Happy 22nd Birthday Salesforce & Thank You to our Ohana who have made it all possible! March 8th 1999 we were founded at 1449 Montgomery Street, a 1 bedroom apartment on Telegraph Hill. Today we are 60K employees strong expecting to do over $25.75B! Everything is possible! ❤️🇺🇸 pic.twitter.com/AyZFkUBUnH

— Marc Benioff (@Benioff) March 8, 2021

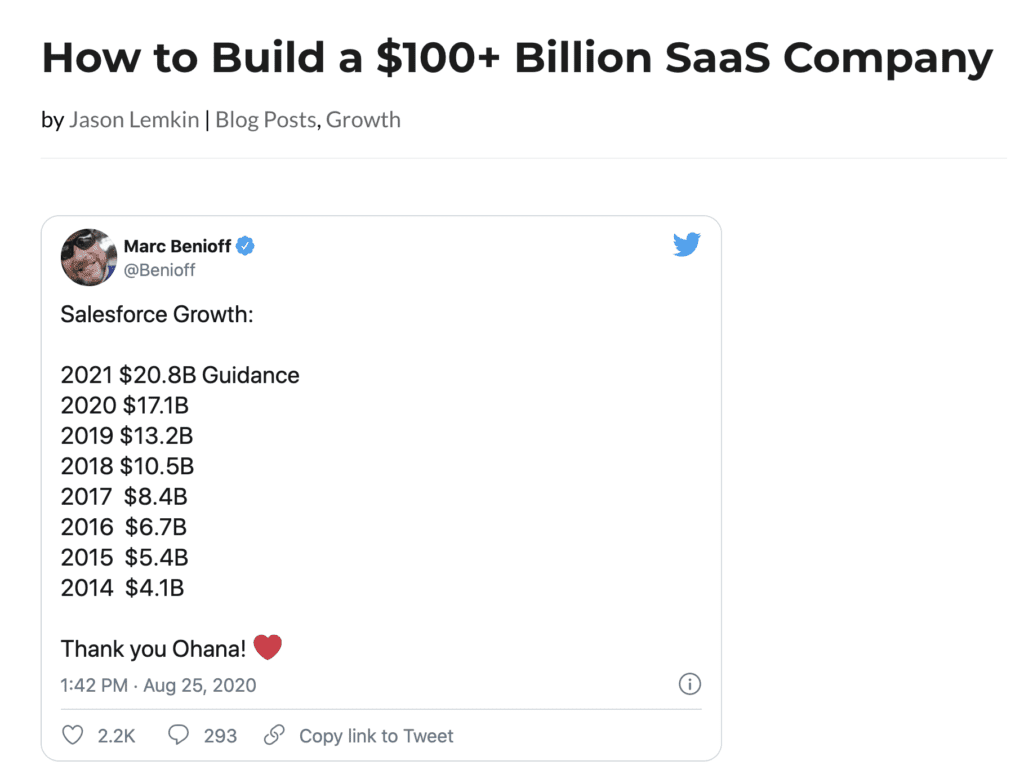

We last checked in with Salesforce after $10B in ARR and a $100B market cap here — and it’s just cruised past that since.

Salesforce has now crossed $24B in ARR, a $200B market cap, and is buying Slack! Wow. Its growth is 20% Year-over-Year, an incredible growth rate at $24B ARR … and faster than anyone has ever grown in software at $20B+ ARR … but at the edge of what it takes to be a “fast-growing” SaaS company. Below 20% growth, and you’re a mature SaaS company. So kudos to Benioff and Team for keeping an incredible growth engine going — both organic and inorganic.

5 Interesting Learnings:

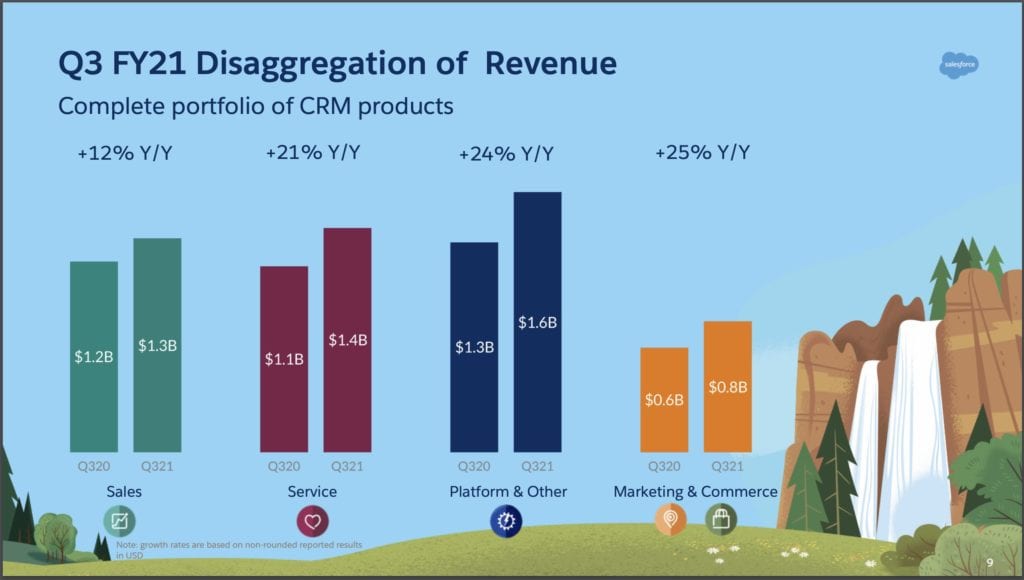

1. Its Classic Sales/CRM Product is Now Just Its Third Largest Product. This trend has been true for a while, and now both its Service Cloud and its Platform group are bigger and faster growing than the classic CRM product we all know and use.

It’s super interesting that today, Salesforce is more of a Service Cloud than a Sales Cloud. Service is bigger and faster growing.

Yes, you’ll almost certainly need more than 1 core product to keep growing past $1B ARR. Salesforce needs 4+.

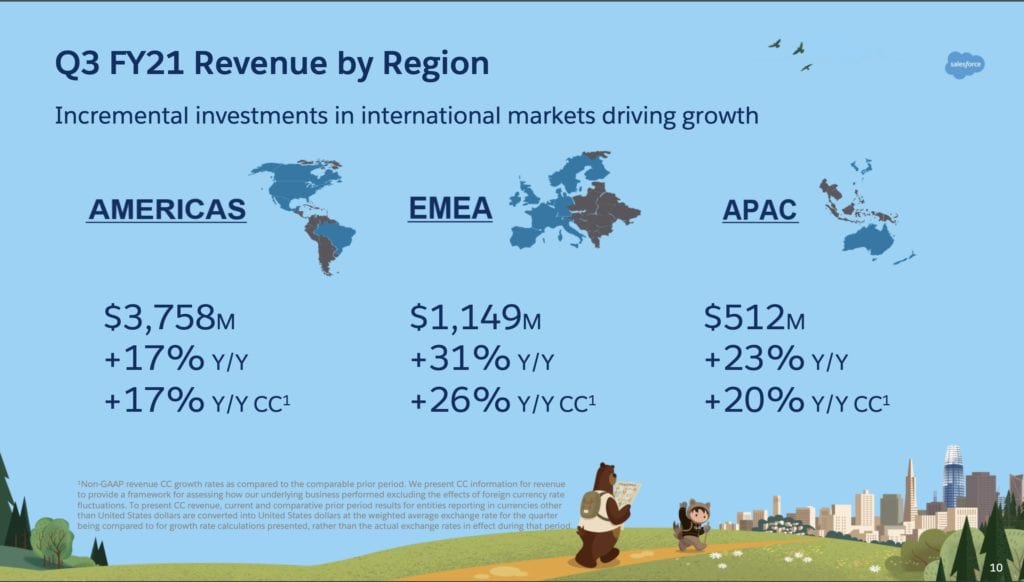

2. Europe is on fire for SaaS. EMEA sales not only crossed a $4.5B run rate, but are growing 31% — vs. 20% overall for salesforce. Yes, the time zones can be tough. But if you have traction in Europe, lean in.

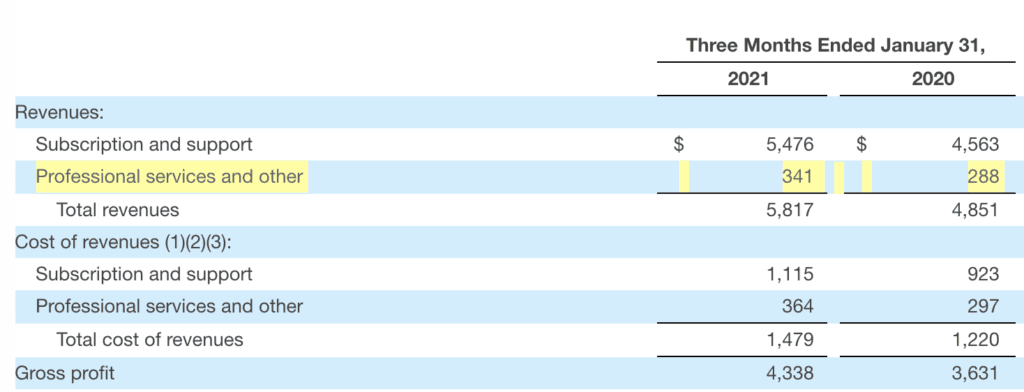

3. Only 6% of Revenue from Professional Services — Which They Lose Money On. While most Salesforce implementations require a lot of professional services, Salesforce has intentionally pushed almost all this work to its implementation partners. The original reason had as much to do with lower margin in services as bandwidth. And the pro serv Salesforce is still stuck doing itself are negative gross margin. Still, others such as Qualtrics and Veeva have managed to make services profitable enough to keep their revenues “in-house”. There’s no one answer here.

4. Churn Still a Bit Elevated Since Covid. While most SaaS leaders seem to have seen a resumption to pre-Covid levels of churn, both Salesforce and Zendesk are still seeing relatively low churn — but higher than pre-Covid. With 20% overall growth, but only 17% growth in deferred revenue / RPOs, churn is still a bit elevated.

5. Doubling By 2026 to $50B ARR. Salesforce has not only projected continued 20%+ growth for next year, but has compounded the next few years to $50B in ARR by 2026. The awesome force of recurring revenue.

And a bonus note:

6. Slack matters. With a plan to grow 20% each year, Salesforce has to add $5B+. Slack will be $600m of that in current / fiscal ’22 and much more the following year, since Slack was at $1B+ ARR at the time the deal was struck. Put differently, Salesforce needs M&A to hit its growth plan. It might not have made it without Slack.

Not too shabby! -> 21 Years to $24B in ARR.

More here our previous deep dive on Salesforce:

(note: the Q4 slides aren’t out yet, so I’ve mixed some Q3+Q4 deep dive points together. the differences should be immaterial)