Here's the thing we're all re-learning in 2024:

To be VC-backed, you truly have to grow at insane rates

At least, Triple Triple Double Double (3x 3x 2x 2x)

Ideally, Triple Triple Triple Double Double

If that's not you, don't raise. Or stop raising. Or at least, be realistic.

— Jason ✨Be Kind✨ Lemkin 🇮🇱 (@jasonlk) February 7, 2024

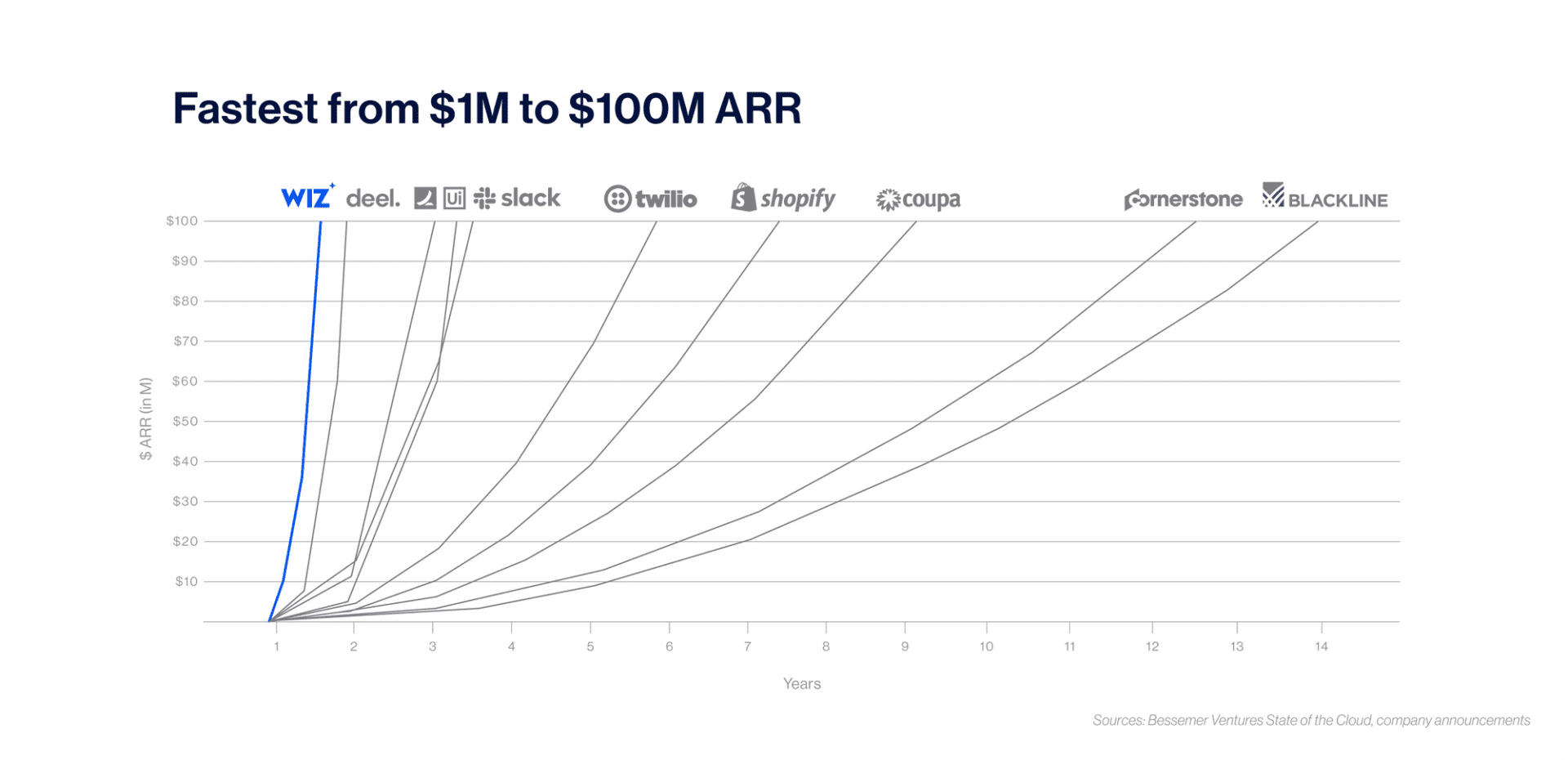

A few years back, as SaaS was exploding but hadn’t yet revved into true hyperdrive, Neeraj Agarwal of Battery Ventures summarized a lot of what VCs were talking about with “T2D3”. That if you tripled the first year after you past the first $1m-$2m in ARR, and tripled the next year, and then doubled after that, you’d have a pretty good shot as growing into a unicorn. And mathematically, that’s still true today. That sort of growth compounds into a $100m+ ARR pretty frequently. In fact, you don’t even quite have to hit “T2D3” to get to unicorn status in the end if you’re just a bit patient. More on that math here.

But fast forward to today, and there are 1,000+ SaaS and Cloud unicorns. They’re being minted every week — or at least they used to be. What’s the bar now to be a decacorn-in-waiting? To merit those crazy high valuations we seem to be seeing almost every day?

The biggest change is that growth investors, the folks that invest at $10m+ ARR, are often now looking for SaaS startups to be tripling at this stage — not doubling. Or at least growing 150% or so.

Is that fair? Isn’t doubling at $10m+ a year plenty good enough? It certainly was for a long time for mid-stage and growth-stage VCs. But the explosion of valuations and market caps in SaaS isn’t “free”. There’s a cost. And the cost is an expectation of even higher growth than before. Growth stage VCs aren’t hunting unicorns anymore, they’re hunting decacorns.

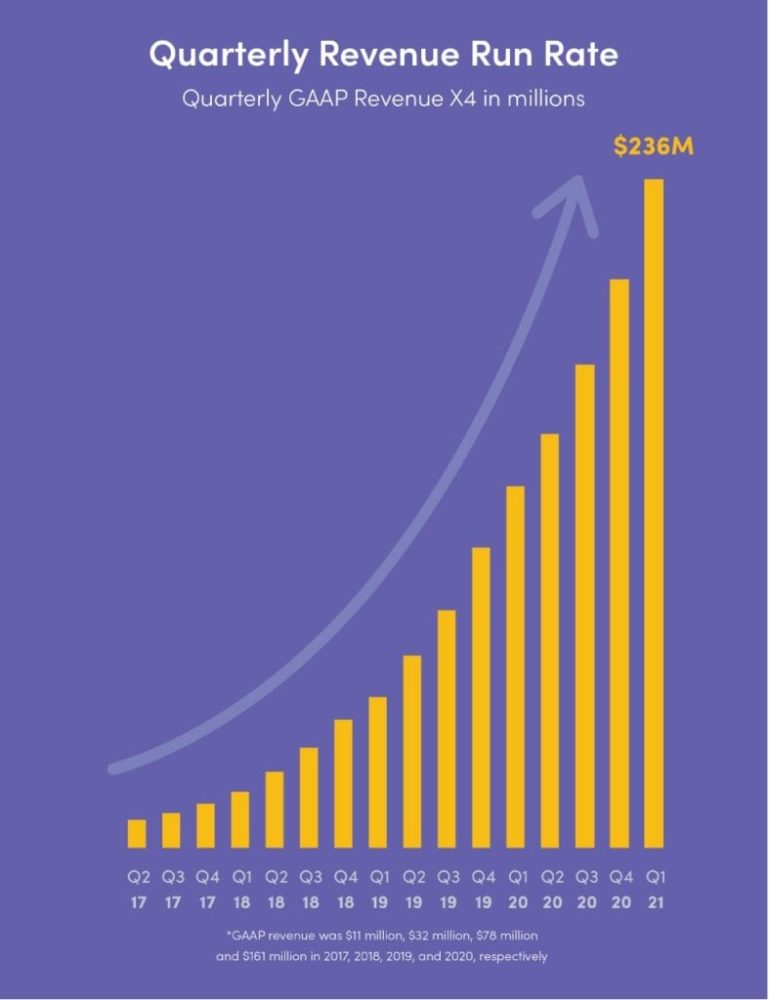

Let’s just pick one recent example, Monday.com. You can see here that at $11m ARR, they almost tripled the next year to $32 million ARR, and then grew 2.5x the following year to $78m ARR and then 2x’d after that to $161m ARR.

Now this isn’t to say we all have to grow at quite this rate. Nor that every Series B VC round is really being done at 3x growth at $11m ARR.

But bear in mind even with these incredible numbers, Monday.com is worth $9 Billion today — not even quite a decacorn yet (soon I am sure, but not quite yet). 🙂 So if you become a unicorn someday, those unicorn investors are going to expect this out of you.

And it does mean that this sort of growth is what many growth-stage VCs are hunting for — and also paying up for. They’ll pay the seemingly crazy ARR multiples. But not for nothing. They’re expecting T3D3 growth in return these days. Not T2D3 anymore. Not for the premium prices, at least.

Again, you can get to $100m+ ARR growing very nicely without ever having to quite hit some of these growth rate numbers. Don’t let it overwhelm you. But do let it challenge you. And be aware that the bar has gone up.