procore, and goodness, better than — Gitlab, RingCentral, SentinelOne, and Confluent. And so many of those are just growing at jaw-dropping rates. That’s the bar. To do better than those ones, to raise at a unicorn valuation now.

It is what it is right now. SaaS remains on fire from a customer perspective, but not so much from a public markets perspective. UiPath was on fire at IPO, worth $40B+ and now today is “just” a decacorn at a $10B valuation. Still epic. But not really enough to have supported some of the crazy valuations we’ve seen in the past few years.

Just bear in mind how things have changed. It sounds fun to make Unicorn status. But the implicit bar from that milestone is just so high today. So high.