So every VC is trying to figure out exactly what is going on in the public markets, and many later-stage VCs are quite stressed.

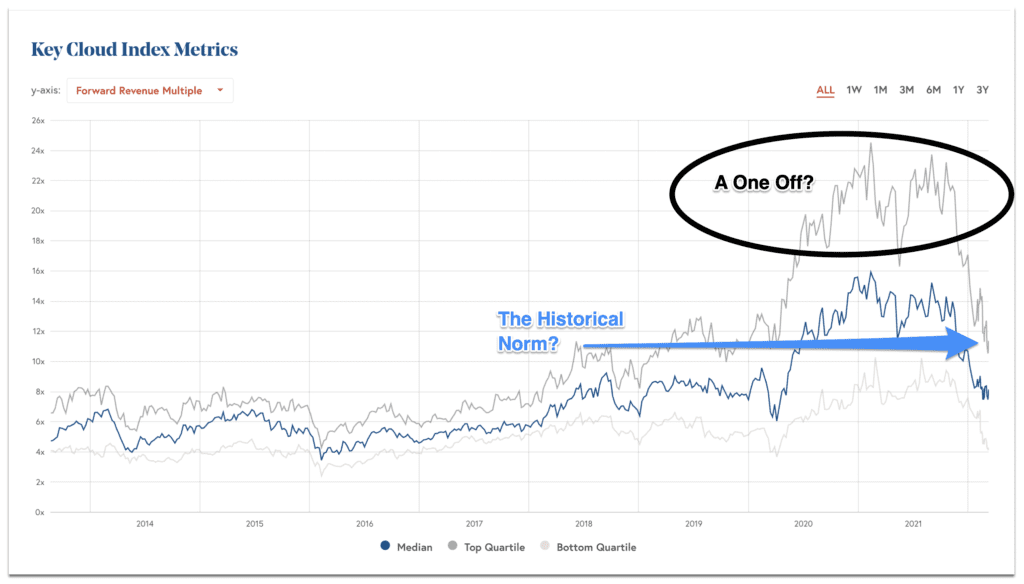

This version of the BVP Nasdaq Index illustrates the question. Was the “Covid Boost” in Cloud multiples just an anomaly?

Put differently, if you look at multiples of revenue for top SaaS and Cloud companies above from 2014-2022, you could come to one of (at least) two conclusions today:

Conclusion #1: Q2’20-Q4’22 Cloud Revenue Multiples Were a Covid Anomaly. Multiples exploded when we all lived in the Cloud, quarantined in whole or in part in the Cloud. But those days are behind us, for most of us. And so, Cloud multiples have rationally fallen back to where they were in 2018 and 2019.

US ecommerce penetration is back to its pre-covid trend line.

As per current trajectory – high likelihood of H2 acceleration in ecommerce sales.

H1 growth looks like 8-10% y/y

H2 could be 12-15% y/yLot depends on how the consumer sentiment sustains though pic.twitter.com/hZbHxysGt6

— Vivek Goyal (@Goyal_Vivek) March 11, 2022

Conclusion #2: It’s Just a Rocky Reentry into a Post-Covid World, and Cloud Stocks are Oversold. The argument here is multiples have fallen too far, since the best SaaS and Cloud companies are growing so, so much faster than in 2018 and 2019. I mean, Snowflake is growing 110% at $1B+! HubSpot is growing far faster at $1.5B than at $1B in ARR. Etc. etc. Whoa. Multiples are too low today, given that the best SaaS and Cloud companies not only are growing faster than ever, but are even accelerating at scale. Growing faster at $200m, $300m, $1B in ARR than before. Conclusion #2 might suggest multiples, in the end, should land somewhere in the middle between the Q3’21 peak and the relative lows of Q1’22.

Personally, I’m too bullish on the incredible growth of SaaS leaders to think it was all a One-Off. Yes, some categories like digital events experienced a one-off benefit they may never see again. And e-commerce got a boost, but not quite the boost we thought, from Covid. But overall, the growth of top SaaS companies is still epic.

I’m betting SaaS multiples will end up higher than 2018 and 2019, but lower than the peak of 2021. That just makes sense. But — I’m a startup guy. I’m not truly an expert here. Just an expert in how the best SaaS companies grow faster, with a higher quality of revenue, than ever before.

But in any event, these 2 different Conclusions from the above chart and data are driving different VC behaviors. Late-stage investors that believe the multiples we have today are the enduring multiples in SaaS are worried, and glum. Their investments are down on paper, and they’ll be reluctant to pay anything close to the prices they paid the past 24 months. Late-stage investors that remain a bit optimistic here will be cautious, but keep deploying Series B, C, and D stage capital, albeit perhaps at lower prices and with more scrutiny. Seed investors that are optimistic haven’t yet changed much. Seed investors that see multiples reverting to the past are becoming much more price-conscious.

Not sure why multiples would go back to where they were

— Tom Loverro (@tomloverro) March 10, 2022

Either way, that’s a lot more stress in the VC ecosystem right now.

WSJ: Tiger Global Manage-ment’s hedge fund lost 36.7% from November through February, while D1 Capital Partners lost about 25% in its portfolio of public investments. 👀

— E-BIT-dee-AY Exit Multi🅿️le.usd 🇺🇦🇺🇦🇺🇦🇺🇦 (@ExitMultiple) March 10, 2022