Just get there

Blackline is worth $7 Billion pic.twitter.com/PmdU6Zf4sD

— Jason ✨BeKind✨ Lemkin ⚫️ (@jasonlk) December 7, 2020

Sometimes, it makes sense to sell your company. Or pack it in. Or move on to the next thing. And yes, no one could have predicted the run we’ve seen in Cloud in the past few years.

But take a look at these examples:

Marketo (and Hubspot):

- Founded 2006

- Marketo IPO’s in 2013 at $700m market cap

- Vista buys Marketo for $1.8B in 2016.

- A little more than 2 years later, it was resold for $4.75B to Adobe.

- Today, just 2 years after that, Hubspot in a very similar space (just more SMB) and with very similar revenue, is worth $18B.

- That’s 18x

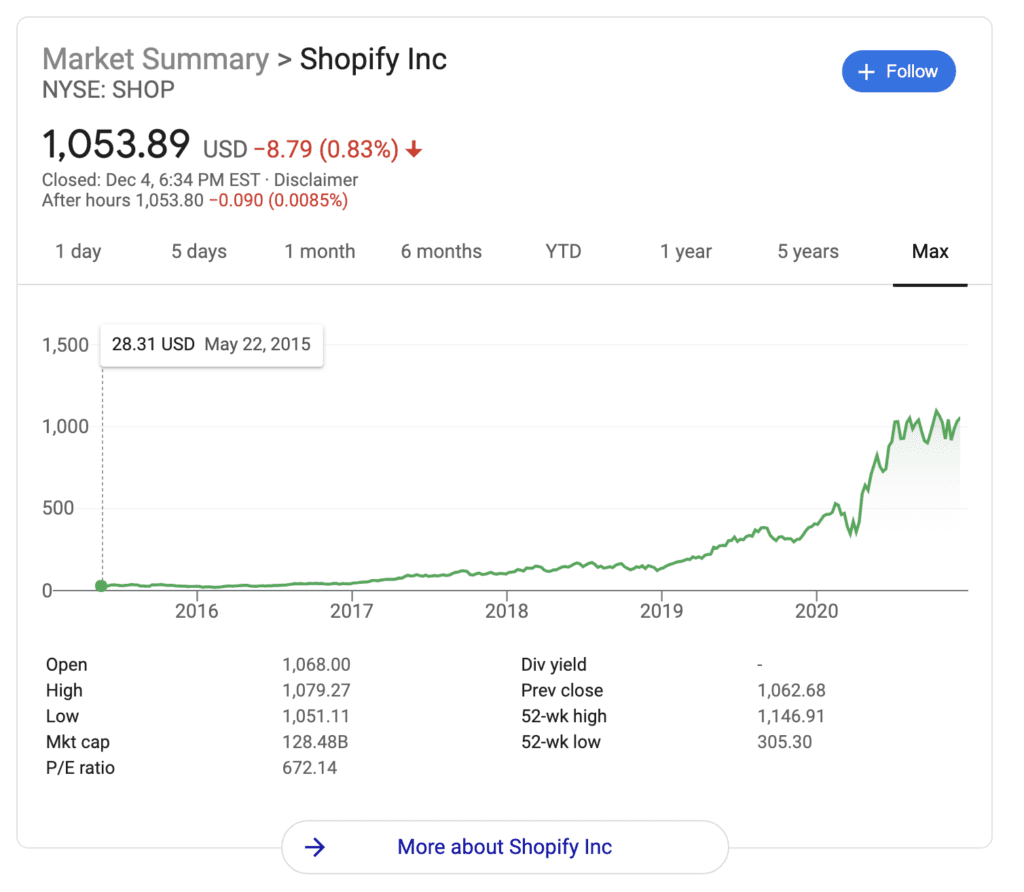

Shopify:

- Founded 2006

- Original CEO steps down, Tobi has to take over

- 2015 IPO at $1.27B

- Today, $128B market cap.

- 100x from IPO

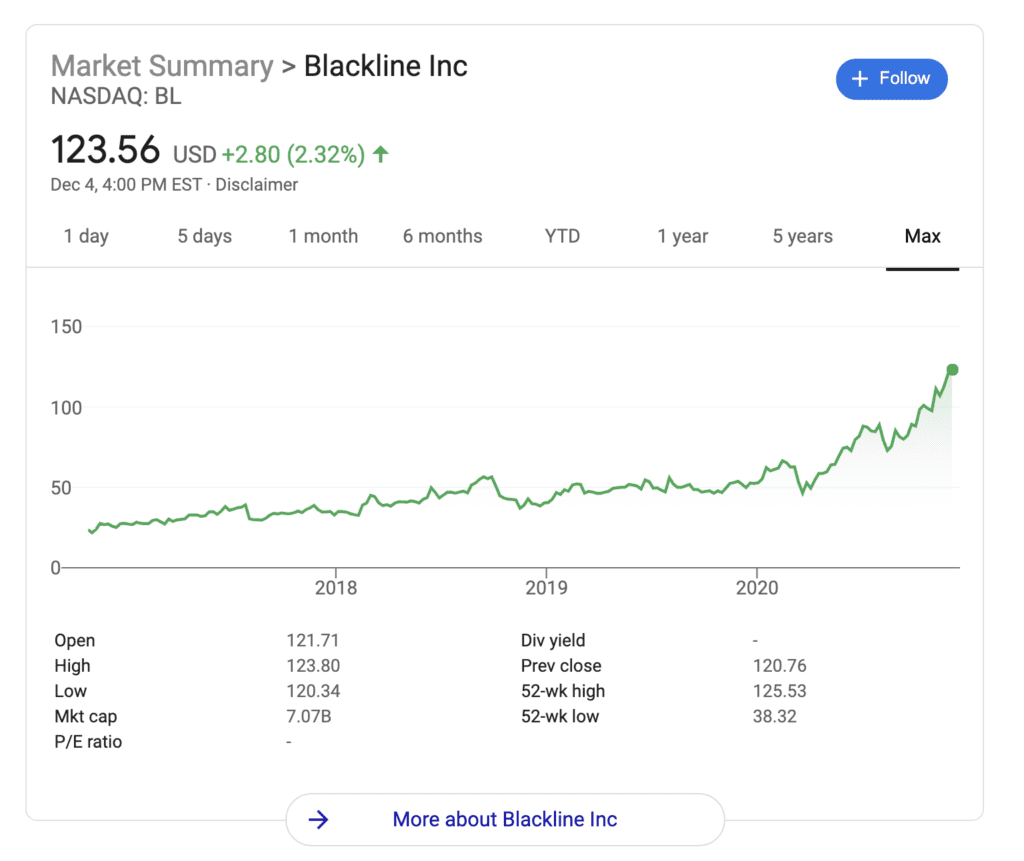

Blackline:

- Founded 2001, boostrapped. Unable to raise any money.

- Solo founder. First product doesn’t work, no revenue for 3 years.

- 2013: first investment. $200m from Silver Lake.

- 2016: IPO at $1.15B market cap.

- 2020: Worth $7B today.

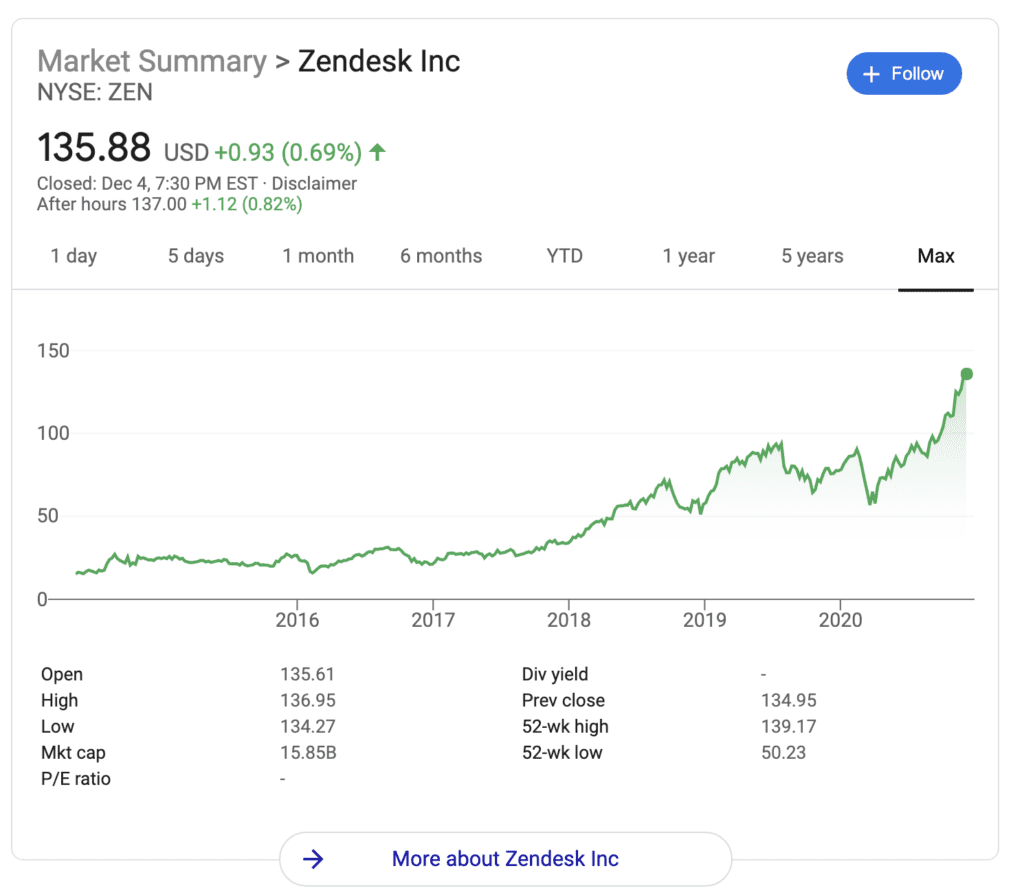

Zendesk:

- Founded 2006

- Raised $500,000 (!) in first angel round in 2007.

- IPO in 2014 at $1B

- Worth $2B by 2017

- Crossed $1B in ARR in 2020

- Today worth $16B

Obviously, these are outliers. And revenue has grown to $1B+ ARR for all the winners. To say that’s a lot of work is an understatement for the ages.

It’s just something to think about. These are the Best of TImes in Cloud and SaaS. And the best of times sure reward … going long. At least, if you really have something.

Maybe give it time — to find out.