So if you are in the support space, or CRM, or just generally sell into mixed enterprise-mid market, Five9 is a good one to follow. The company has been around for decades in the call center and contact center space, but after rebuilding around a web-native platform, saw a rebirth.

Today it’s at $800,000,000 in ARR growing a healthy 29%, and a strong 18.5% EBITDA. But with a lot of telephony and comms bills to pay, gross margins are relatively low at 52%, which is out of fashion at the moment, so Five9 trades at a $3.3 Billion, or about 4x ARR. It should be higher, but these are the times we are in. Growth is down a bit, but not dramatically from the 33% annual growth at $550m in ARR.

5 Interesting Learnings:

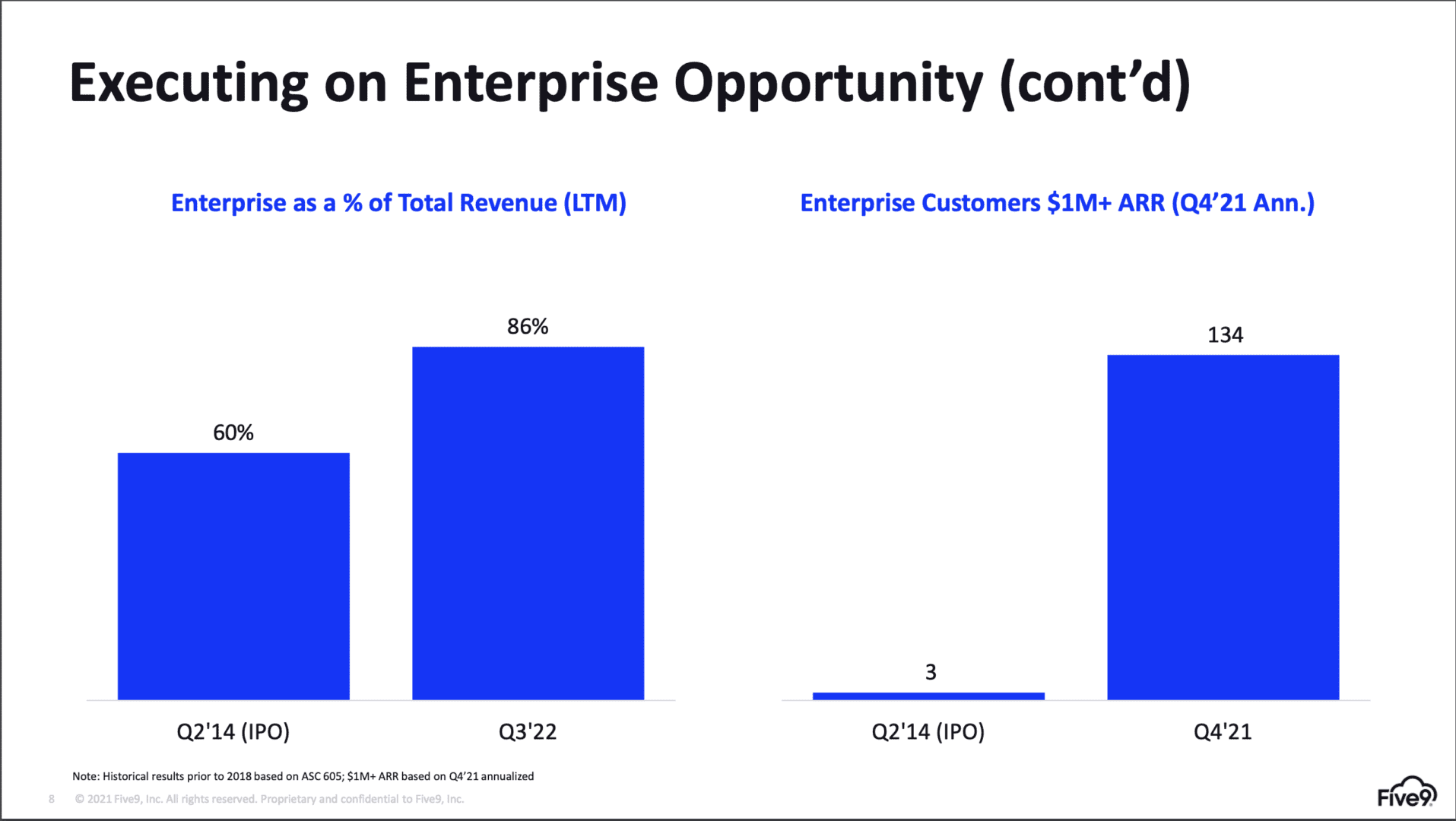

#1. 134+ $1m customers, 86% enterprise. Five9 has fully moved from an SMB product to a true enterprise one, now with well over 100 million dollar customers.

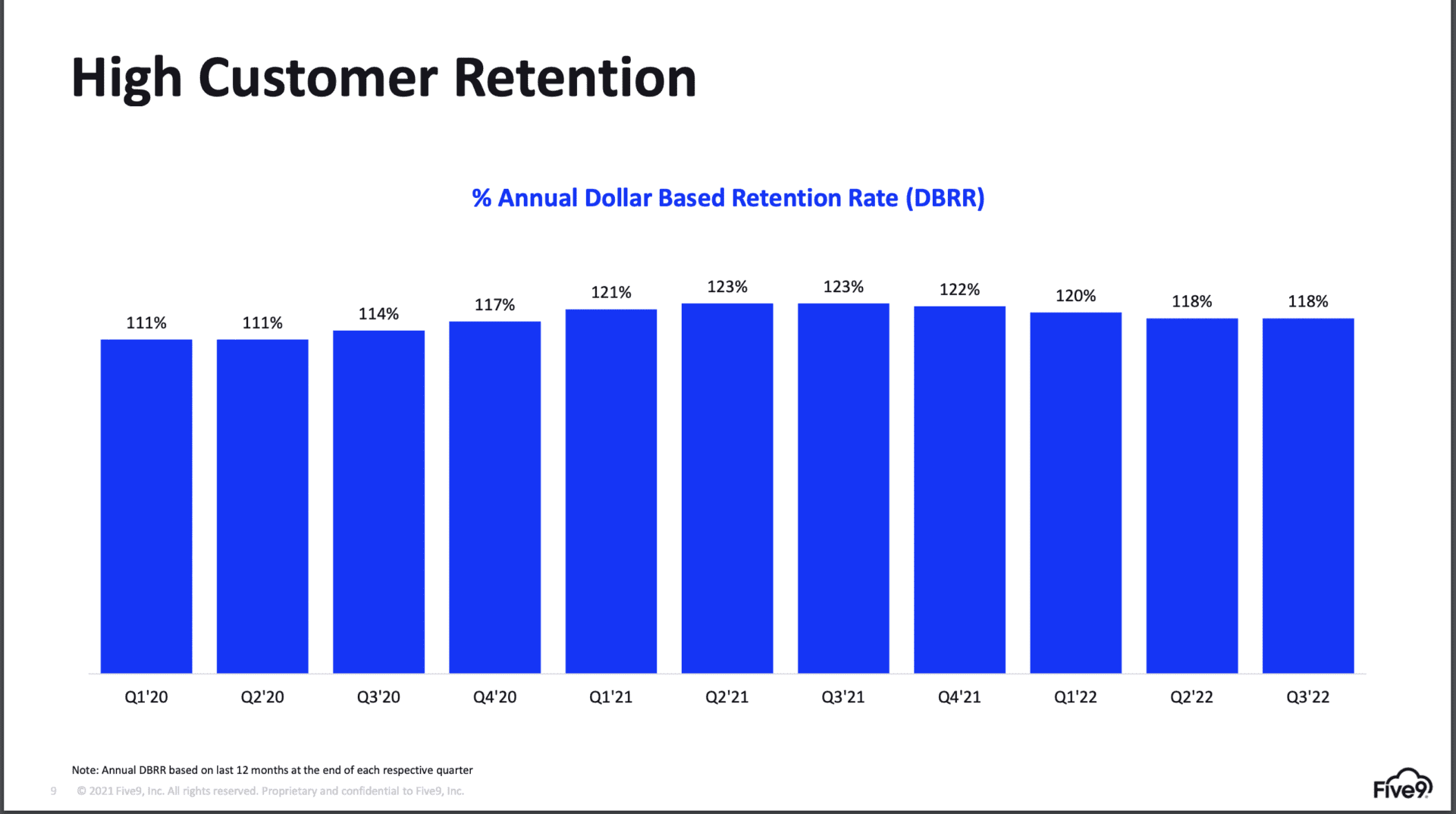

#2. NRR down a smidge, but still above where it was pre-Covid. Some Cloud and SaaS leaders like Twilio have seen bigger NRR hits in the current macro environment, but so far, it’s been muted for Five9. Annual contracts, though, can certainly mask some of this for another few quarters.

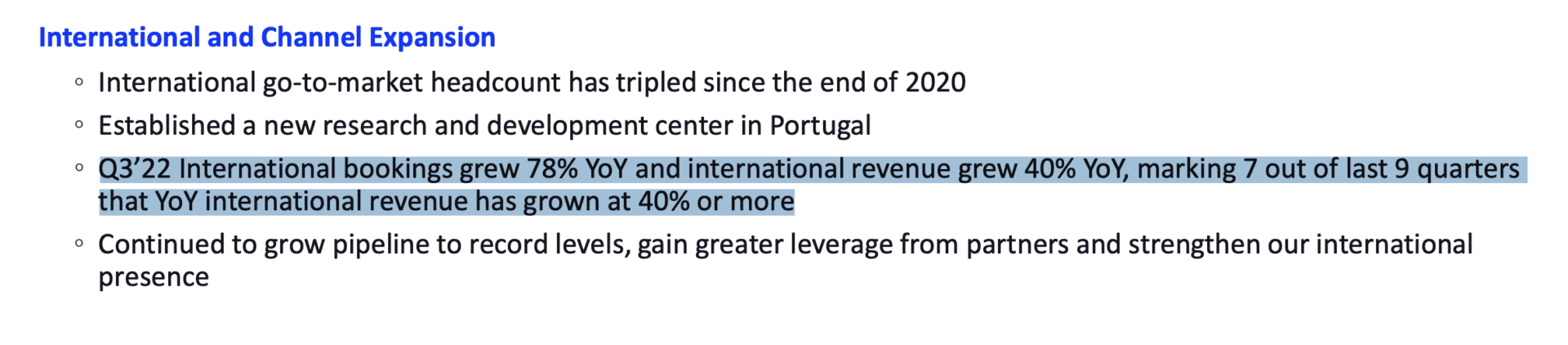

#3. International Growth Exceeding North America. I track this closely mainly because I see so many founders not focus as much here as they could. SaaS works everywhere, at least for most apps. It’s harder in telecom and even harder in fintech, but still — go as global as you can. It can really, really boost your revenues. The majority of HubSpot’s revenue is international, for example, and for Five9, its international bookings grew 78% last quarter and revenue 40%, far higher than the overall.

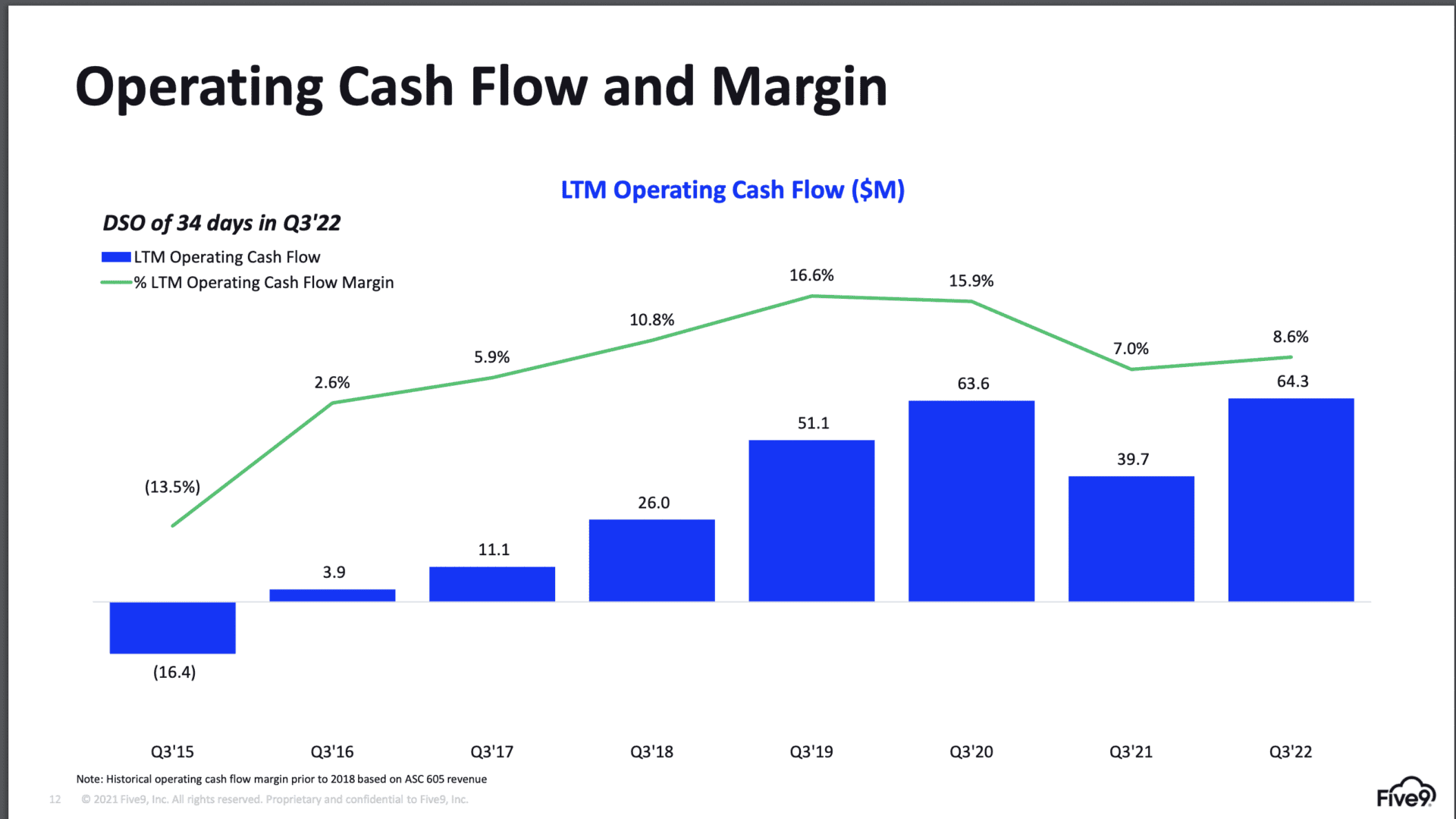

#4. Hitting The “Rule of 40” and Operating Cash Flow Positive, But Maybe Not Enough Cash Being Generated. Five9 is executing at a very high level, but clearly, Wall Street wants more. And what is probably wants is even more cash flow. While Five9 is cash-flow positive, its cash flow margins have dipped. The public markets probably want to see more progress toward 20%, not a partial step back.

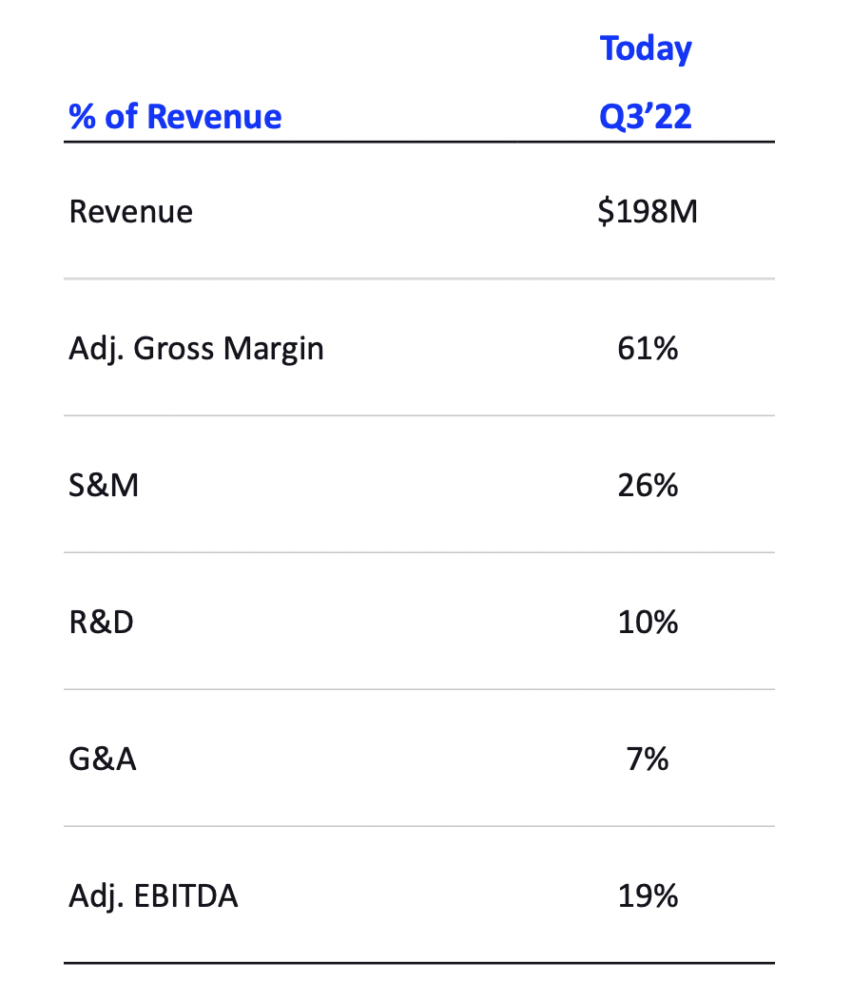

#5. Lower Gross Margins Compress Amounts to Spend on Sales, Marketing, and Engineering. The chart below illustrates the tougher challenge Cloud and SaaS companies with lower gross margins face today. There just isn’t as much “room” to spend on …people. To get profitable, Five9 is only spending 10% of its revenues on R&D, i.e. engineering, much less than the 15%-20% others do. And only 26% on Sales & Marketing, which is still a lot, but less than others. When your gross margins are 52% and even 61% “adjusted,” that leaves 20% less of each dollar to spend on sales, engineering, and marketing than a traditional software or SaaS company at 80% margins has.

So boy, if Five9 shows anything, it’s how much tougher the world is today. Just over a year ago, Zoom wanted to buy them for almost $15 Billion, and all anyone cared about was growth, growth, growth. Today, Five9 is growing at 29% at $800,000,000 in ARR … and yet trades at just 4x revenues. Why? The markets just want it all today. And then some.