So we’ve done so many great things with Zendesk over the years, and now it’s the end of one era for Zendesk — and the beginning of a new one. It’s now “going private” for $10.2 Billion. It may well IPO again in just a few years, we’ll see. But this will be one of the last chances we get to see its financials and metrics as a public company. Once it goes private again later in 2022, Zendesk won’t publish many metrics anymore.

Q2 $ZEN results are in. Revs up 28% y/y to $407M. Annual run rate of $1.63B. Non-GAAP operating income of $24M. Free cash flow of $41M. No earnings call due to pending acquisition. Probably our last earnings as a public company. 👋🙏🐟 Press release here: https://t.co/waXBKIw2rQ pic.twitter.com/gMYS0O1kH9

— Mikkel Svane (@mikkelsvane) July 28, 2022

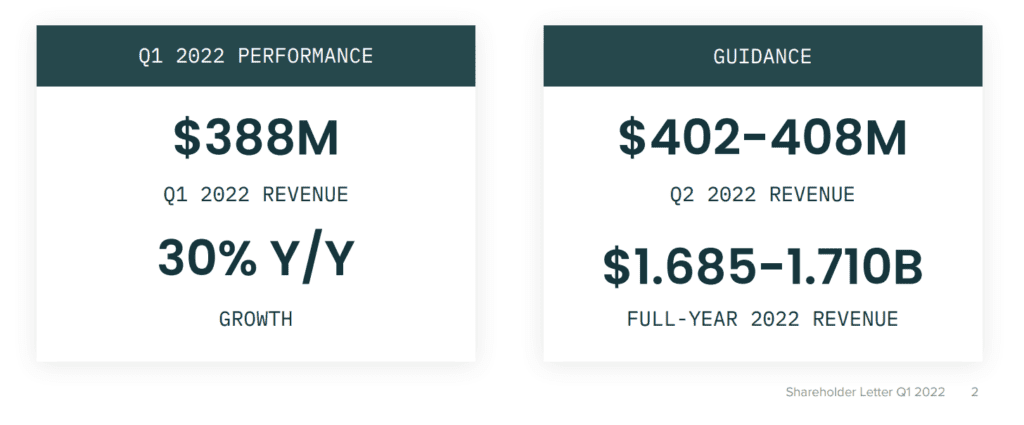

Zendesk has really grown up. As we’ll see, it’s growing a very impressive 30% at $1.6 Billion in ARR, and has slowly and steadily gone quite upmarket. It’s moved beyond its tiniest customers, of an ACV of < $1k, but other than that, it’s going upmarket without giving up its SMB roots.

In fact, Q1’22 was Zendesk’s highest first-quarter revenue increase in history. A shot across the bow of anyone saying SaaS is slowing. At $1B in ARR, Zendesk was growing 24%. Its growing 20% faster at $1.6B in ARR.

So let’s call this The Last Edition of 5 Interesting Learnings From Zendesk (like we did with Slack, as it got acquired by Salesforce). But there may well be another edition a few years down the road.

5 Interesting Learnings at $1.6B in ARR:

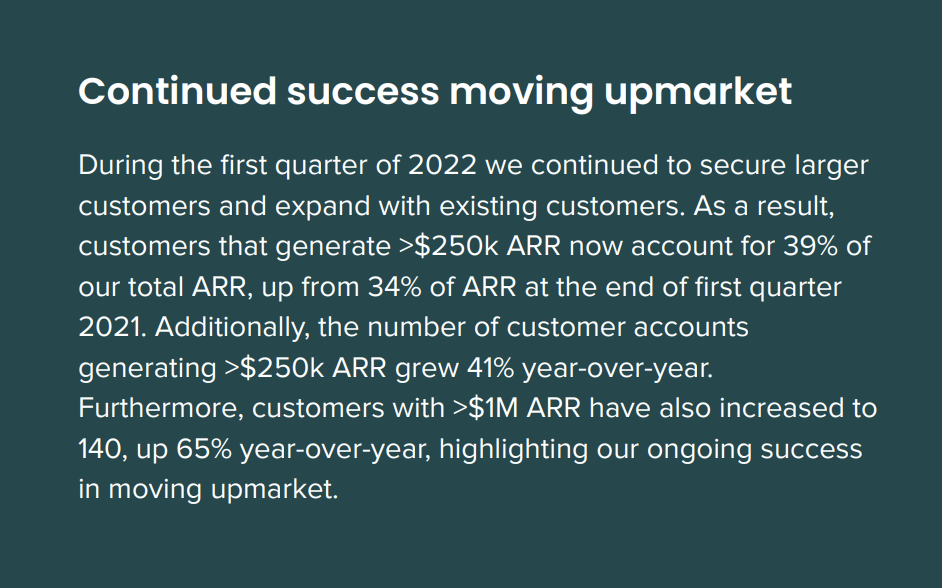

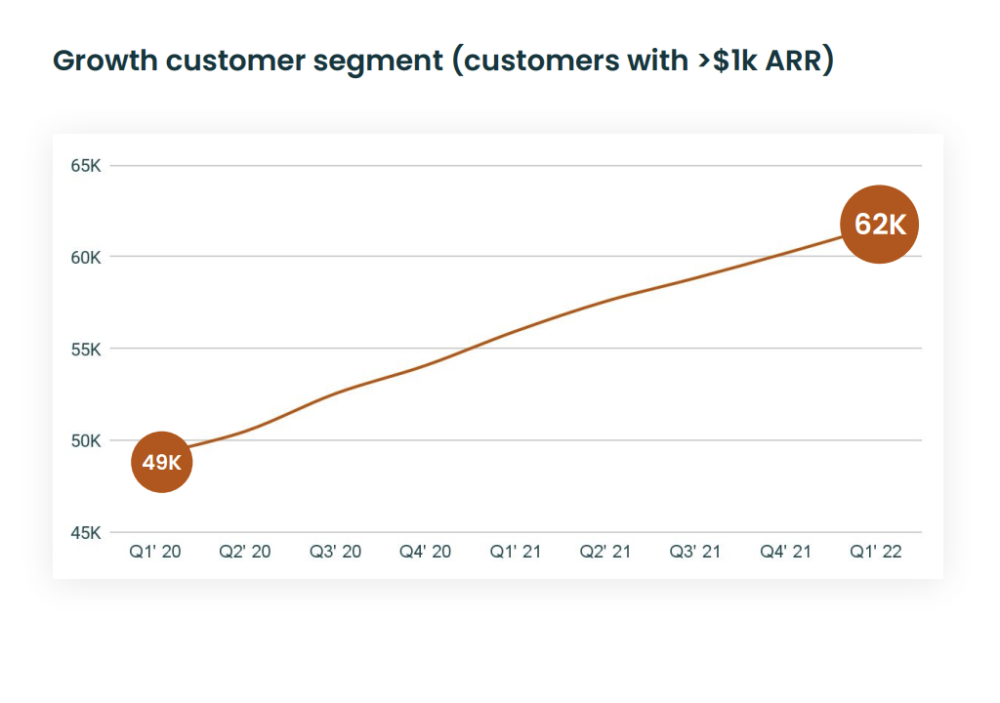

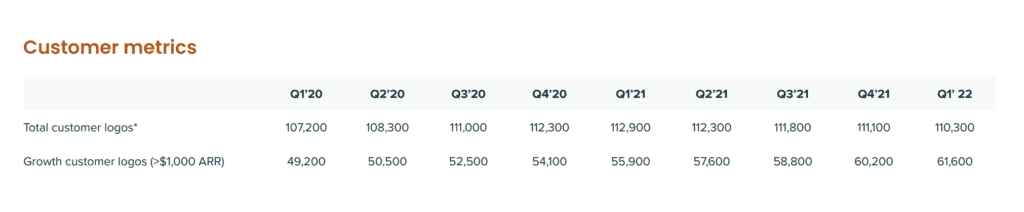

#1. $1m customers are the fastest-growing segment of all. Zendesk has 62,000 customers that pay $1k a year or more, but it’s $1m+ ACV customers are up 65%. They have 140 of them, so at least $200,000,000 in ARR comes from Whales — $1m+ customers. Even though Zendesk still has thousands and thousands of SMB customers.

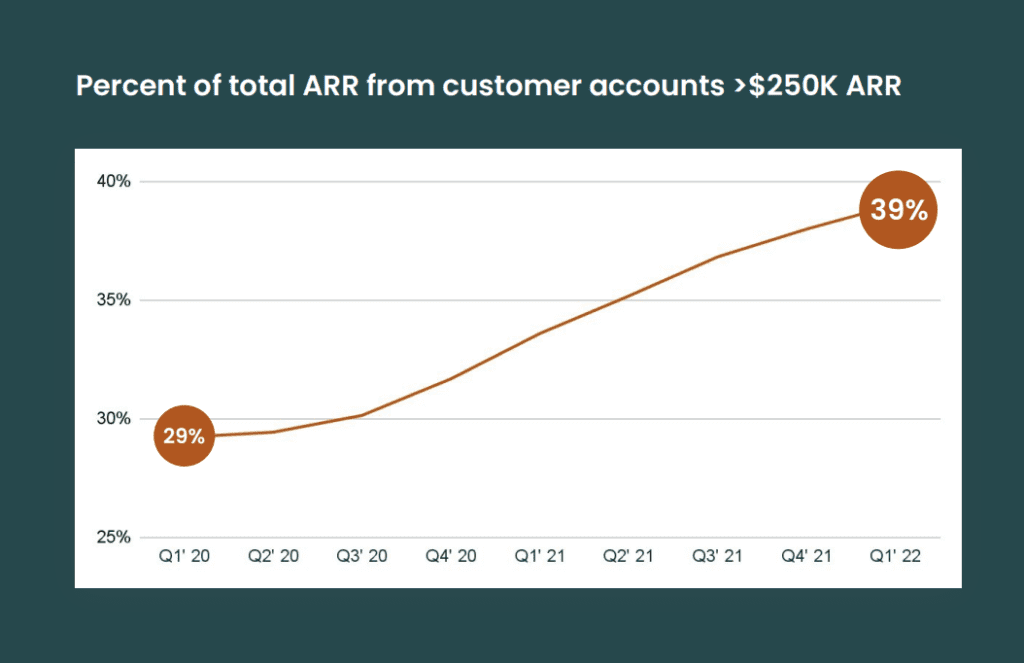

#2. The march upmarket has been slow and steady, but now 39% of revenue is from $250k deals. Up from 29% in 2020. Zendesk IPO’d as an SMB support solution. Fast forward to today, and it’s still that — but even more, it’s an enterprise CX solution with $250k+ deals driving growth.

#3. Customers with < $1,000 a year in revenue are < 1% of total revenues. While Zendesk still has thousands of SMBs, the tiny customers no longer even show up in the metrics. They are less than 1% of total revenues. But Zendesk has also raised its prices substantially over time, with price per agent now $49-$99 / month. That’s opened up a lot of white space at the very bottom of the market. But it’s a space that is economically irrelevant to Zendesk at $1.6B in ARR.

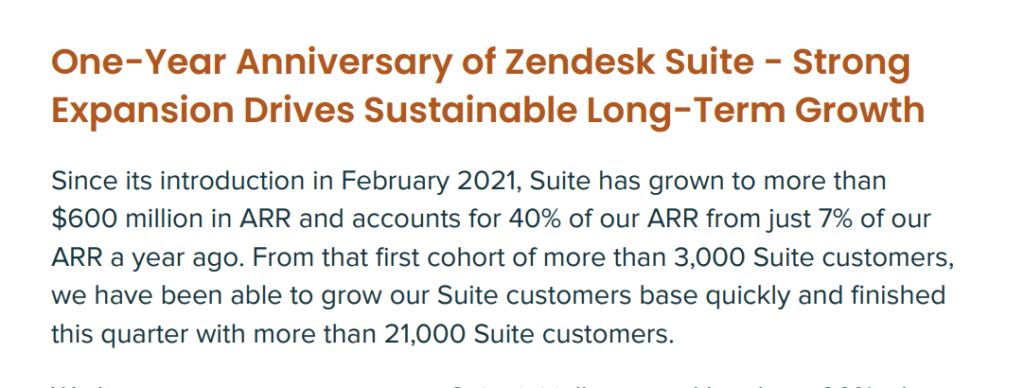

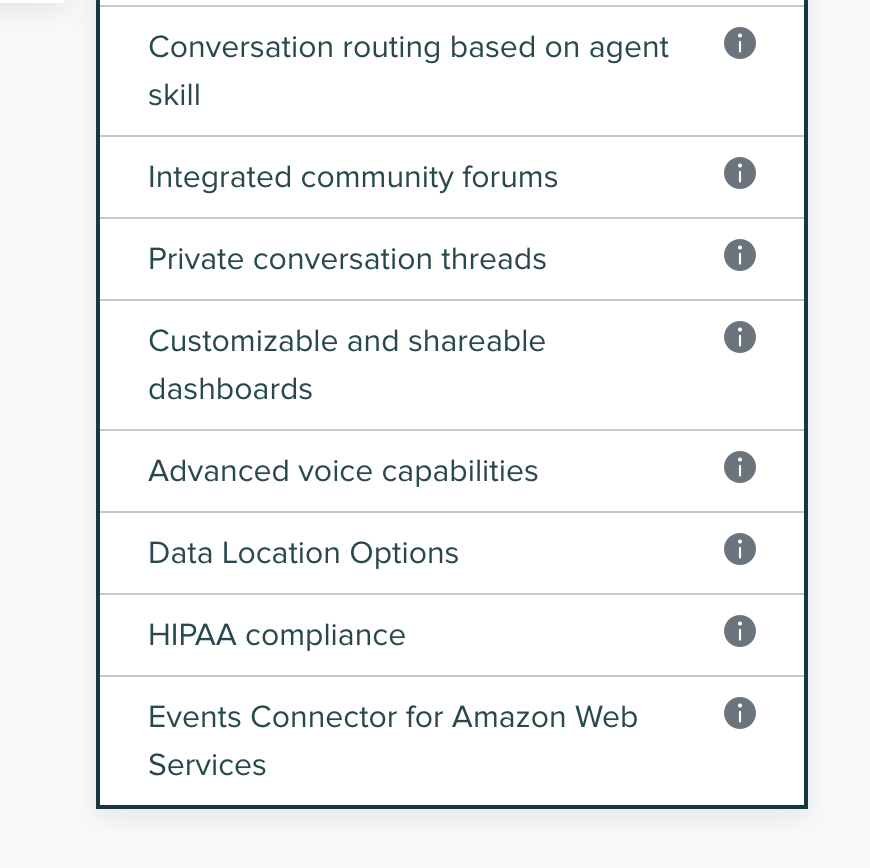

#4. Going beyond “ticketing” has been key to growth — its Suite editions, with voice, forums, routing, etc. are now 40% of ARR — up from 7% a year ago. While Zendesk arguable hasn’t gone truly multi-product, it has gone “omni-product”, doing much more than its original core of ticket-based support. That expansion of surface area has been key to Zendesk’s growth, with its “Suite” customers paying 20% more, with very rapid adoption. And signing longer contracts (19 months) with higher retention and lower churn.

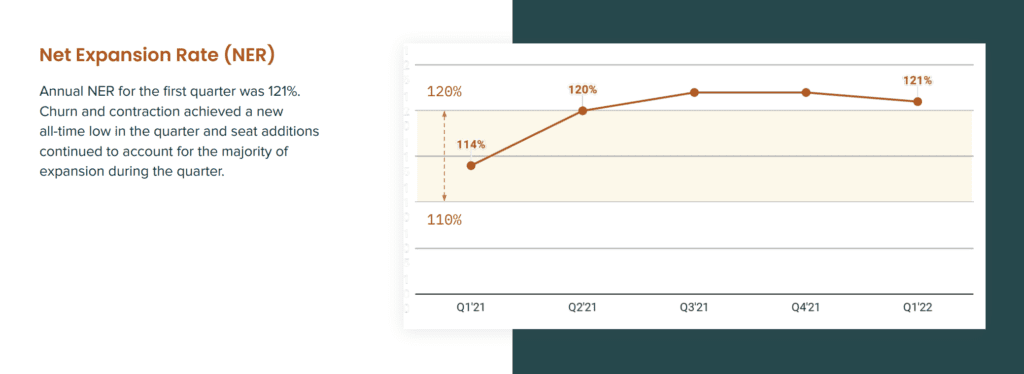

#5. NRR/NDR remains strong at 120%. This has been another key driver for Zendesk. It’s grown from OK NRR of 105%-110% to top-tier NRR of 120%. At 30% annual growth, this higher NRR is a key driver of growth at well.

And a few other interesting learnings:

#6. RPO growing materially faster than ARR, at 35% short-term and 38% overall. A great sign for the next year or two. More and more SaaS companies do deep dives on their Revenue Performance Obligations, i.e. the amount they have under contract they haven’t delivered yet. It’s a good proxy for future growth, as it shows how much revenue is already under contract for the coming year and longer. With RPO up 35% in the next year, and 38% overall, Zendesk has a good year or two sort of already in the bag.

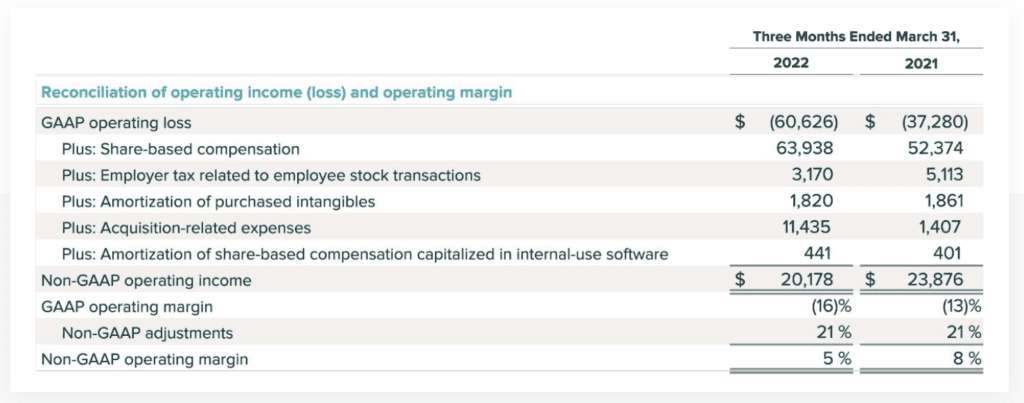

#7. Cash-flow positive, but not profitable even at $1.6B in ARR. This is perhaps the biggest knock on Zendesk’s otherwise stellar metrics. Even well past $1B in ARR, it’s not profitable. It is cash-flow positive however, generating $34m in cash flow last quarter, for an annualized rate of $140m, or about 8% of revenue. Those numbers are fairly middling compared to other public SaaS companies, and perhaps the only fuel for Zendesk’s detractors. Sales and Marketing costs also remain high compared to others post-$1B in ARR, at 53% of revenue. Getting this down is a key level for profitability at scale.

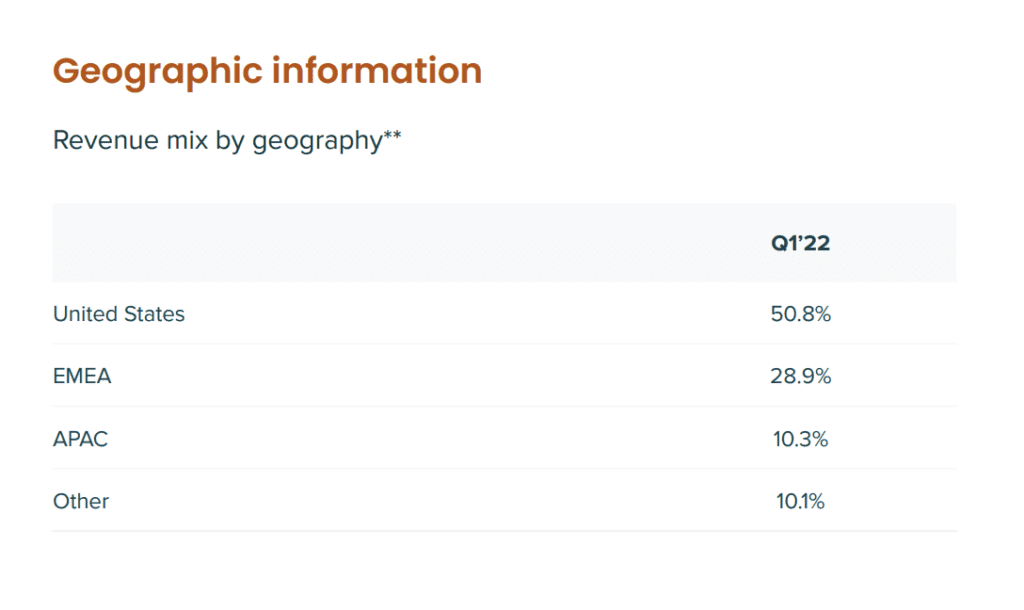

#8. 50% of revenue in the U.S., 50% outside of it. Zendesk’s European roots may contribute to its slightly outsized EMEA revenue, but in any event, it’s another good reminder that B2B SaaS generally has few borders. Run toward, not away, from global expansion in B2B.

#9. Its 61,000 $1k+ customers make up 99% of its revenue, but there are another 50,000 tiny, tiny customers. They no longer are material to revenue, but some certainly grow larger over time.

Wow, what an incredible journey so far for Zendesk!! We will miss having them as a public SaaS icon, but it will be fascinating to see how it progresses without the direct pressure of being a public company. It may well emerge growing even faster when if and when it IPO’s again.