Today the 1100th VC fund of 2016-2017 was announced. It’s hard to keep up with the explosion of new funds. I’ve even raised a few myself.

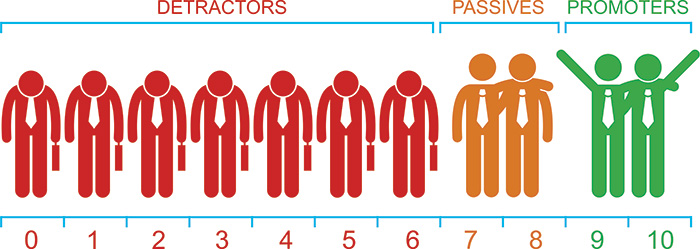

But there is one I want to rate a 10 on the VC NPS Scale — Would, And Always Do, Recommend to A Friend. Point Nine Capital has raised €75M for its fourth fund.

Despite our headquarters being a dozen time zones away (Berlin vs. SF), I’ve been fortunate enough to be a co-investor with Point Nine on many winners (Algolia, Automile, Front, etc.). What I’ve learned from that experience is there is no team more founder-dedicated, win-win and positive than Christoph, Pawel and the Point Nine team. Christoph’s first angel investment was Zendesk. Overachieving on your first at-bat I suspect was an informing experience about doing things “the right way” that continues to this day.

If you are raising in SaaS or marketplaces or B2D in general, and if you are seed in Europe in particular. Go there.

VC is a weird industry. It is necessary for success for many start-ups, and in that sense, a mitzvah. I would have nothing myself without venture capital. I needed it in both my start-ups, both to get off the ground and to scale.

But as a founder-turned-investor, I like most, have mixed feelings about VC. I’ve had rough experiences with VC, transparency issues, and in general, experienced a lot of Chaotic Neutral behavior. It tends to jade you on the industry, even though we need it and it plays a critical role.

I’ve tried to hold myself to a higher standard.

I try to emulate Point Nine here.