So we’ve posted a lot on SaaStr over the years on how to understand how VCs think. On how they need to invest in unicorns not just to make money, but just to survive.

But what does it take to be a truly elite VC? And if you meet with a truly elite VC, what are they looking for?

Truly elite VCs have Billion Dollar Positions.

This is a much higher bar, and achievement, than merely a billion-dollar sale, or a billion-dollar IPO. Because even if you are a great seed investor and invest early in a great one that 8 years later sells for a stunning $1,000,000,000 (!) … the fund won’t make a billion. In fact, a seed fund might only own say, 5% at that point — or “just” $50m. And the partners themselves generally keep 20% of that after paying back expenses, so $10m. A lot. But perhaps not as much as you’d expect from a $1B+ acquisition.

No, the real elite players have made investments so great that the startups themselves aren’t just worth billions, but the VCs’ own stakes are.

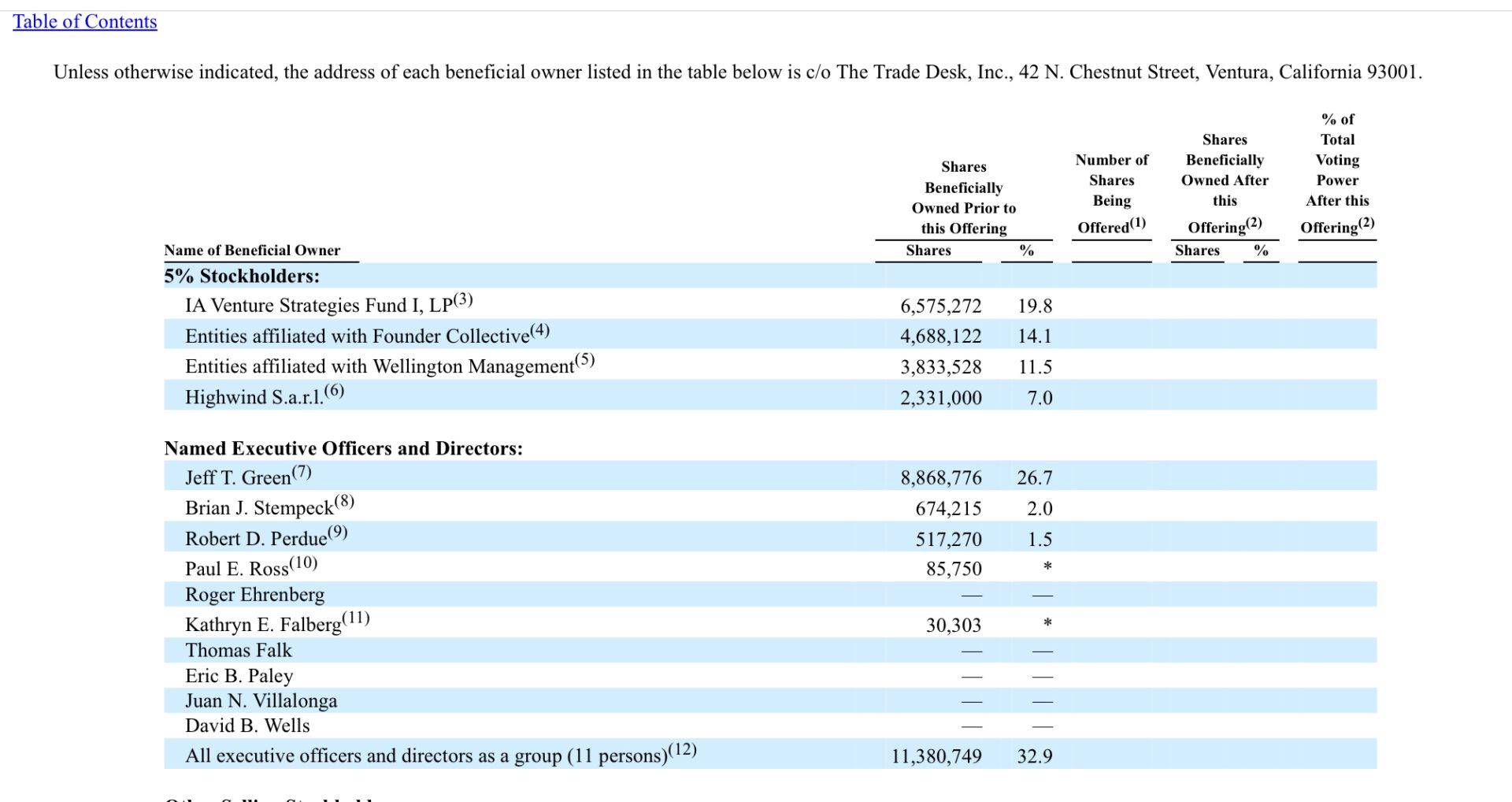

Let’s take one example, The Trade Desk. Today it’s worth a stunning $40 Billion. And because it was so capital efficient, two small seed funds were able to provide a lot of the capital it ever needed. IA Ventures owned 19.8% before the IPO, and Founder Collective 14.1%. Both wildly successful, but pretty tiny funds.

Now both distributed out a lot of their stock before today. But imagine they’d held it.

- $40 Billion x 19% = $7B+ after IPO dilution for IA Ventures

- $40 Billion x 14% = $5B+ after IPO dilution for Founder Collective

Now they both didn’t hold this long, but it illustrates the point. Billion Dollar Positions.

The very, very best VCs have them. Often, more than one.

And that’s why when you meet the truly elite VCs as a founder, they’ll be looking for very specific things. If their investment, if all goes extremely well, just might be worth one billion dollars. Even today.