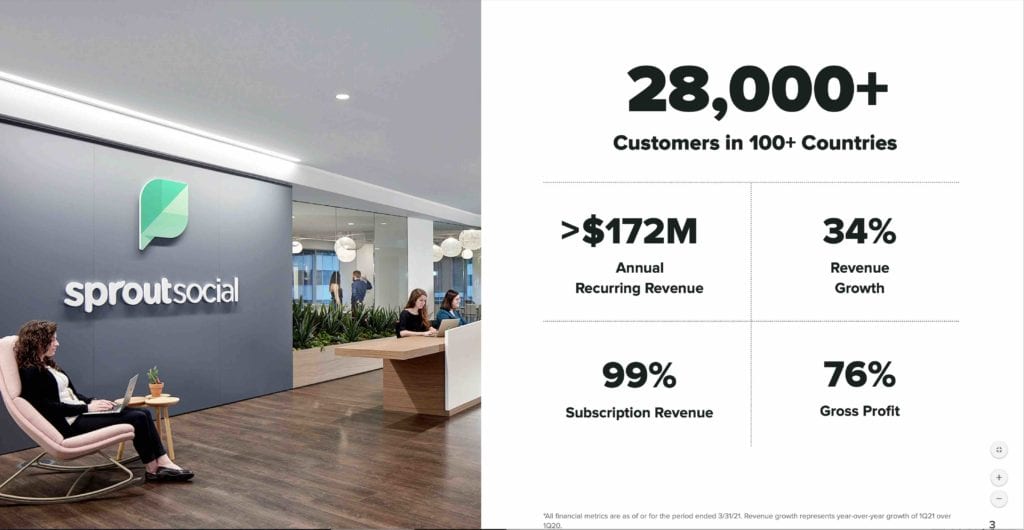

So one of the quieter SaaS success stories is Sprout Social, a leader in social media management. Sprout Social IPO’d somewhat quietly at the end of 2019 at about an $815m market cap — small for a SaaS IPO. But they kept at it. Fast forward to today, Sprout Social is now worth $4.9 Billion (!) at a $180m ARR, growing 34% a year.

If that growth from an $815m market cap in 2019 to $4.9B today doesn’t inspire you, I don’t know what will. It’s not your valuation today that matters. It’s what you can grow into in SaaS.

Also a reminder that power laws are everywhere in SaaS. Sprout Social was founded in 2010. Nine years later, it was worth $815m — impressive, yes. But then just 2 years after that, they are worth $4.7B. Keep going in SaaS. Value compounds.

5 Interesting Learnings:

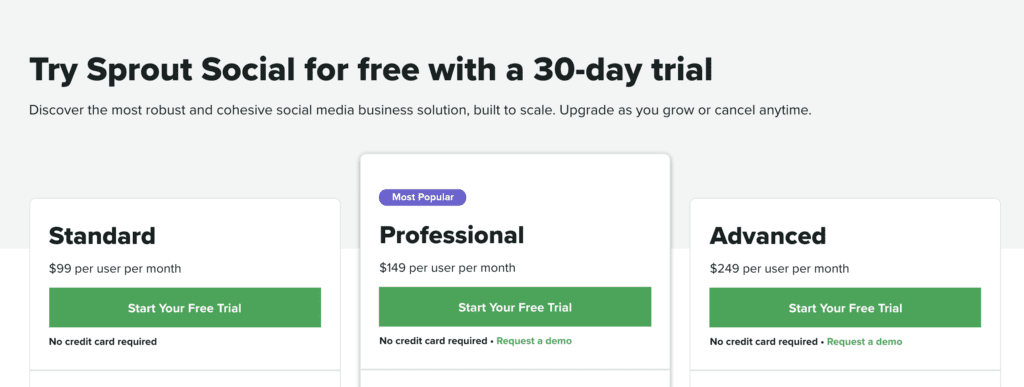

#1. Overall NRR of 110%, 120% excluding SMBs. Sprout Social is a great one to track NRR because they have a pretty even (by revenue) mix of customers small, medium, and somewhat large. They have 28,000 customers total with plans starting at $99/month. If you sell a lot of Team plans and aren’t truly Enterprise, Sprout Social is a good comp.

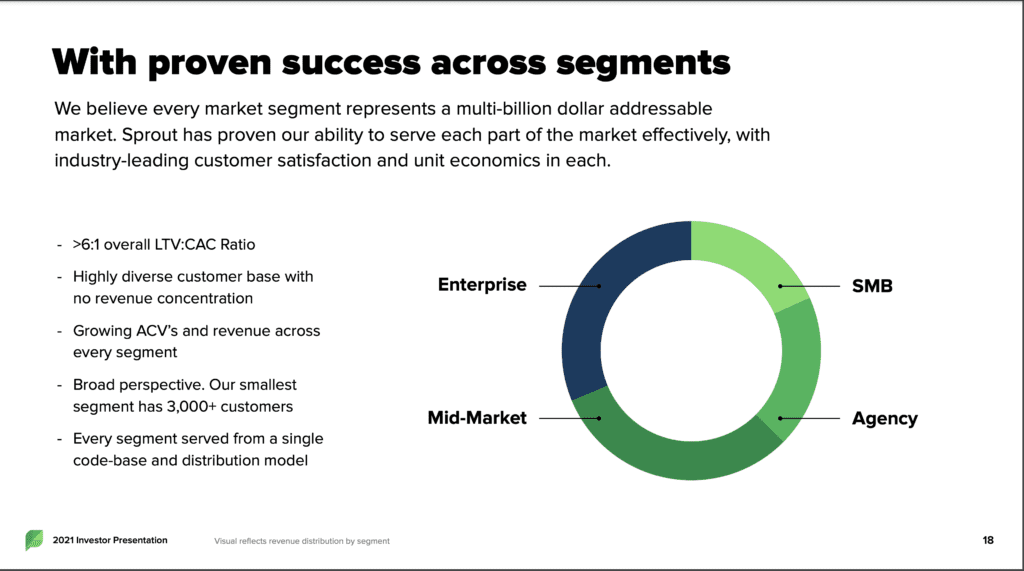

#2. For Sprout Social, a $10k a year customer is a bigger customer, and the fastest growing segment, up 44%. So Sprout Social is going upmarket, but carefully. SMB, Mid-Market and “Enterprise” are all about equal segments of revenue:

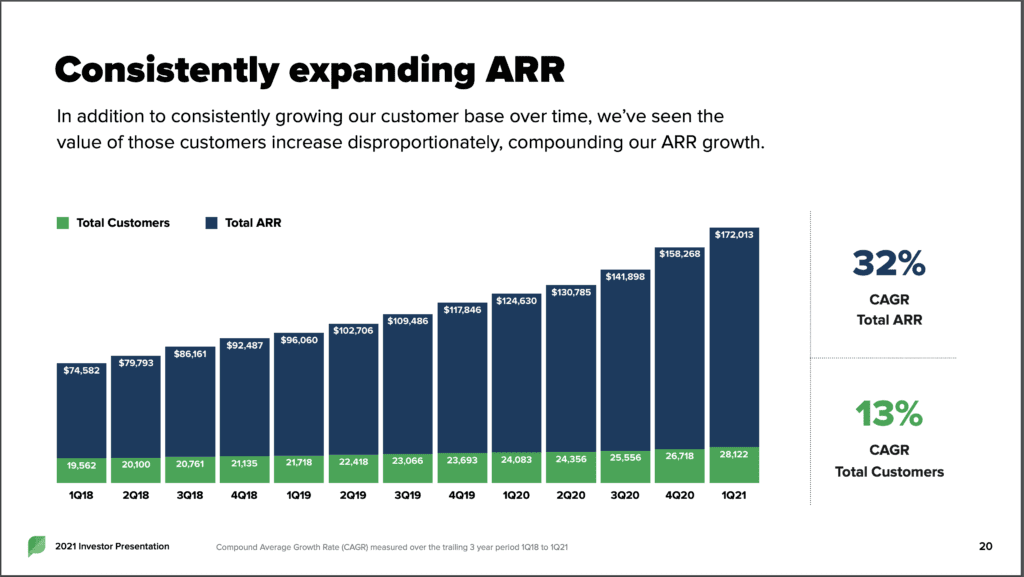

#3. 13% Annual Customer Growth with 110% NRR Yields 32% ARR Growth. This is a great chart illustrating how ARR growth exceeds customer growth typically in SaaS with 110%+ NRR. While Sprout Social has “only” added 13% new customers each year since 2018, those customers even with 110% NRR compound, leading to 32% ARR Growth. A reminder of the incredible power of NRR of 110% over, say, 100%. And just how long your existing customer base can fuel your growth.

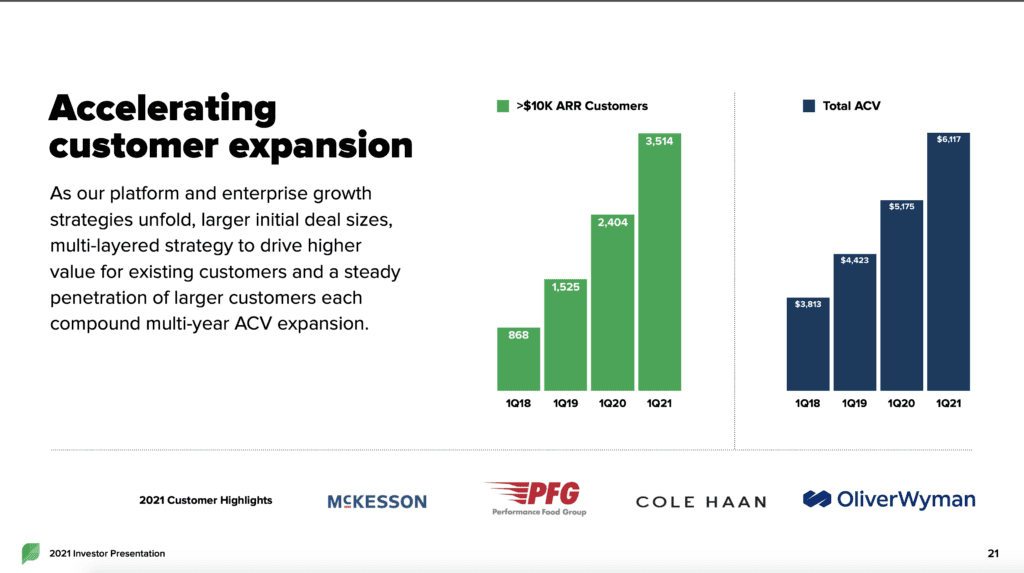

#4. Were somewhat slow to aggressively grow their $10k+ ACV customers — until approached $75m ARR. In 2018, even at $75m in ARR, Sprout Social only had 868 $10k+ customers. But today at $180m ARR, they have 3,500 $10k+ ACV customers. Sprout Social waited to focus on somewhat larger customers. But once it did — it worked.

#5. Growing faster at $180m ARR than $100m ARR. We are seeing this with more and more Cloud leaders. Sprout Social has accelerated. Growth today is at 34% — versus 30% at IPO at $100m or so ARR. The difference is huge. It put Sprout Social into the “high growth” category of SaaS companies vs. medium growth. And as a result, their revenue multiple has gone way up.

And take a great look back at Sprout Social at $50m ARR when CEO Justyn Howard came to speak at SaaStr Annual: