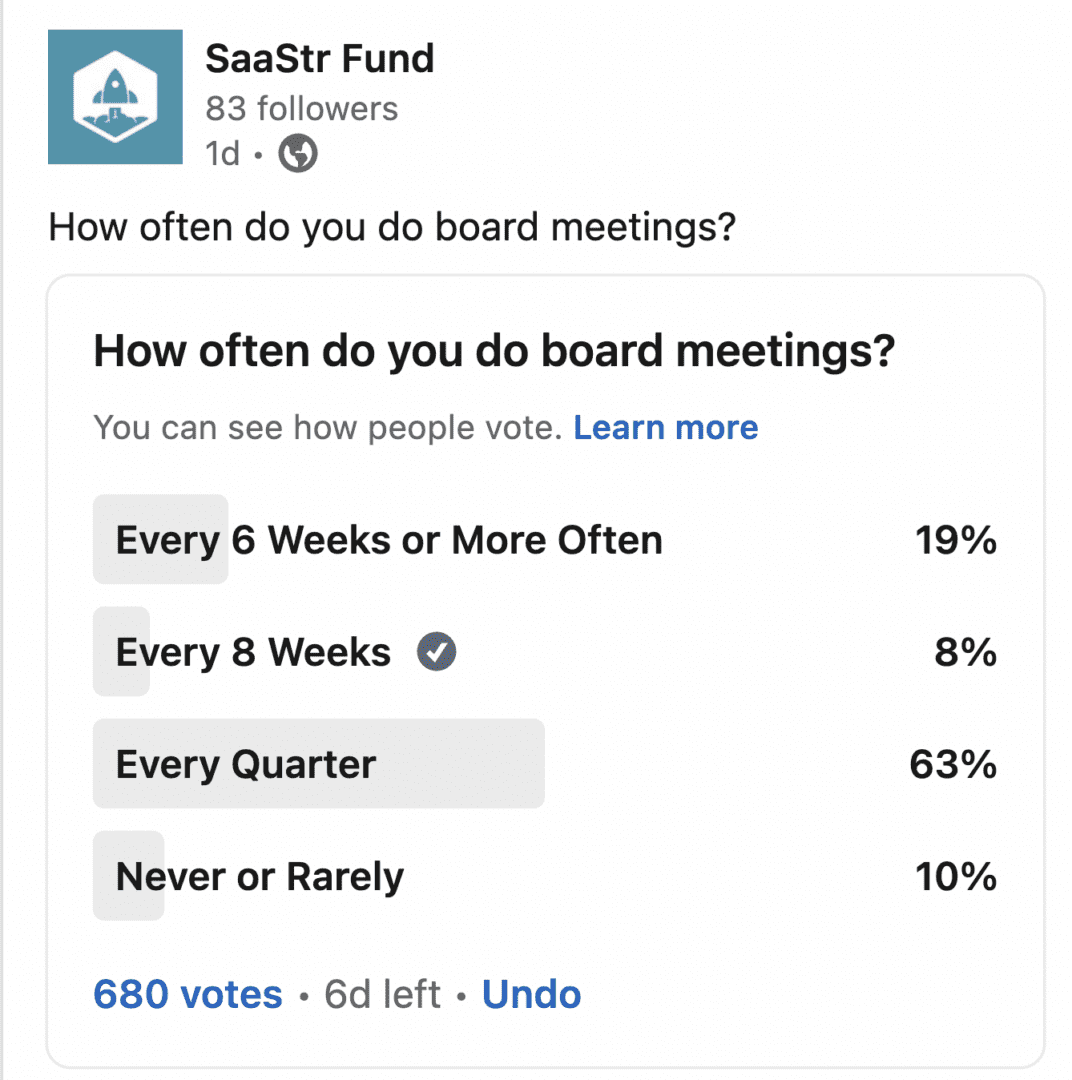

If you have board meetings every 60 days, your investors will be actively involved

Every 3 months, they'll be up to speed, but you won't always be top of mind

Never, and your investors will focus on other things

Up to you which path is best, really

— Jason ✨Be Kind✨ Lemkin 🇮🇱 (@jasonlk) March 8, 2024

In the Boom Times of late 2020-early 2022, many startups … really never had board meetings. Or barely had them. Or had 1 or 2, but would sort of never schedule the next one.

They didn’t take them seriously. The money kept coming, and in many cases, the VCs didn’t care. They were on enough boards anyway.

See, e.g., FTX. No board meetings, and no one cared. The money and times were just too good, and founders had all the power in hot deals anyway.

But now a lot has changed. And folks are paying a bit of the price for not having board meetings. And never got the benefits from having them.

Sequoia Capital has long been the gold standard of venture capital. Bar none.

But two of its largest ever checks, if not its largest, are in companies without boards of directors or CFOs.

FTX just bit the dust. And you're reading this on the other one.

— Dan Primack (@danprimack) November 9, 2022

VCs, once they have been doing it a while, basically become professional Board Members, and they write a lot about that. But I rarely find these posts help founders hack board meetings to help them. Or even explain why you should do them — if you don’t have to.

But how can you make Board Meetings work for you as a founder — especially if you are early stage and don’t have to have them yet? A few non-obvious ways you can use having regular Board meetings to help you. A lot.

- First, VCs that attend regular board meetings are much, much more likely to invest again. And to make intros for the next round. Never assume a VC will write you a second check. There is no obligation to write another one. But, you can hack it. All but the smallest VC firms hold “reserves” for second and even third checks into their portfolio companies. These reserves are used to double down on their winners, but also, to give a little more runway to the ones doing OK or pretty well, but not yet great. But the odds you get this “extra runway” check go way, way down if you don’t keep investors in the loop. The second best way to keep them in the loop is monthly investor updates (so do this!). The very best way is to invite them to detailed board meetings every 6 weeks. The VC sitting in those board meetings 6-8 times a year is much, much more likely to write a second check than one that isn’t. Ditto all of this for intros to the next round as well.

- Second, done right, your management team will really enjoy board meetings. Having them in board meetings includes them in the journey at a senior level (even if you are tiny). You may not care about board meetings. But your heads of product, engineering, sales, marketing, success, etc. … even if they are stretch leaders, or even individual contributors in the early days … will really appreciate being included. It will make them feel heard and included, not just by you as CEO/founders, but also by key outside stakeholders. Folks take board meetings seriously. As part of that, your team will genuinely appreciate being part of it all.

- Third, and probably most importantly, your management team will hustle to hit their deliverables and goals for board meetings. This is key. Board meetings are a bonus, almost free outside forcing function for you. You can only push the team so hard to hit your monthly, quarterly and annual goals before you break them. Make sure everyone attending board meetings has quarterly and annual goals to hit (even monthly if you can) that are tracked at each board meeting. Then, they have to present a dif to those goals at each meeting. They’ll worry, squirm, and hustle in slightly different ways than they will with you. And you’ll learn a lot watching how they rise to this challenge. Fewer and different excuses (if any).

- Fourth, it’s a great way for your investors to learn about your team. Hopefully, your investors know you personally well. You shouldn’t need a board meeting for that. But how do they get to know your VPs? A board meeting presentation is the best way. That also means you should talk less — and your team should talk more. Your investors can always just have a 1-on-1 with you.

- Fifth, it helps cover your arse. Your investors can’t say they didn’t hear about something, or were unaware, if you actually not just emailed them about it — but fully presented it to them in a board meeting. This is a real benefit in tougher times.

- Finally, you might even get useful feedback. I’ve had boards that never helped me at all. I’ve had boards that helped a bit. I’ve never had a board that was awesomely insightful, though. But … a good board of seasoned executives (or even just 1) will likely create a format that provides you 1 or 2 insights that help you step out of your box. It forces you and everyone to take a 6-times-a-year perspective on things it’s often hard to take time to do. These board meetings will force you to think a bit more strategically that week than you might. That’s good.

So what’s actionable here?

- First, do board meetings earlier and include your largest investors — even if they don’t have board rights. Folks without board or observer rights that own > 5% are worth including at least until the next phase, or maybe at least for the first year or so after they invest. (Just be clear on the timing here).

- Secondly, include the team and let them talk more and you less. You can always do a 1-on-1 Zoom with an investor later.

- And third, these days when you can raise $5m on SAFEs without “giving up” and board seats … maybe have regular board meetings anyway. Every 6 weeks like clockwork. You’ll at least get the benefits above.

They matter.

(note: an updated SaaStr Classic post)