As we’ve talked about before, the great thing about SaaS is it compounds. Once you have something, it builds on itself. But it takes time. It takes 7-10 years to build something real.

If all founders started off with 10-year vesting,

I suspect this would reduce and minimize like 50% of co-founder issues

* It forces you to have the tough conversation up front

* It protects the ones that stay from the ones that quit

* It better aligns expectations— Jason ✨Be Kind✨ Lemkin (@jasonlk) July 30, 2021

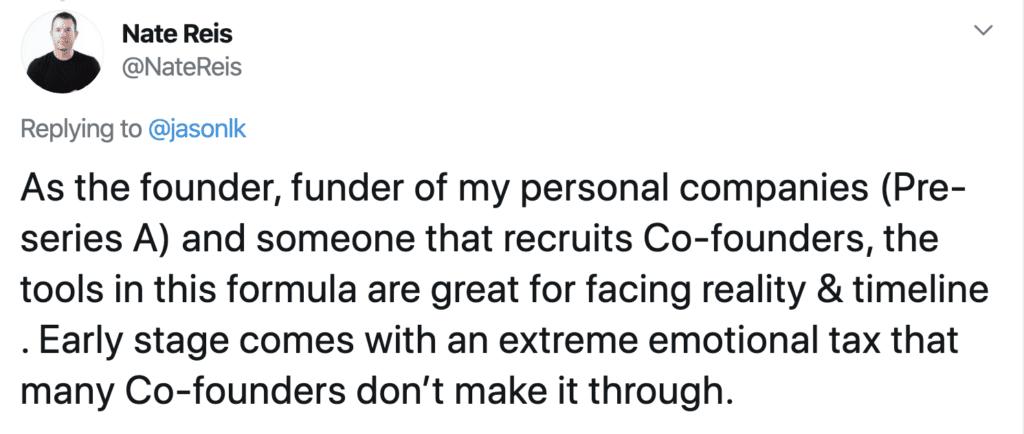

If you are reading this, you’re probably up for that 7-10+ year commitment, assuming you’re fortunate enough to get there.> But what about your prospective co-founders?

Are you all sufficiently committed enough to make it in SaaS, over the extended term? You guys can talk about it. And say all the right things.

Here’s the thing: do you know for sure? As Mark Suster wrote a while back, the #1 thing founders privately tell him is they got this wrong. Mark talks about getting vesting right, getting equity ratios right, etc. etc. All good stuff.

So I’ve got a simple test for you. For you and your co-founders in SaaS at least, do this with your stock:

- A 5, or better yet, 6 year vesting schedule (not the traditional 4), with

- A 1 year cliff starting 12 months after you close seed funding, or launch of MVP — whichever comes later. (I.e., if you leave before those 12 months, you leave with 0 shares. Zero).

- No vesting at all for all the hard work you’ve already done prior to that cliff. None.

- With full acceleration / 100% vesting if terminated after an acquisition (so-called “double trigger”).

Ok, what does this do? Well, it will force you all to have an honest conversation. Because it’s perfectly aligned with the 7-10 year journey in SaaS. With the fact that there’s no tornado, no viral explosion in SaaS. There’s not going to be any Instagram insta-hit. That’s there’s zero value in SaaS until you’ve at least built a real business, with real customers.

>> If your co-founders all agree to this, intuitively and quickly — including yourself, no exceptions — I’d argue you’re on the right path, as a team. And if for some reason someone later then doesn’t work out, and steps off — all or most or at least enough of their equity will come back in the right ratio relative to the journey.

[Note the acceleration in acquisition won’t really matter too much — all this can and will be renegotiated in any acquisition. But it doesn’t hurt and will make you feel better, that if for some reason it’s out of all of your hands — you’re no longer in charge of the journey, because you’ve been acquired — you at least have nominal protection then.]

But …

Don't pick a cofounder that

– has something better to do

– wants to see how it goes

– has a clear backup plan

– sees it as risky

– argues over who should be CEO

– doesn't 100% believeYou'll see

— Jason ✨Be Kind✨ Lemkin (@jasonlk) July 18, 2020

If you can’t all agree to this. To take the modest risk inherent in this schedule, to the compounding, to the longer-term journey … Then it just isn’t going to work out, as a team.

>> In that case … Fix it now. This simple test will likely ferret it out, if your team isn’t committed enough for SaaS.

Anyone that fails it should move from founder status to early employee, with commensurate economics.

I remember when 8 months in, with 5 months of cash left, my co-founder walked out the door and didn't return

And I didn't really know how to build software

Yes, we survived. Yes, in the end, we pushed through.

But pick your partners wisely.

We never really got that time back

— Jason ✨Be Kind✨ Lemkin (@jasonlk) October 16, 2020

(Note: an updated SaaStr Classic post)