Ok, hopefully you’ve built a careful, thoughtful financial plan for the year. You have your base plan, your stretch plan, a thoughtful approach to spending and burn rates, and more.

The 3 plans you need to make as a founder:

The C10 Plan, The C60 Plan, and the C90 Plan: pic.twitter.com/JSPcjbfzpt

— Jason ✨Be Kind✨ Lemkin 🇮🇱 (@jasonlk) October 4, 2022

And yet … I know many of you haven’t started, or have only done a cursory job of financial planning. That’s a mistake for several reasons. First, without a strong, data-driven model, your goals for next year will be much harder to hit. Second, even small amounts of mis-spend and over-spend can compound over the course of the year to a much higher burn rate. More on that here. And third, and most importantly, you need to know how far to stretch. Without a strong plan, doing even better is just … a hope. You won’t know where to spend, how many to hire, and what the plan for each month should be. Your team won’t know, either.

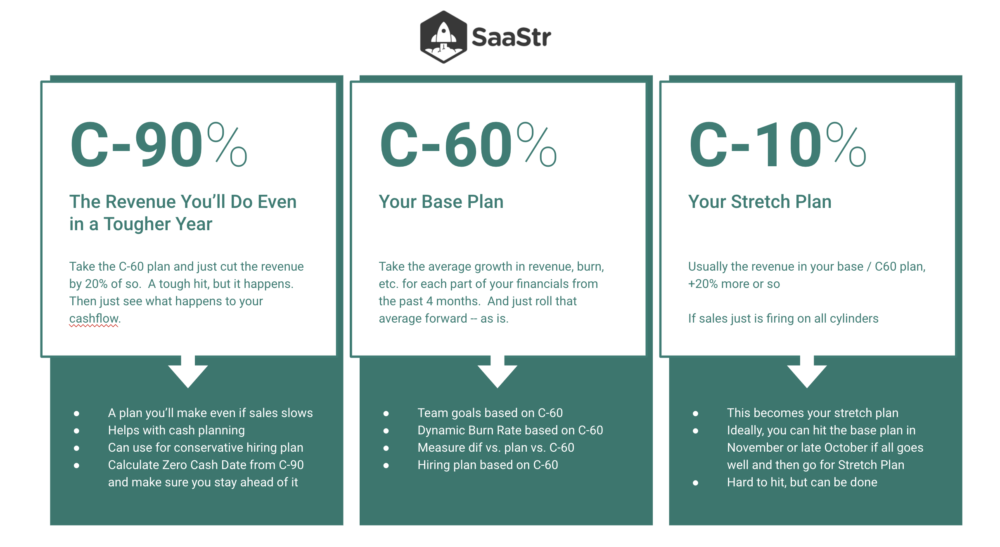

And in fact, you need three plans to run your SaaS business for next year. Especially these days, when venture capital is so much tighter:

- A C-60 Plan. This is one you have a 60% confidence rate you can hit. C=Confidence. Much higher, and you aren’t pushing hard enough. Much lower, and it’s too risky to plan around. This is your base plan. And one you can almost automate the first draft of (see below).

- A C-10 Plan. This is a variant of the C-60 plan that you think maybe, just maybe, you can hit. Usually, it’s around 20% higher than the base / C-60 plan in SaaS. So if your base plan is to grow 100% next year, your C-10 plan is often 120% growth. This becomes your stretch plan. Much higher than 10%, and it’s too easy to achieve. Any lower, it becomes implausible. But you can tweak this to C-15 or C-20 if you want.

- A C-90 Plan. OK, this one is just for planning purposes. The broader team doesn’t use it. This plan is if the burn stays the same, but revenue comes up short. You need this plan to know how long your cash lasts if next year is harder than planned. It’s fairly easy to build as well. Take your C-60 plan, keep the expenses the same, but cut the revenue, say, 20%. Watch your burn and your Zero Cash Date go way up. Make sure you have enough cash to support this model. Especially these days.

OK, so you need a relatively high-quality plan — but that isn’t too hard to make. It’s usually not as hard as it sounds. Start with an “L4M” model — a model that just averages the growth rate in your revenue, your costs, and your burn rate for the last 4 months or so. And just roll those average growth rates forward into next year. It’s that simple. Here’s how:

So if your revenue is, say, growing 5% a month on average for the past 4 months, burn rate going up 3% a month, and each individual cost area a varying amount — just roll them all forward each month into the end of next year. That’s the most likely scenario — for now. Your C-60 Plan. You may do better, you may do worse. But it’s generally a good base plan you can put together in 10-30 minutes. And if it’s truly missing some big deals, some big trends, and or big costs — then make tweaks on top of it.

Then, once you tweak the C-60 Plan a bit, and finalize it … then increase the revenue as much as you can so that it’s still plausible to hit (i.e., a 10%-20% chance to hit a higher top line). That’s your C-10 plan. Again, that’s often +20% on the revenue side, and then make sure you add in the costs. Now you have your stretch plan.

And finally, build your C-90 Plan. This one isn’t that fun, but it’s easy to build. Key all the costs from the C-60 plan above, and just cut the revenue growth by 20% or so. Your burn rate will often go up about 20%-25% as well under this plan. And especially if you don’t really like the C-90 Plan, at least talk about it with the founders and the finance team. You may have to implement it. A lot of founders don’t really like the implications of their C-90 Plan and hide from it, or even never build it. That often leads to tears.

Now you have 3 plans — and 3 burn rates and Zero Cash Dates. Use the C-60 plan for the Base Plan and everyone’s goals for next year. The C-10 plan for the Stretch Plan and bonuses for everyone if you hit it. And the C-90 Plan to manage cash.

And if you don’t like your cash reach after this — figure out what to cut, or how much to raise, that gives you 16+ months of runway.