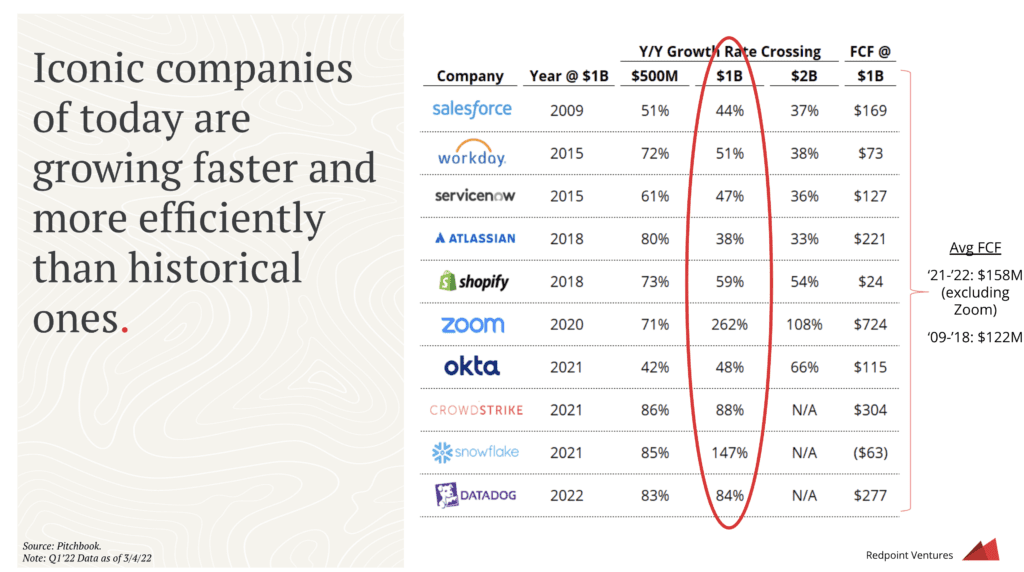

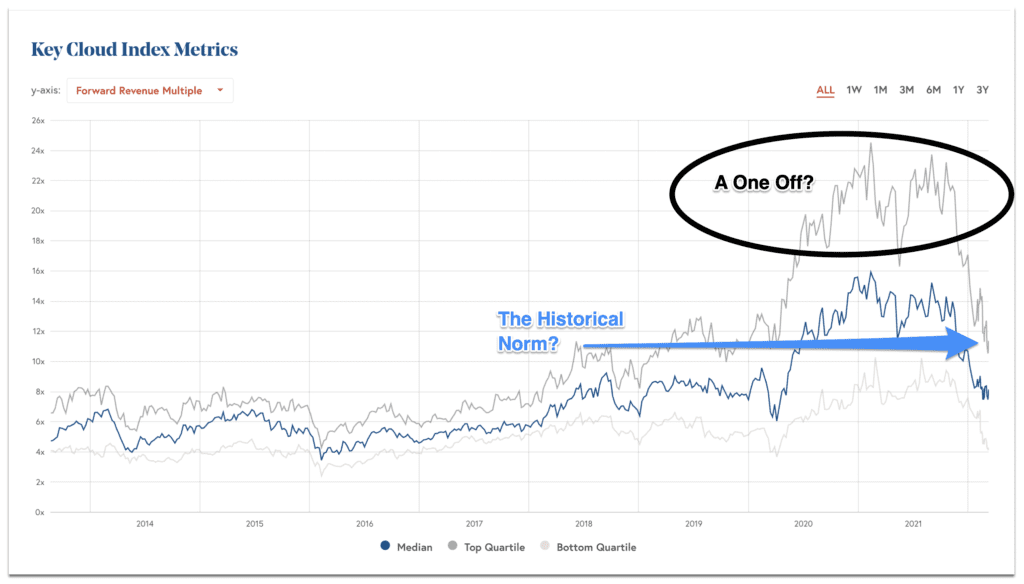

SaaS investor Logan Bartlett put together a good summary of the tumult in the SaaS public markets here. I like it because it models out two scenarios — one if the current downturn is like 2008, another if it’s like 2000. Personally, I think this contraction will be less severe than either. Why? While SaaS multiples may have gotten too high, the best SaaS companies are growing faster than ever. So much faster. The bounceback IMHO will be fairly fast. The question though is what multiples … things will bounce back to. Perhaps they will never be quite as high as the peak of Q3’21.

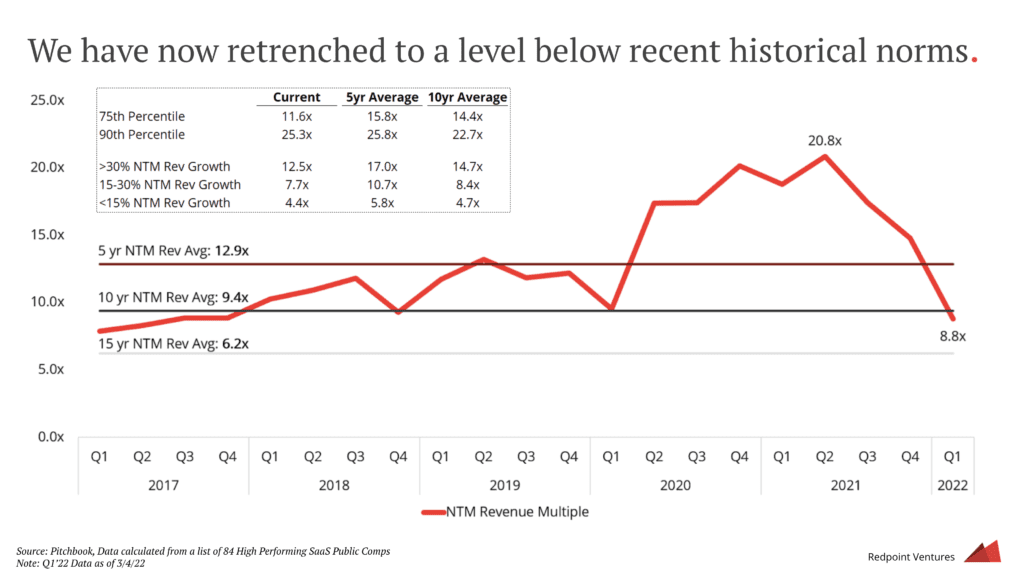

You can view the whole presentation here but this slide was perhaps the most salient summary of where we are at today in SaaS:

Just look at the chart above. Top SaaS company multiples in just a few months have fallen from an all-time high of 20.8x next year’s revenues … all the way to 8.8x, below historical averages. Even with just draw-dropping growth from SaaS and Cloud leaders.

There’s a few conclusions you can draw:

- The late-stage market, in particular, is really hurting — for now. When multiples are below the norm from 2017-2020 now, that’s bad. Too bad IMHO.

- It’s now easy to see SaaS stocks now as oversold. With the best SaaS companies growing far faster than ever — how can multiples we lower than historical norms? Yes, interest rates, inflation, etc. etc. But still.

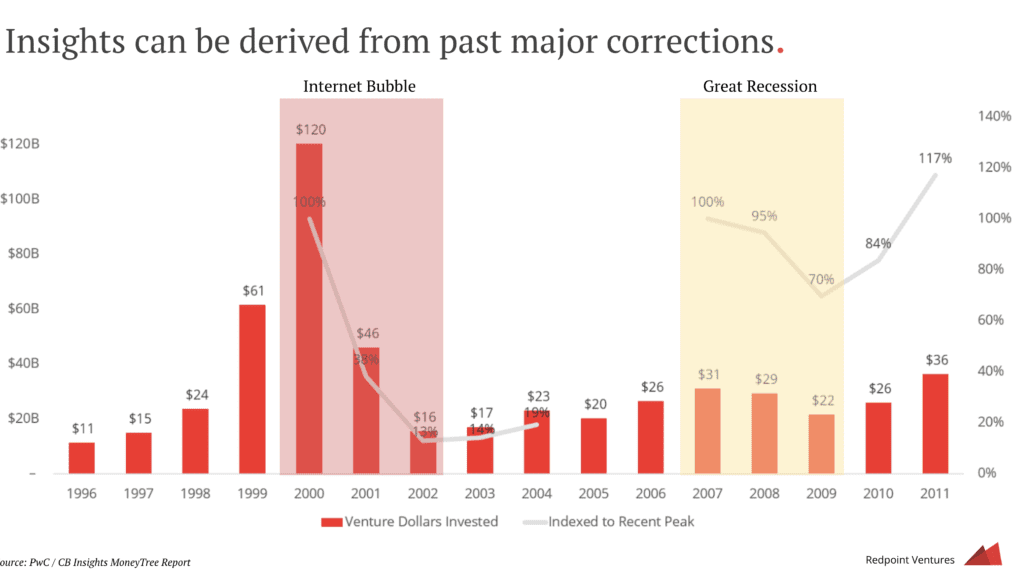

Redpoint looks at What If this downturn is like 2008, or even 2000? The bounceback was quicker and less severe in 2008, but both took … a long time. Personally, I see no similarities to 2000, but others do. For either downturn, contrast that to the March 2020 downturn, which literally lasted just weeks:

I predict a somewhat painful blip. But a short one. Times are too good in SaaS. I mean, GitLab alone just grew 69% last quarter at $320m in ARR. But let’s see. This stuff is hard to predict.

But the next few months and quarters could be the worst time to raise growth and expansion capital in quite some time. The multiples are just … so low. And so much lower than just a few months ago. And still dropping.

A related post here: