So Fastly is a public Cloud company you may not have heard much about in a while. It started off with a ton of PR and attention as a next-generation, super fast CDN, and had an early IPO, but for the most part, has quietly been heads down since then. Customer count isn’t really growing anymore, as we’ll see below.

For a while, its market cap dipped to a tough low — but 2023 was good for Fastly. Its stock is up a stunning 122%! That’s second only to Palantir. A good part of the gains are from finally getting EBITDA positive.

Still, it’s not all such great news.

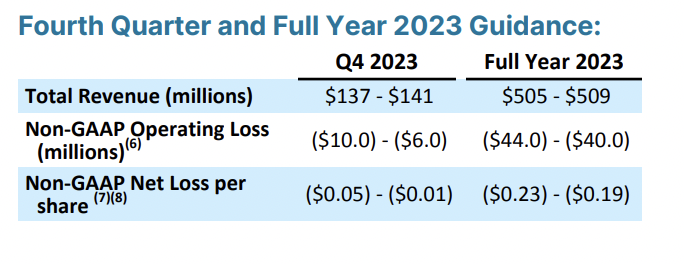

Revenues have now crossed $500m in ARR, but growth is modest at 18% year-over-year and gross margins are inherently lower in the category at only 52%. Fastly is also still losing money, albeit less.

Net net, they are trading for a bit more than 4x ARR. Low, but up from the 2x super-lows of 12 months ago.

Let’s dig in.

5 Interesting Learnings:

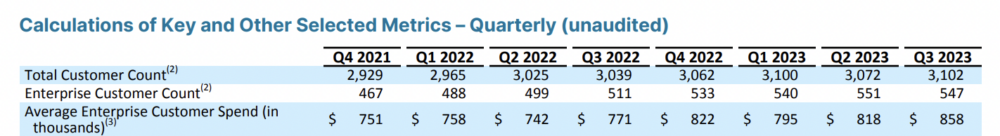

#1. Customer Count Flat, Really For 2 Years

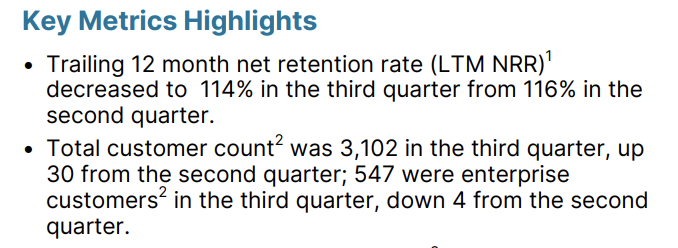

Fastly isn’t adding customers at the moment, with 3,102 customers last quarter, up only 30 from the prior quarter, and in fact enterprise customers were down to 547, from 551 the prior quarter.

Fastly had 2,929 customers in Q4’21 so at a practical level, it hasn’t added a material number of customers in 2 years. They’ve just gotten existing customers to increase their spend, as we’ll see.

#2. But NRR Holding Up at 114%

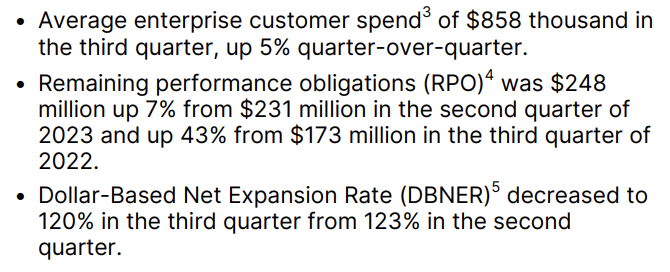

But at least NRR is holding in this macro environment. It’s seen a slight dip from 116% to 114%, but overall customers aren’t leaving Fastly. DBNER decreased to 120% from 123%, a drop but still a strong metric. And really the source of all its growth.

#3. High NRR and Account Expansion Source of All Revenue Growth

Some basic NRR math — with essentially 0% customer growth, 114% NRR combined with an overall enterprise spend expansion of 5% translates into 18% revenue growth.

Fastly is an example of what happens when you have decent NRR and modest account expansion but zero new logo growth. You get ~15% annual growth.

#4. Channel Partners Are the Big Bet for Future Growth

While the results remain to be seen, Fastly’s Channel Partners have tripled their deal registration. A bet on the partner channel driving future growth.

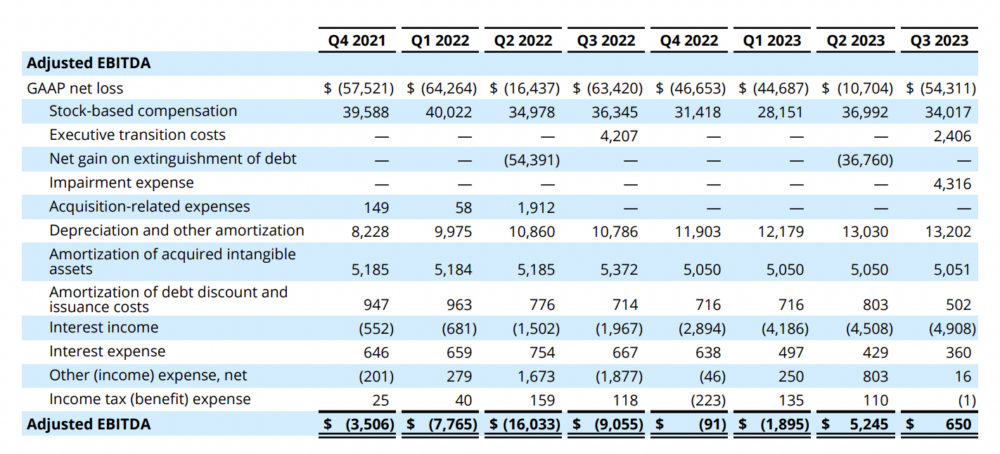

#5. EBIDTA Positive (By a Smidge), But Still Running At a Loss

It takes many SaaS and Cloud leaders close to $1B to get profitable or at least cash-flow and operation-margin positive, and Fastly is one of them. Even at $500m, it’s still losing $40m a year on a non-GAAP basis.

Still, the past two quarters it has become EBDITA positive, if just barely. This likelyis part of the stock bump. Investors do now see a clear path to profitability, albeit one with modest revenue growth.

Really, Fastly is a tough story. A product that started off as a rocketship, with a strong enterprise focus. But one that didn’t diversify and iterate enough. And now is making the slow march to profitability over growth.

It’s a bit of a financial engineering play at the moment. Customer count is flat, NRR remains strong, and it’s on a slow march to profitability.

We’ll see if there’s another big play to come.