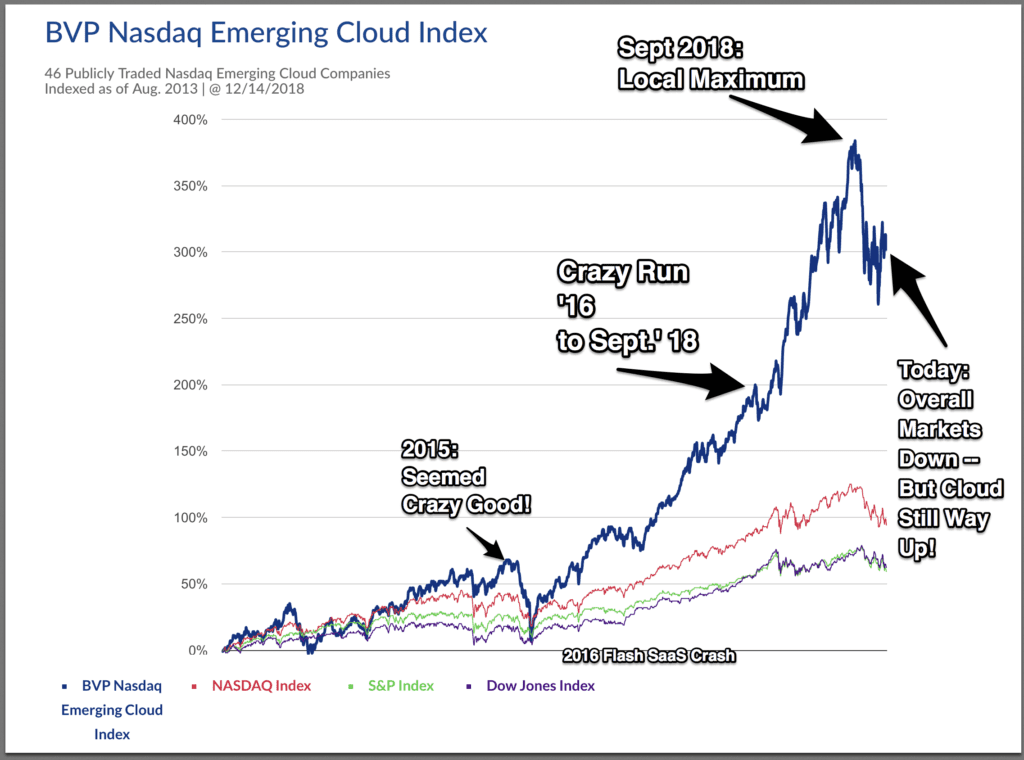

We originally ran a version of this post way back in May 2015. It didn’t seem like SaaS could get much better than in 2015. And indeed, briefly, for just a few weeks in Feb 2016, there was a SaaS “flash crash” and things got worse. But then right after that, SaaS and the Cloud just picked itself up and went on a tear. 100+ Unicorns (!). $3b and $5b and $7b valuations became the new $1 billion.

Back in 2015 we wondered, 5-6 years into a Bull Run, if it might make sense to have a Quiet Plan B. Just in Case. Just in case there was a downturn. And there was, in February 2016. It only lasted like a month. And for the rest of 2016 and 2017, SaaS just went on a tear.

2018 was an odd year. On the one hand, SaaS stocks continued to grow and outperform. But the overall stock markets, were down or flat. That’s made folks nervous:

These days again really are the Very Best of Times for SaaS. 2018 Was Crazy. We thought Cisco buying AppDynamics for $3.7b in 2016 was a lot. Fast forward to 2018, Microsoft buys GitHub for $7.5b and SAP buys Qualtrics for $8b, and there was Unicorn IPO after Unicorn IPO in 2018. Relative newcomers Twilio and OKTA are flirting with public decacorn status.

And yes, it could get even better. Maybe valuations will go up another 2x. Maybe there will be 1,000 or 5,000 Cloud Unicorns, not just 100. But even if that happens, it won’t be that much better, it won’t feel that much better. Companies may grow even faster, valuations for Super Hot startups may grow even higher. But going from 9.6 to 9.9 on the Best Of Times 1-10 scale won’t feel that different. It’s just soooo much better than any time I’ve been in SaaS since ’05.

And yet … we all know really, it can’t last, not at these levels. Or at least, the bull run has to come to an end. It always does, it always has, and it will again.

No matter what, the best SaaS companies will continue to grow faster than ever. Amazing new startups and technologies will continue to be born. And the CIO’s budget will continue to be repurposed at a tremendous pace from maintenance and on-prem to Cloud and SaaS. But the unprecedented multiples we’re seeing, which breed all these unicorns — they probably won’t last.

So at some point, startup valuations and multiples will come down. That means funding will get harder. That means startups will have less to spend, because burn rates will have to come down.

Ok, ok, you say. Gravity is inescapable. But so what?

I remember when I was called up in ’08 (when the world had ended, in global crisis) to talk about what to do with one of my investors. Had I seen the “Sequoia Memo”? Of course I had:

And the cautionary tale was useless for me in SaaS.

So my answer was: Nothing. No changes. As a post-Initial Traction SaaS company that was reasonably capital efficient — there was nothing for us to do in a downturn. We had to keep growing. We had an efficient sales model. We still had $3m in the bank. Nothing’s going to change, except maybe we’ll hire a little more slowly (which we didn’t), and maybe we’d get to cash-flow positive more quickly (which we did, for better or worse … probably a mistake with hindsight).

And what really happened in the downtown of ’08-’09 was that IT and SaaS budgets were scrutinized very carefully, and upgrades and upsells got much tougher … but basically everyone renewed even at the worst of times. At least their more critical apps.

And even if you’ve leveraged a high valuation — the beauty to SaaS is you can grow into a valuation pretty easily, just given time. If valuations fall 50%, and you grow, say, 125% next year … maybe you’re just back to where you were last year. That’s OK. The world won’t end.

And once you are at Initial Scale ($10m+ ARR), you really can just “dial it back”. I remember in early ’09, being on a panel with the CEO of Eloqua. He said they’d gone profitable for the first quarter ever as a reaction to the financial meltdown. How? Just hired less in sales, and spent less in marketing. It probably hurt them long-term. They didn’t invest for growth. But it also was a simple, “easy” Plan B to implement once you are post-Scale.

So really, Plan B just has to do with money, cash burn, and cash reach.

I’d break things up into 3 types of SaaS companies:

- Lean, and pre-Initial Traction (pre-$1-$1.5m in ARR): No need for a true Plan B. You need every single resource you have. Keep doing what you are doing.

- Fat, and pre-Initial Scale (<$10m in ARR). These are the ones I worry about. Somehow, a lot of founders in Hot and really pre-Hot SaaS companies have come up with some magic metrics about how much they can lose per employee. So the more employees they have, the more they lose. A lot of SaaS startups around $2m in ARR are losing >$400k-$500k or more a month, if they are well funded. This is where the crunch will be, if and when it comes.

- Fat or Thin, post-Initial Scale ($10m+ ARR). I say no need for a Plan B — you really can dial back without layoffs or much drama if things get worse — but … maybe raise a little more money if you have any concerns about the economy. Take the little bit of extra dilution (it’s cheap at this scale, anyway) and put away another 12 months of runway.

To that second group — a few million in ARR, burning $5m+ a year … congrats on the funding … but you do have some danger.

You may want a Plan B. That Plan B will be either to grow even faster, get to Initial Scale ($10m+ ARR) even faster, and grow into that third type of SaaS company above. I like this Plan B.

Or understand how, and if, you could cut half the company in your Fat, pre-Initial Scale SaaS start-up if you don’t get there quick enough.

Bear in mind though — cutting people and scaling back is just terrible in SaaS. This is the real risk with the Fat Startup that isn’t yet at $10-20m+ ARR. If you ask anyone senior at Salesforce what the company’s worst strategic mistake was, they’ll tell you it was underinvesting in hiring in the ’08/’09 downturn. Since SaaS compounds, if you take a year or two off in pushing the pedal to the metal — you lose so much growth on the back-end.

But at least knowing how Plan B can really work, in the back of your mind, may help your sanity just a smidge.

It can get better than this. But not that much better.