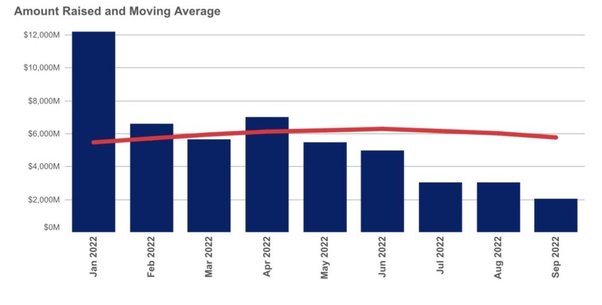

So in the Boom Years of late 2020 to early 2021, a lot of best practices working with VCs fell apart. Founders stopped caring. VCs did so many deals, they stopped caring. Everything was Up, Up and Up!!

Now, it’s tougher times for many. If nothing else, it’s dramatically harder to get funded at the Series A and B stages, and almost impossible at C and D unless you are an AI play executing to perfection. More on that here.

With that, it’s time to get back to working with and managing your VCs and board better. I’m going to share a list of things most venture-backed startups did … through about 2020. And then just stopped doing.

#1. Have Board Meetings Every 60-75 Days. Just Do It. You may not like them, you may think they are unnecessary. But VCs just don’t stay as engaged without board meetings. And until you are bigger — say $20m-$30m+ ARR — quarterly isn’t often enough. Too much changes. Especially if you don’t have a ton of cash on hand. More here

#2. Get The Founders’ Comp for The Coming Year Approved in Writing, Including And Especially Anything Nonstandard. But Even Just Your Base Salary. It’s pretty much required, but most founders stopped doing it. This only puts you at risk if things don’t go well. I have no idea what most founders I’ve invested in pay themselves. Trust is good, but disclosure + trust is even better. If your investors find out in tougher times that you’re paying yourselves what seems to be too high a salary, it will, if nothing else, breed some misalignment. Or more.

#3. Get a Real Financial Plan for the Year Approved, Including a Formal Burn Rate Budget. Way, way too many startups haven’t gotten a 2023 plan approved yet. It’s really not OK. If you do it, and get it approved — then at least somewhat, the responsibility is shared. And everyone understands the risks and prognosis. And then iterate with 3 plans: a Base, A Stretch, and A Bad Case. More on how to do that here.

#4. Send Out Very Prompt Monthly Investor Updates By Email. It’s OK If They Are Only 90% Accurate. Don’t wait for the perfect numbers back from some outsourced finance firm. Send a quick flash update the day the month closes, if you can. It only builds and inspires confidence. It doesn’t have to be perfect.

#5. No Surprises. Telegraph bad news way, way ahead of time. VCs are wired for bad news, but they are also wired to process things and be patient. Give the earliest heads-up possible on bad news. Also, no “Sh*t Sandwiches”. Don’t package bad news after a bunch of pseudo-good news. Get straight to it and address it head-on. At the start of the conversation, not buried at the end.

#6. Carefully forecast and re-forecast your Zero Cash Date. And share it in every monthly update. Your cash-out date is a dynamic metric. So update it dynamically. Every month. And make it as core to your investor-level metrics as your MRR is.

#7. Stop doing so many written consents on Carta and otherwise. Why? Because it will force you to do them live at Board Meetings. This isn’t a common tactic, but one I’m recommending more and more.

#8. Improve How You Report Metrics, Especially Gross Margins. Too many founders were fast-and-loose with a lot of metrics the past few years. It’s time to lock them down. Especially for folks with gross margins less than 70%, to be very rigorous with what your gross margins really are. At least so folks know.

#9. Ask for Tough Feedback. Most VCs have just stopped giving critical feedback. Why? They don’t think it’s in their interest anymore. They’d rather see many startups struggle than risk getting a “bad reputation”. So you gotta ask for it. And if you do, your VCs and investors will respect you more. Because only the best really ask for and can take tough feedback.

#10. Don’t Run Out of Money. The entire venture industry is under stress this year. If you need a bridge round, discuss it — early. Talk about it, Talk about what to do if you have less than 18-24 months of runway. Don’t just … run out of money. You might laugh, but this is far too common. Founders hide from running out of money, and/or plan way too optimistic financial plans that can’t realistically be hit.

To some, this will look like a very basic checklist. But it isn’t, or at least, isn’t anymore. Almost everyone stopped doing at least some or even all of this stuff. But if you don’t, your investors are less likely to be there when you need them. Not the best look these days.