There is an explosion of Big Data and analytics happening right now outside of your cloud perimeter. The advanced analytics market alone will be worth close to $30 billion by 2019 per Markets and Markets, and we’re already seeing close to 200,000 open positions for data engineers and data scientists on indeed.com from companies such as Bloomberg, Walmart, Verizon, and Sony per DataCamp. This will completely transform how your customers adopt technology and increase their appetite for data.

Are you sitting on “data gold”?

Your clients are investing significantly in their own analytics capabilities, which is mostly noise to many SaaS companies. But other SaaS companies are recognizing the increasing strategic value of their application data to power customer analytics. They’re capitalizing on the opportunity by exposing Data APIs that establish new revenue channels, reduce churn and differentiate from competitors.

Introduce new revenue channels to your business model

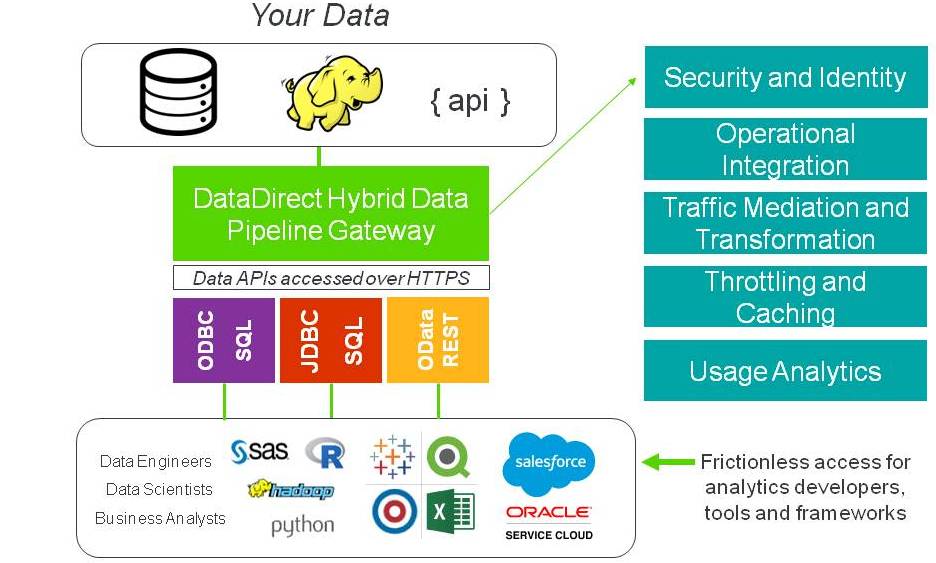

Organizations are investing heavily in analytics, giving SaaS vendors a strategic opportunity to monetize their data. SaaS APIs are primarily provisioned for application and process integration that leave many of your customers’ analytics professionals behind, such as data engineers, data scientists or business analysts. In contrast, Data APIs are designed for frictionless data integration for analytics workers and infrastructure through industry standard interfaces such as OData (REST) or ODBC/JDBC (SQL).

Progress provides Data API Management solutions for SaaS companies to rapidly deliver this capability in months so you can focus on your core business.

NetSuite is an example of a SaaS vendor monetizing their SuiteAnalytics data by offering a BI connector (ODBC/SQL). To further illustrate the value of supporting open standard Data APIs, Salesforce sells access to data for reporting using Salesforce Connect (OData/REST) that starts at $4,000 per month.

Reduce churn using sticky integration with analytics

There will always be alternatives at renewal time, but your commitment to customer analytics will reduce churn. By offering an integration strategy focused on analytics, your customers will maximize use of your application data with their latest investments in advanced analytics to be consumed by key decision makers. Switching to a competing SaaS application can stall your customers’ analytics delivery by months, or even years.

ServiceNow is one of the fastest growing SaaS companies for enterprise software, and offers ODBC/SQL access to get plugged into their customers’ external reporting infrastructure.

Competitive advantage in a crowded SaaS market

There are many SaaS companies and Data API management for analytics remains a strategic opportunity to differentiate, in contrast to APIs for application integration. Data APIs can be rapidly deployed alongside an existing API layer with limited dev time.

With a comprehensive analytics strategy that includes Data APIs, NetSuite was able to better compete with established players in their market to expand their customers base before and ultimately get acquired by Oracle for $9.3b.

This is a sample of SaaS providers offering Data APIs either directly or through a partnership (ODBC, JDBC, OData):

- SAP SuccessFactors

- Oracle Service Cloud

- Microsoft Dynamics CRM

- NetSuite

- Plex Systems

- Acumatica

- Marketo

- SAP C4C

- Salesforce

- And more …

Learn how to monetize SaaS APIs with Open Analytics

From this datanami article, “open analytics” is the integration of an open data access layer into business applications to be directly consumed by external analytics tools and popular programming languages. Data APIs deliver an open analytics strategy for your SaaS application that creates new revenue channels, reduces churn and beats the competition. Progress partners with SaaS companies of all sizes, from $0-100m+ ARR, to deliver these capabilities.

Read this whitepaper to learn more about Open vs Embedded Analytics, Decision Criteria for Cloud ISVs.