So when we first started writing about Bill.com at its IPO, it was a sleepy SMB accounting product. In fact, it took 14 years to get to this sleepy (but still impressive) IPO. Things were coming together, but to truly realize repeat founder Rene Lacerte’s vision, the company needed 2 more things: its network of suppliers to get so big, it created a massive network effect. And its payments network to roll out.

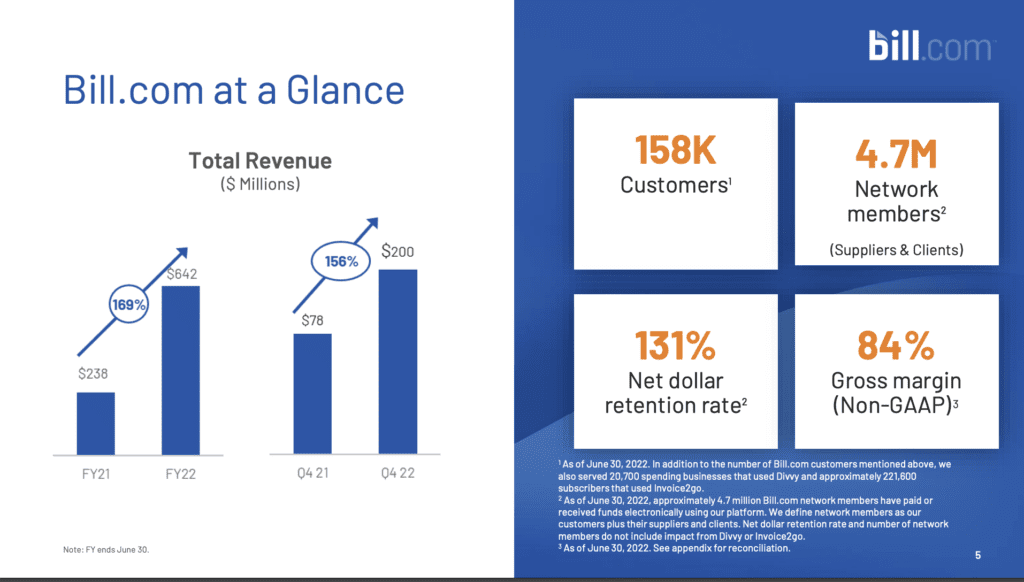

Well, once they did, boy, Bill.com just exploded. Fast forward to today, it’s at $800,000,000 in ARR growing … hold your beer … a jaw-dropping 158%. Yes, 158% growth at $800m in ARR. Yes, that can’t last forever, and half of it was from acquisitions (see the discussion below). But yes, it’s the most incredible SMB growth story in SaaS we’ve ever seen.

5 Interesting Learnings:

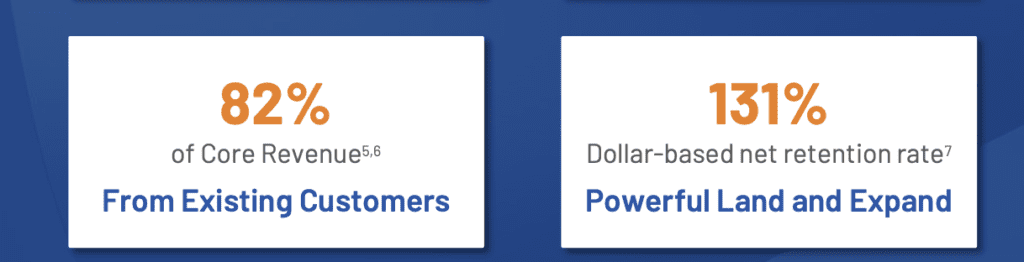

#1. 131% NRR. Up from 110% at IPO, 124% in 2021, and 121% in 2020. Don’t let anyone tell you it can’t be done with SMBs.

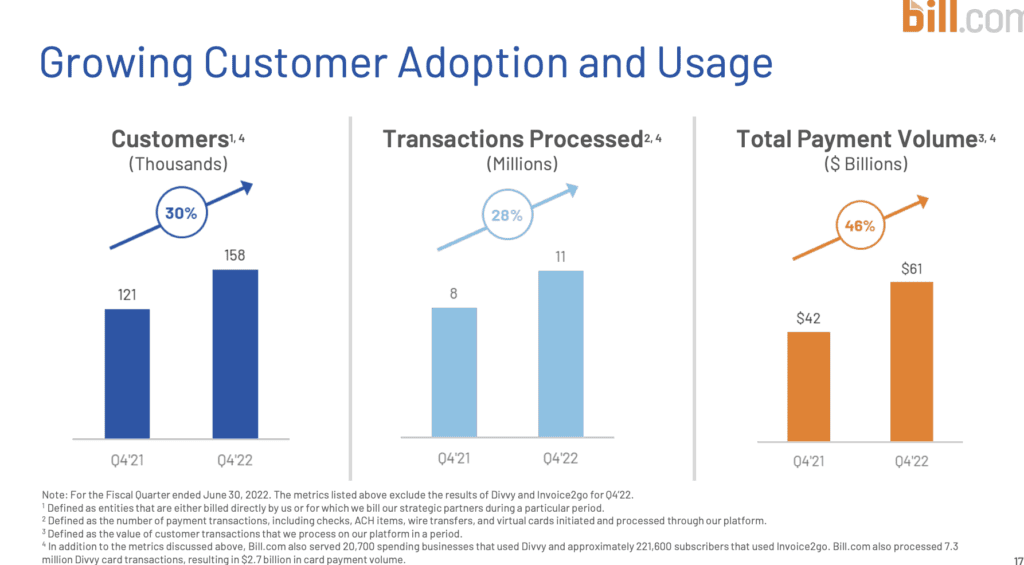

#2. Jaw-dropping growth is mostly from the existing customer base. Customer count grew a still impressive 30%, but fueled 156% total growth.

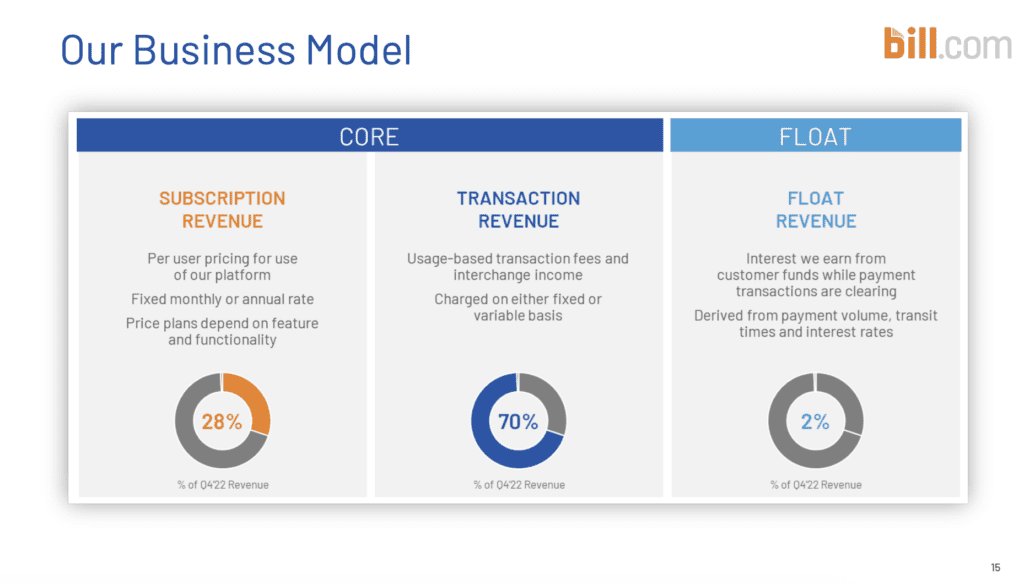

#3. Like Shopify, Bill.com is now less a SaaS company than a transactions company built on top of a software layer. Both Bill.com and Shopify now get the majority of their revenues from payments and payment processing. This is radically different from the IPO, when payments were just getting going. If you want to see a poster child of adding fintech to a SaaS the right way, well, it’s Bill.com. Importantly, they built their own payment processing network from scratch. It took years, and was a big undertaking.

#4. A Big Boost from M&A. Growth would have been 71% without it. Divvy and Invoice2Go together are at $360m run rate, so that’s a “one-off” (in a sense) crazy extra boost to the growth rate.

#5. 157,800 core Bill customers, and another 20,700 Divvy customers. So they’re doing it the hard way — with a ton of very small customers.

And an incredible deep dive we did with CEO Rene Lacerte here: