A life poorly lived is a trap

Go for it at least once

— Jason ✨Be Kind✨ Lemkin (@jasonlk) May 5, 2023

BusinessInsider had a great story a ways back on Datto’s $1b exit to Vista Private Equity (more on the role of PE in SaaS here). So much of it resonated with me, especially the story of the CEO’s 10-year journey, and turning down an earlier $100m offer to sell. A decent offer to buy your company is so rare. Founders think it is common. M&A is not. Most founders never get a decent offer to buy their company. And those that do in SaaS, often only get one or two. Assume you get few-to-no offers to buy your startup. Ever.

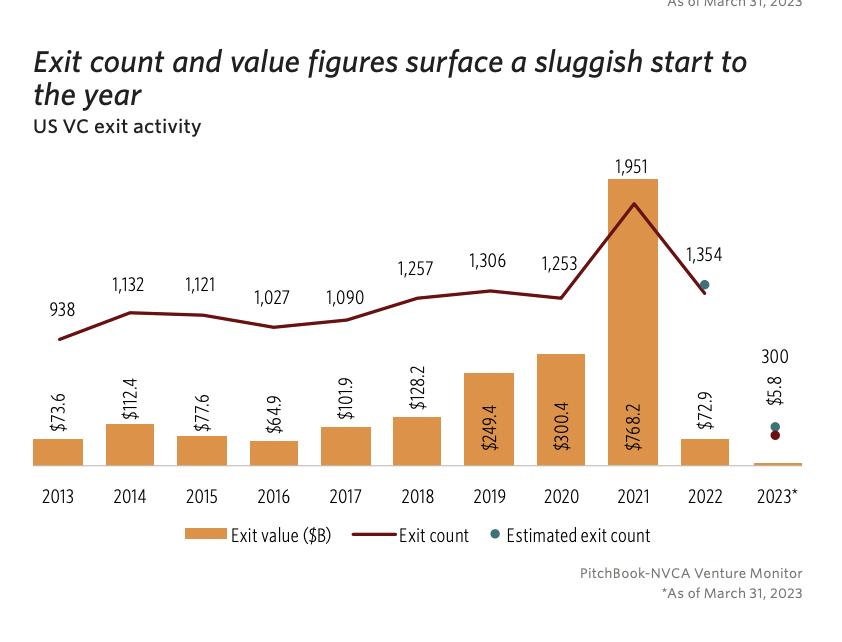

And it’s even tougher now. Take a look at the latest Pitchbook data here. Acquisitions are way, way down:

So saying no is so risky.

Generally speaking, there is no sane reason not to take the first, good exit. You have $0 now. Making $2m, $5m, $10m if you have $0 in the bank is so insanely significant. And those extra few millions beyond that? Not that important.

Unless you count the size of your house at the Yellowstone Club as personally meaningful, unless you truly need to flex and/or can’t live within your means, there is no meaningful quality-of-life difference between making $5m-$10m and $50m-$500m. Not really. You can take care of your family. Do what you want in this world. Live your life on your own terms. Put the kids through college. Buy a nice enough house. Travel the world. You don’t need to roll the dice any further and risk losing it all. Not logically.

In the first start-up I joined, we sold for $1b quickly thereafter, and I was worth $12m on paper. For a few months. And then it all evaporated. To $0. It took me years to recover. Years to get over it.

In the first start-up I joined, we sold for $1b quickly thereafter, and I was worth $12m on paper. For a few months. And then it all evaporated. To $0. It took me years to recover. Years to get over it.

So sell. Unless — you can see the future. In a way others can’t. And it says otherwise.

As a first-time founder, your risks are so high. Probably, your bank account is $0 or negative. You’ve put years of your life into this. You have no back-up plan.

And then, after years of hard work, and finally dragging this to million of revenue … you get an offer to sell for $10m. Or $20m. Or $50m. Or whatever.

You have to take it. There are less than a hundred of these exits a year, across all of tech. And as the price goes up, the buyers get even fewer and farther between.

Anyone logically would tell you to take it. Spock would tell you to take it.

And yet … here’s the thing. Usually … that first pretty good offer comes in just when it is getting good. That’s why and when the first decent offer finally comes in.

You are a founder. You know. You know if you are going to get crushed, or if you’re just getting this darn thing finally off the ground. Finally getting to escape velocity.

If it feels right to push on, don’t sell. If it feels like you are just rounding second, don’t sell.

That feeling distills why we do it all. This crazy thing of starting companies. It is crazy. The last thing you’ll want to do is sell just when it finally gets good. Just when you are about to really take off. Don’t sell then. Even if logic says otherwise.

If you don’t feel it, though. Take the money and run. Odds are, risk and time adjusted, you’ll never get a better offer again. Or maybe even never another offer at all.

(note: an updated SaaStr Classic post)