By Todd Gardner, Founder and Managing Director, SaaS Capital

I had an entrepreneur ask me a few weeks ago – “What are SaaS companies ‘going for’ these days?” Here’s the answer I gave him.

How to value a SaaS company?

I said, well, it depends on a number of factors, but four and a half times annual run-rate revenue is average. His response was – “What? You have to be kidding me! Last time I checked they were going for 10 times revenue!”

And so it goes; the opaque, confusing, and highly volatile practice of valuing a private SaaS business is frustrating for entrepreneurs and investors alike. Furthermore, the lack of transparency adds a tremendous amount of friction to a capital raise or the sale of a company.

The reality is, it’s not all that hard to get a quick read on your SaaS company’s valuation. As discussed in our recent white paper, How to Value a SaaS Company, the two most important things to know are: what are public SaaS companies “going for,” and how fast is your business growing relative to its peers. These two pieces of market data will get you 75% of the way to an answer, and three or four internal metrics will get you the rest of the way there.

The conversation above may seem like a “buzzkill” to entrepreneurs, but that is not the intent. Quite the opposite in fact. Our valuation guide summarized below is meant to help you properly position your SaaS company to get the highest valuation possible. It will also be helpful in determining the amount and timing of a future equity raise. And as a side benefit to CEOs attending the SaaStr Annual conference, you will benefit from knowing that the vast majority of the CEOs sitting around you in the audience did NOT raise money at 10X revenue, even if a few of them on the stage did.

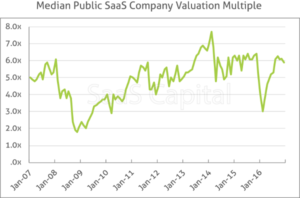

The SaaS valuation process starts with the current median revenue multiple of public SaaS companies. The chart below shows the historical trend, but go here to pull the most recent data. Make sure to get the revenue multiple based on the current year expected revenue.

Once you have the most recent multiple, subtract 1.3 to get the current private multiple based on ARR (annualized run-rate revenue). Private multiples are lower because smaller, private companies are generally riskier and their stock is not easy to sell. If the public multiple were 7.0 times revenue for example, then the average private ARR multiple would be 5.7 times.

The 1.3 times revenue discount was derived from internal private SaaS company data and from 451 Group data based on hundreds of M&A events and fundraisings in 2014, 2015, and 2016. The private discount to public valuations is relatively constant over time.

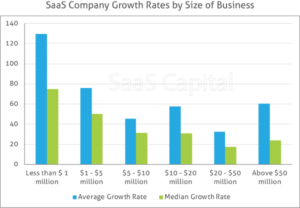

Building from there, the key company-specific metric is revenue growth rate. But it gets a little tricky here because to get a higher multiple, your company must be growing faster than other similarly sized SaaS companies. It’s easier to grow quickly when a company is small, and so the growth premium varies by company size.

The chart below shows the average growth rate for different-sized private SaaS companies based on the 2016 SaaS Capital survey of 400 companies, and this should be used as your benchmark. If your company is growing faster than average for its size, the business will be worth more than the 5.7 times calculated above, and if it’s growing slower, it will be worth less.

How much of an impact the growth rate has on valuation can be estimated based on public SaaS company values. A rule of thumb would be if your business is growing at twice the average rate, the valuation multiple would grow by 50%. For example, a $3.0 million SaaS company growing at 100% (twice the rate of its peers) would get a growth premium of 2.8 (50% of the baseline multiple of 5.7), making it worth about 8.5 times revenue, or $26 million dollars. Similarly, a $60 million SaaS business growing at 50% is also growing twice as fast as its peers, and would also garner a similar growth premium.

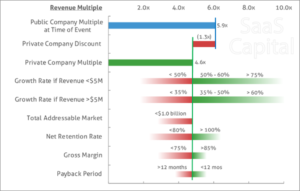

There are four other metrics that will impact a company’s value beyond the current state of the public market and its growth rate. They are:

- Size of the addressable market

- Retention rate

- Gross margins

- Capital efficiency.

Do better than “average” on these factors and the valuation multiple will go up; do worse, and it will go down. The chart below can be used to estimate the overall impact of each factor.

The fact of the matter is, private SaaS companies, on average, were never “going for 10 times revenue.” Only a few outliers achieved those valuations. The reality is a little less sexy, but still very healthy, and knowing where your business stands based on real-world data will give you an advantage in negotiating the best possible outcome for your company. For a more detailed look at this topic, download the full white paper How to Value a SaaS Company.