Duolingo has dominated online language learning, rocketing to $360m in ARR and a $3.25 Billion market cap after launching back in 2012. And in today’s market, that’s strong performance. While the average Cloud stock has fallen almost 50% in 2022, Duolingo’s has stayed up, and is down just 10% in the past 6 months. So it’s doing what Wall Street wants today.

But is Duolingo SaaS? Well, it’s SaaS-ish. The core product is very B2C, but the upgrade to paid has very SMB B2B metrics, and 80% of the revenue is subscription based. So at a minimum, it’s a good one to learn from, especially in this PLG and freemium world.

5 Interesting Learnings:

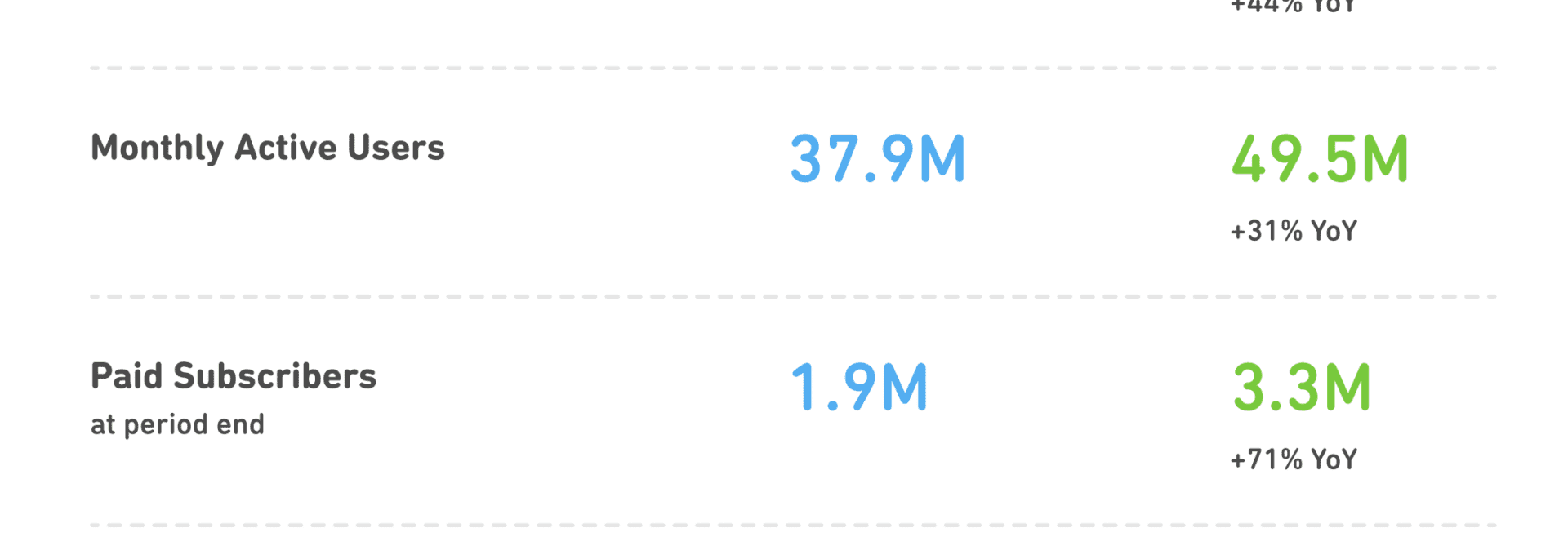

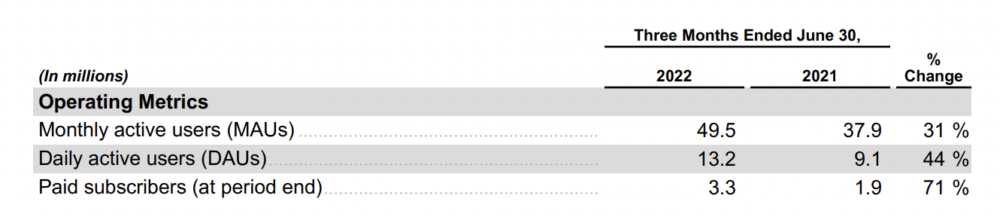

#1. 38 million active users yields 1.9m paid. We wrote a classic SaaStr post long ago saying you needed about 50,000,000 Freemium users to make the model work, more or less, and Duolingo’s metrics tie to this. They have almost 40 million free users to get to their scale.

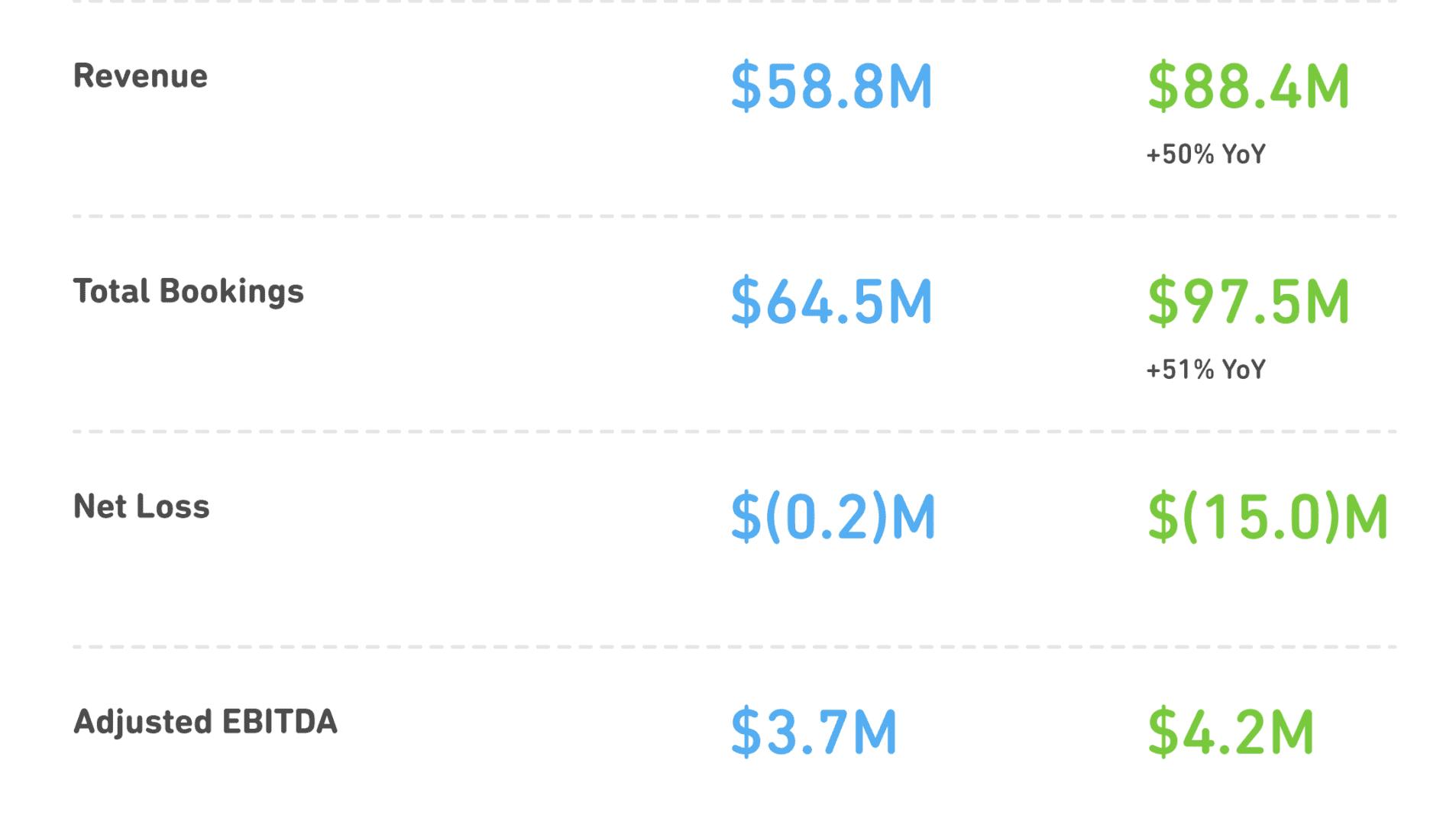

#2. Strong growth (50%) combined with positive EBITDA. This is what the markets want today — pretty strong growth (it doesn’t have to be insane, just strong) combined with a company generating cash, not burning it. Duolingo isn’t yet profitable at $360m+ in ARR, but it is EBITDA positive.

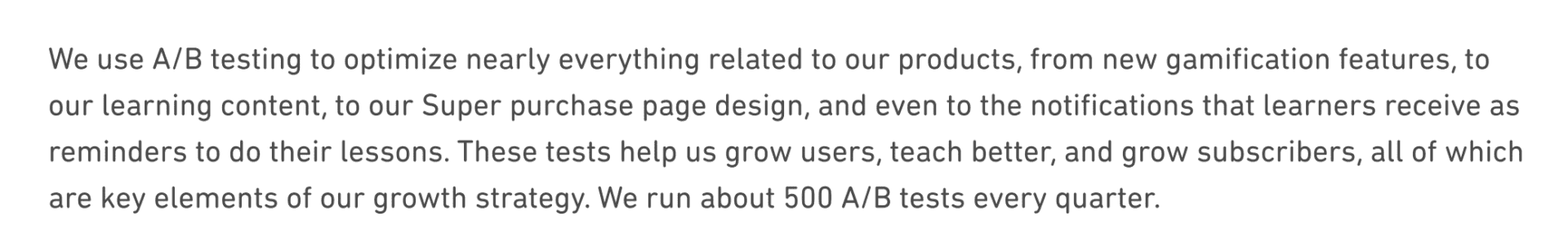

#3. Everything is aggressively A/B tested, including new product development. While common in B2C, it’s interesting how big a deal this is for Duolingo. A/B testing can be harder in lower volume B2B products, but it’s a reminder we all need to do more of it. They run 500 A/B tests a quarter.

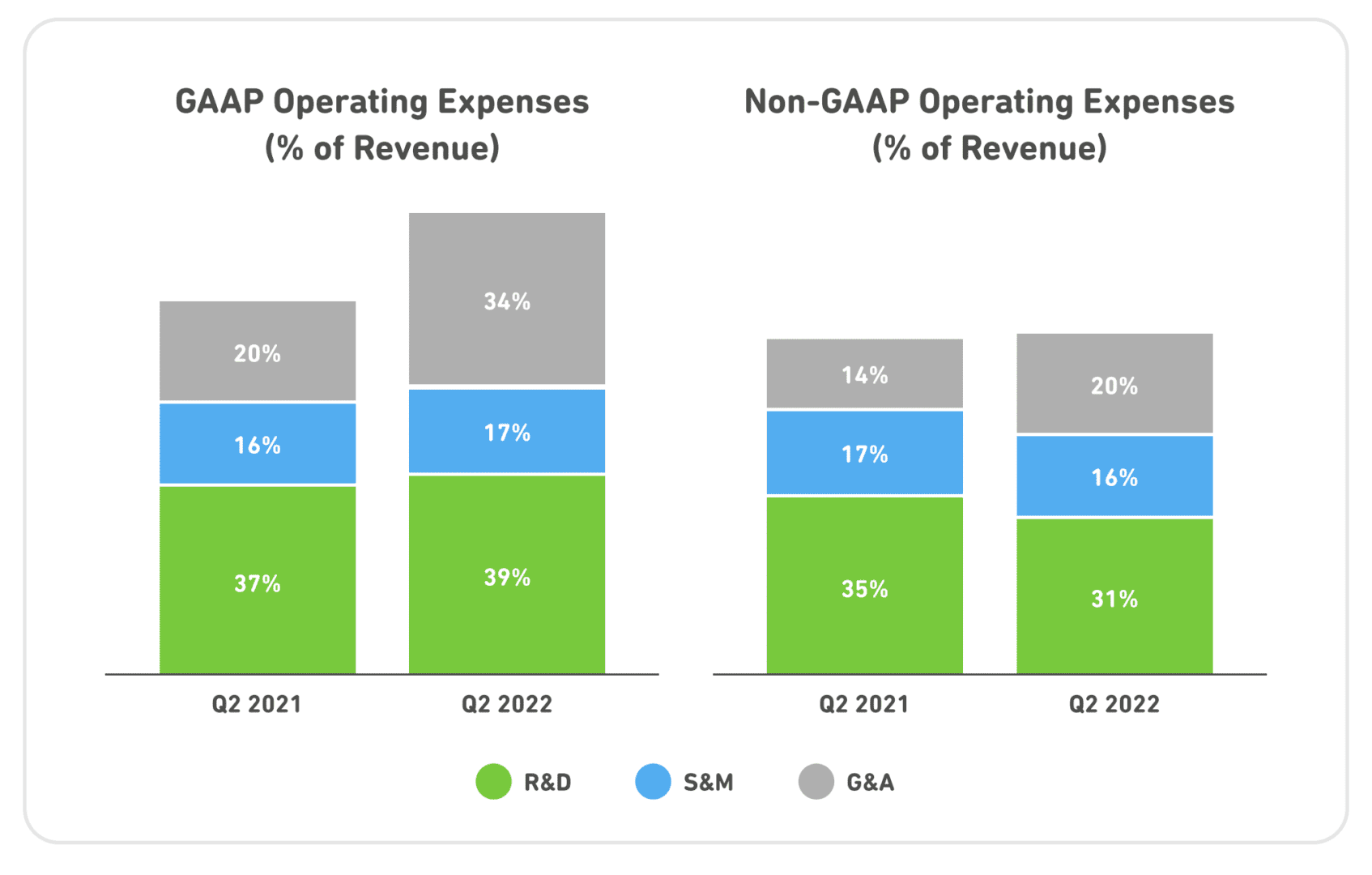

#4. Very low sales and marketing costs — and they put the savings into engineering. Duolingo spends a lot on engineering — more than most in SaaS, at 39% of revenues, that’s much more than the 20%-25% average. But it makes up for it by only spending 17% of its revenue on sales and marketing, less than half of many SaaS leaders. This doesn’t work for everyone, but it works for Duolingo.

#5. Getting better and better at monetizing their base. Duolingo’s revenues are growing 51% at almost $400m in ARR, even while its user base is growing 31%. How? Paid subs are up, conversions are up. Paid subs are growing 71%. Perhaps that will have to slow down at some point, as you can only improve conversions so much. But it’s a reminder you can always drive up conversions, and also, a reminder you can wait. You don’t have to over-monetize your free users too early. Duolingo is still primarily free.

And a few other interesting learnings:

#6. They raised guidance, even with some macro challenges. Duolingo says you can still grow nicely, even in today’s somewhat turbulent times. A pretty great story, with 50%+ growth at $400m in ARR, a very low-cost marketing and sales model, and nice free cash flow leading to a $3.5 Billion market cap.

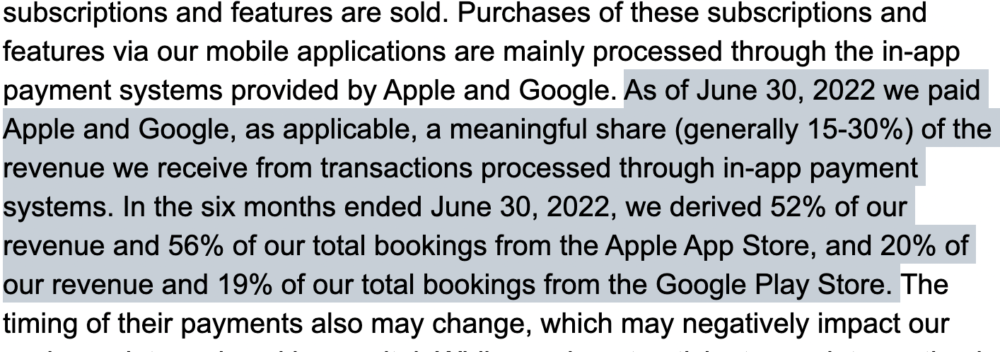

#7. 52% of revenue from Apple App Store, and 20% from Google Play. Interesting to see the iOS:Android breakout here. And a lot of 15-30% fees paid to Apple and Google.

Go Duolingo!!