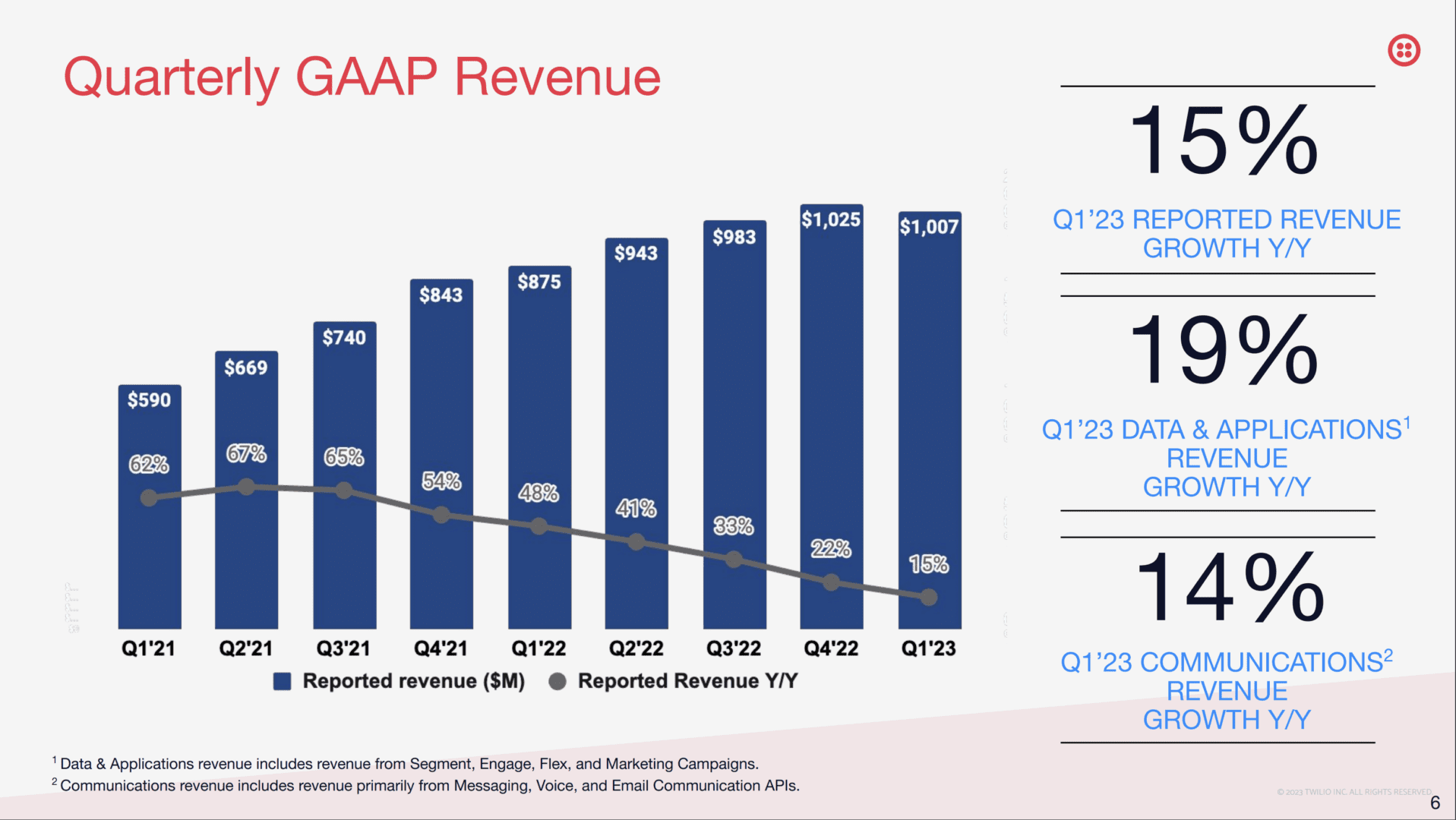

So Twilio is perhaps the top “hero” SaaS company that has taken the biggest hit from the crunch of 2023. Twilio dominates many of its spaces and segments. It’s the Stripe for Communications. But that’s also a segment of the market where customers have cut back heavily. As a result, growth has radically slowed for the first time ever, to just 15% at $4 Billion in ARR.

5 Interesting Learnings:

#1. From 48% growth to 15% in just 12 months. Twilio is the same great company it was in 2022 and 2021, but it’s also been the segment where buyers have cut back perhaps the most. Almost half of that growth is from acquisitions, though, so the “organic” deceleration is from 35% to 15%.

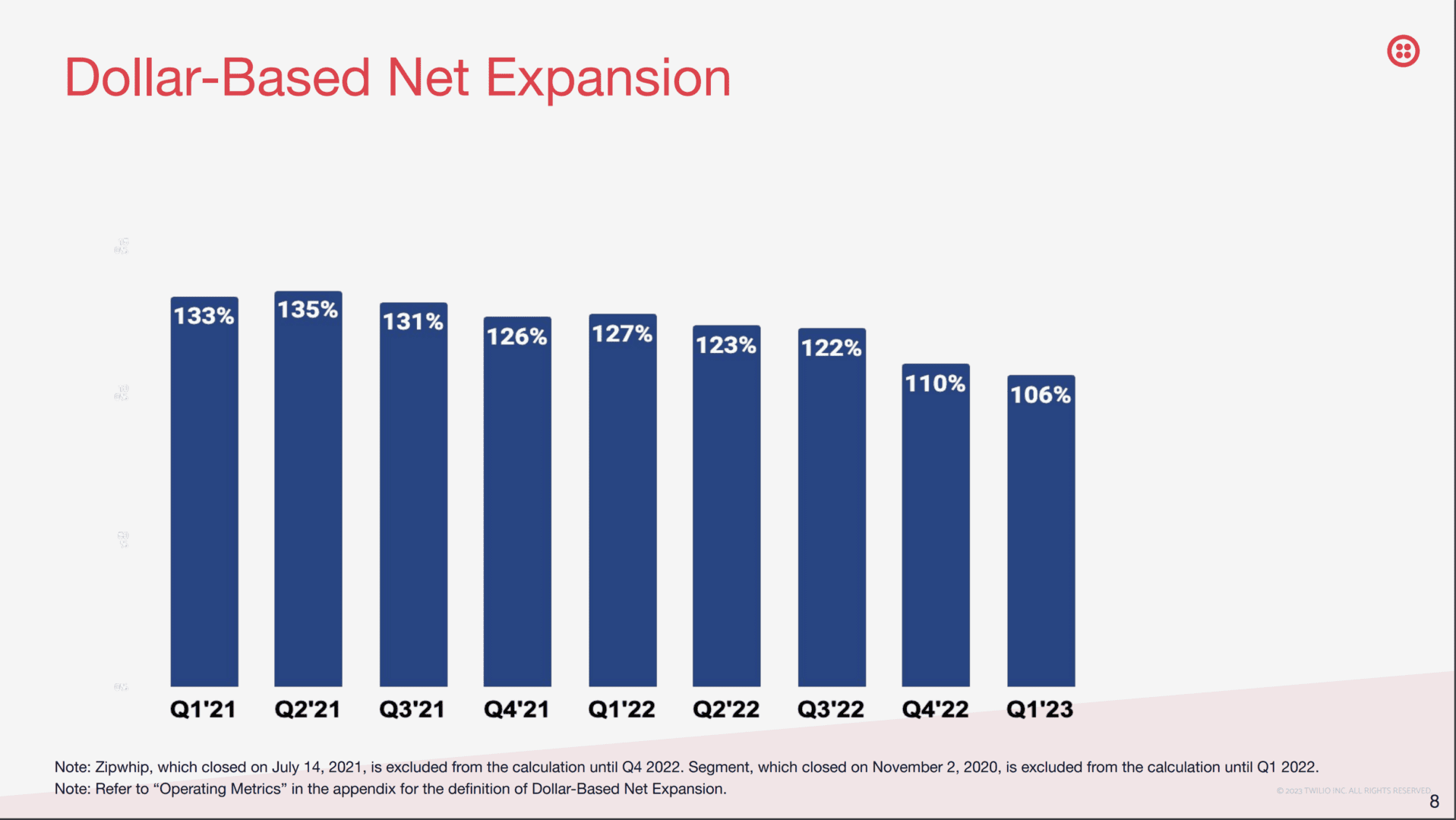

#2. The Big Hit is in NRR — Down From From 127% to 106% in 1 Year. A Risk With all Consumption-Based Services in Tougher Times. Snowflake is seeing something similar, albeit not quite to the same extent. But both Twilio and Snowflake sell a lot based on consumption. That’s easier and faster in some cases to cut back than seats paid on an annual basis. And that’s a big reason revenue growth has slowed so dramatically. For the first time ever, Twilio isn’t getting the 120%-130%+ NRR “boost”.

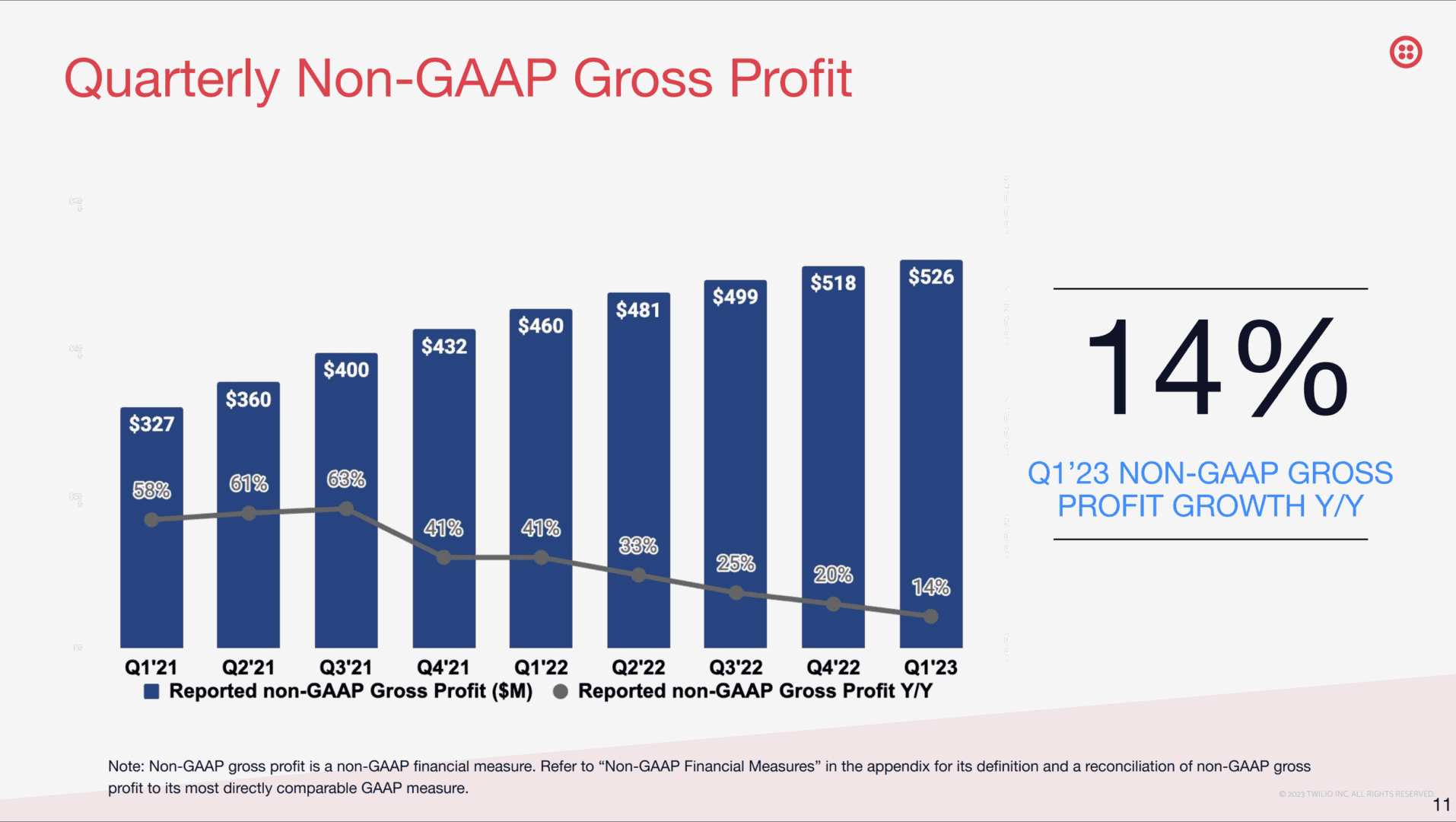

#3. Getting More Efficient — Like Almost Everyone in SaaS and Cloud. Twilio’s non-GAAP gross profit continues to grow and non-GAAP operating margins have crossed 10%.

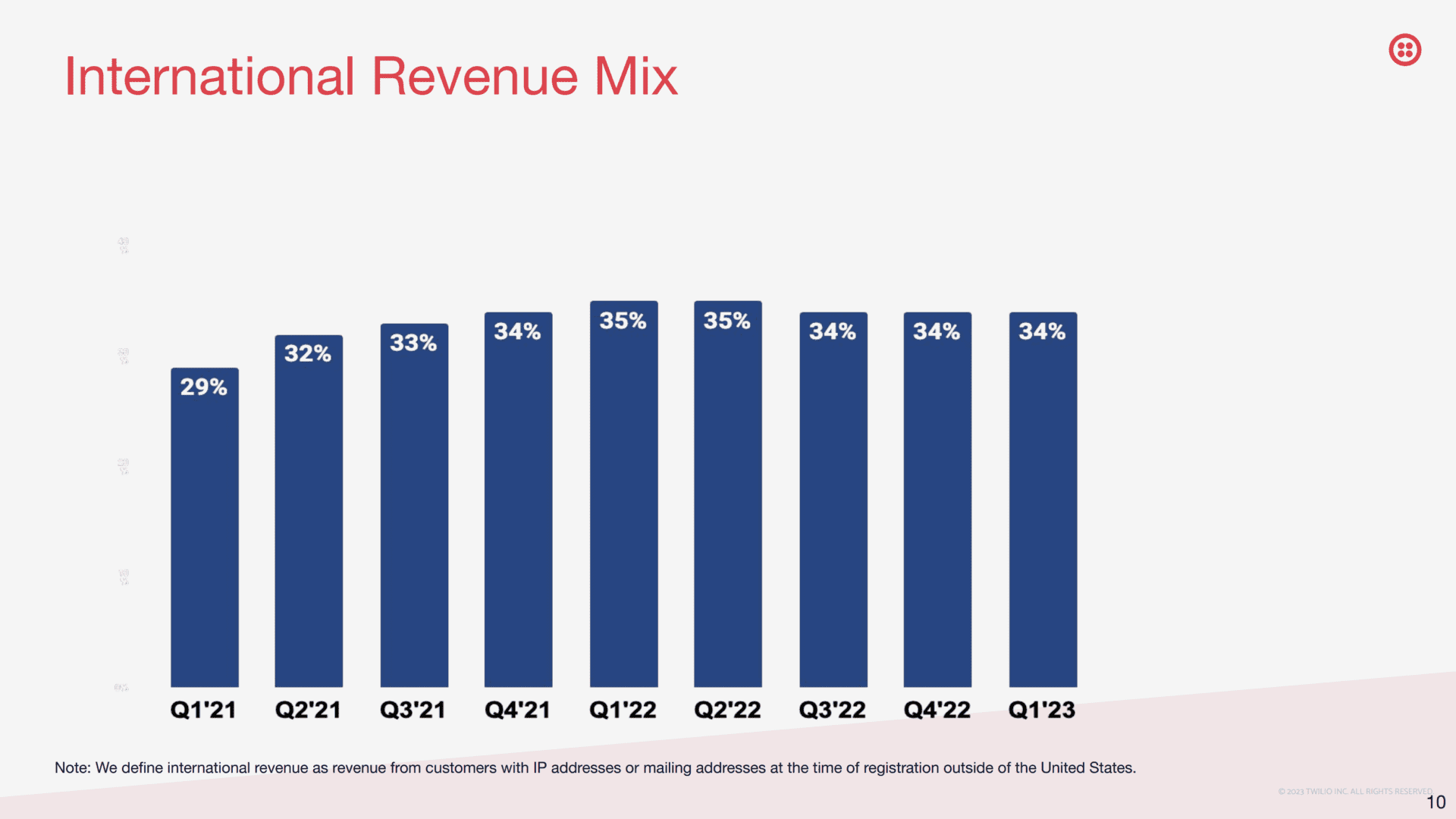

#4. A Third of Revenue from International. While that percentage isn’t growing, it’s still impressive for a communications-based company. Go Global!

#5. Headcount Down 25% Since September 2022, But Revenue Still Up. Never a fun exercise, but a reminder and example of just how much more efficient SaaS and Cloud companies are now vs. the Boom Times.

These days, challenge yourself to look at the market comps. Leaders like Monday, Asana, and Atlassian have seen growth rates slow, but remain at impressive rates. But leaders in communications like Twilio and RingCentral have seen much bigger challenges.

Twilio’s one of our hero companies and has gotten to $4 Billion (!) in ARR in near-record time. But the headwinds of 2023 have been a bigger challenge than anticipated. Especially in NRR.