The founder of Squarespace still owns 36% of the company

What is 36% of $15 Billion, anyone know?#founderpower

— Jason ✨BeKind✨ Lemkin ⚫️ (@jasonlk) April 16, 2021

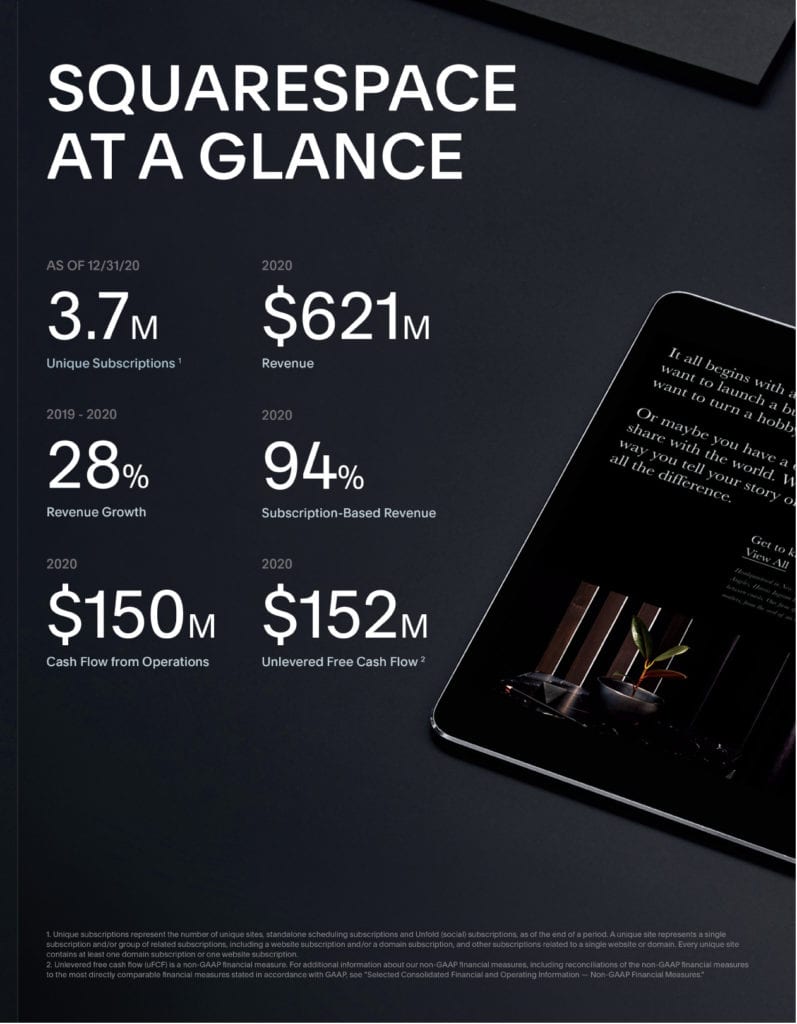

Not too long ago, we took a look at Wix at $1 Billion in ARR. Now, Squarespace has filed to go public at $700m in ARR. Perhaps the most interesting thing is just how similar both these website-builder-plus-ecommerce companies are. Squarespace may be more design-focused, Wix the somewhat more cost-effective solution.

But in many ways, Squarespace looks like a 70% version of Wix. It’s growing at the same rate (~30%), booming from ecommerce (+78% for Squarespace, +60% for Wix).

It’s pretty incredible in fact that both these two businesses can hit $700m and $1B in ARR, both growing 30%, neither able to clip the wings of the other.

Their roots are very different, however. One leader comes from Israel (Wix), and is particularly strong outside the U.S. The other is a design-focused leader from the center of design, New York (Squarespace).

So what can we learn from Squarespace as it becomes a public company?

Today is an incredibly amazing day as @Squarespace lists on the @NYSE via a direct listing. Congratulations to our team, our customers, our investors, and everyone who has come together to make this happen. Looking forward to the next decades of innovation and even more success! pic.twitter.com/rASOW4NfbB

— Anthony Casalena (@acasalena) May 19, 2021

5 Interesting Learnings:

#1. Over $500,000 revenue per employee. Squarespace has 1,200 employees and $700m in ARR. That’s pretty darn efficient. As a result, it’s quite profitable, with $150m in free cash flow in 2020.

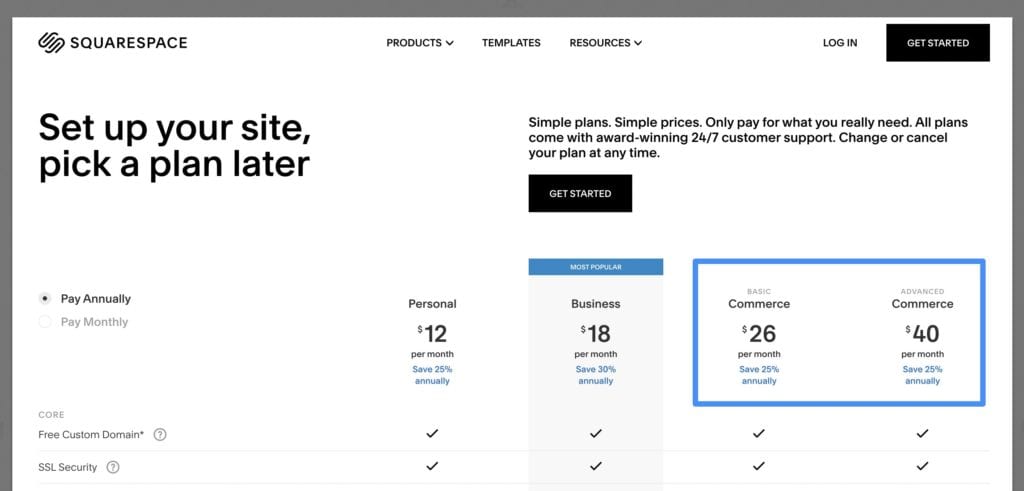

#2. Monetizing ecommerce via subscriptions, but not payment processing. Squarespace has rapidly expanded into ecommerce, with $3.9 Billion in GMV processed, up a stunning 91% from 2019. But in contrast to Wix and Shopify, it doesn’t keep much of the revenue from merchant services itself. Rather, it charges for software subscriptions to take payments on its websites. This ecommerce revenue was $143m in 2020, about 22% of total revenue. But it doesn’t monetize the payments themselves directly very much. Just 6% of Squarespace’s revenues come from payment processor rev shares and other fees. By contrast, Wix generates a significant amount of much lower-revenue revenue by processing merchant fees.

Two different ways to monetize e-commerce on a website.

#3. 85% NRR. It’s very helpful to see this called out for self-service businesses and SMBs, and is pretty low for a public SaaS company. But perhaps not that uncommon for higher-churn self-service and SMB categories. Most higher-churn SaaS companies seem to obscure, or at least, not highlight any NRR below 100%. Wix doesn’t disclose its churn, but it’s likely similar.

It works because their CAC (and Wix’s) is very low.

#4. 70% annual, 30% monthly subscriptions. Helpful to see, and not inconsistent with other similar web services that offer discounts to go annual. Maybe don’t force it in many cases. Let buyers buy the way they want to buy. Zoom did this, and it worked out just fine. More on that here.

#5. Seasonality: Q1 and Q3 are their strongest quarters. Squarespace still sees seasonality, with Q1 benefitting from new marketing spend at the start of the year, and Q3 benefitting from a holiday rush. So seasonality is real here at scale.

And a few bonus learnings:

#6. Growth would be mediocre without ecommerce. Websites revenue (so-called “presence” revenue) only grew 18%. Website revenues grew only 18% in 2020, while ecommerce revenue grew 78%. Blended together, that worked out to 28%. Both Squarespace and Wix would be much less interesting companies without their strong ecommerce components. You have to add a second product to really scale beyond $1B in ARR.

#7. 30% of its revenue outside the U.S. A lot, but less than Wix, which started in Israel and has 43% of its revenue outside North America.

#8. Less than 1% of revenue from enterprise customers. A potential growth path after $1B ARR for Squarespace.

#9. Founder-CEO Anthony Casalena started Squarespace in his dorm room, controls 68% of the voting rights, and still owns 36% of the company. Whoa. Casalena maintained such a large share by bootstrapping for a long time until taking an initial growth round of venture capital years down the road. Another example of the Qualtrics-Atlassian path to minimizing dilution. Not easy, but it can be done.

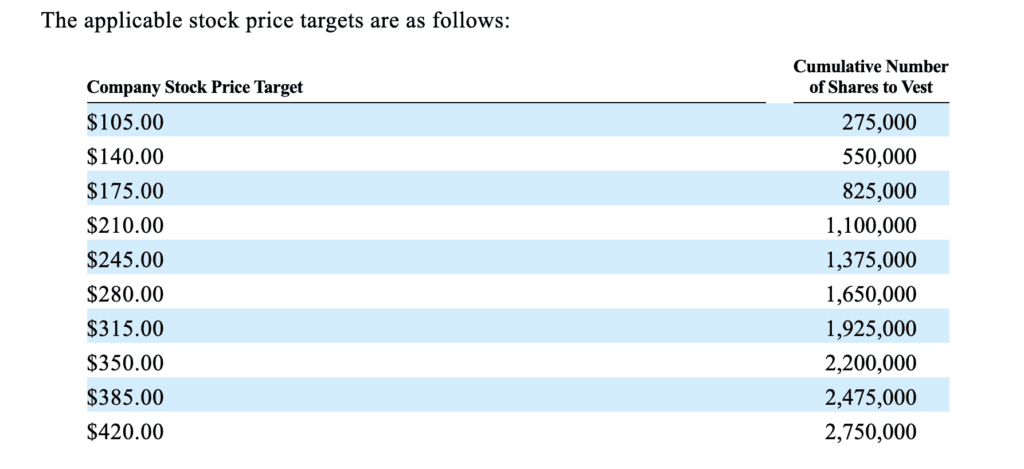

In addition, the board has given him very aggressive additional share grants — but only if he hits very aggressive targets. Incentives matter!