Lots of companies at $10m ARR never hit $100m ARR

But I don't personally know any with 80%+ growth and 100%+ NRR at $10m that didn't get there eventually

If that's you at $10m ARR .. Go Long

— Jason ✨BeKind✨ Lemkin #ДобісаПутіна (@jasonlk) May 10, 2022

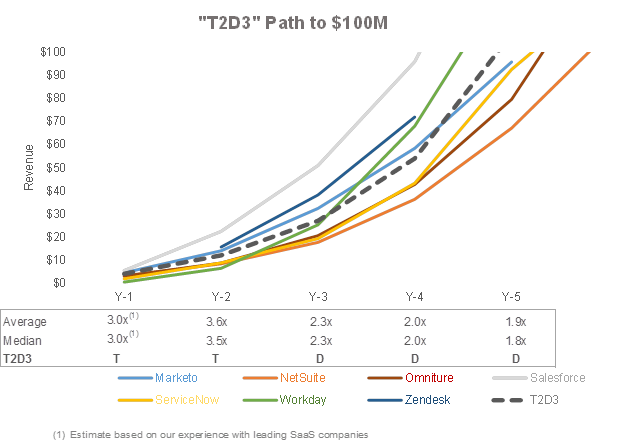

Neeraj Agarwal of Battery Ventures a few years back simplified a lot of the journies top SaaS companies go on to TripleTripleDoubleDoubleDouble, T2D3. That the top SaaS companies triple in the early years, and then double after that to get to $100m+ in ARR. The best SaaS companies do indeed do this and it’s a great yardstick for VCs to measure potential unicorns and decacorns. And it’s a great post and paradigm for building a unicorn:

But for founders, it’s a bit too many moving pieces. Founders just want to know: What Do I Need to Achieve To “Make It”? To Build a Unicorn?

I’m going to suggest something simpler: 10-100-110+:

Triple Double Double is a good goal, but tough to skate to in practice

10-100-110 is enough

10m ARR

100%+ growth

110%+ net revenue retentionDo that, you will build a unicorn

— Jason ✨BeKind✨ Lemkin #ДобісаПутіна (@jasonlk) October 31, 2019

- Get to $10m ARR, however you can. However long it takes. If you can go from $1m to $10m ARR in 1 year like Slack, terrific. If it takes you years like Mailchimp, so be it. Both won and win.

- Grow 100% a year, or just close to it. Many Unicorns and Decacorns didn’t even grow at this rate after $10m ARR.

- And have 110%+ net retention. Then you’ll see it. Then you can do it. The math says so.

What matters is your momentum after $10m ARR, and not just the raw momentum (top line growth), but your momentum in retention.

If you can retain 110% of your net revenue at $10m in ARR, growing 80%, you will get there. To $100m+ in ARR. It’s just a question of when. 120% is even better, much better.

And now we know almost all the top SaaS leaders have 110%+ net revenue retention:

- PagerDuty, 139% net revenue retention. 5 Interesting Learnings From PagerDuty. And Congrats on the A+ IPO!! | SaaStr. And from SMBs!

- Slack, 143% net revenue retention. 5 Interesting Learnings From Slack. As It IPOs (er, Direct Lists). | SaaStr. And part SMBs!

- Zoom, 140% net revenue retention. 5 Interesting Learnings From Zoom. As It IPOs. | SaaStr. And mostly SMBs!

- Fastly, 130% net revenue retention. 5 Interesting Learnings from Fastly. As It IPOs. | SaaStr

- Twilio, 155% net revenue retention. Twilio Crossed $1b in ARR Growing 81%.

More here:

Happy customers that buy more from you beget more happy customers that buy more from you. It takes a few years for this to kick in. But once it does, it becomes unstoppable (unless you make them unhappy later).

$10m ARR + 110%-120%+ Net Revenue Retention + 80%-100%+ Year-over-Year growth gets you to $100m ARR. Almost always.

Yes, if you don’t innovate, your growth will decay. But usually, if you get that far ($10m+ ARR) with happy customers (110%+ net retention) you’ve found a way to continue to innovate enough.

So skate there. Make that the goal once you cross $1m ARR. 10-100-110+. And do whatever you can to make it so.

Ok now say:

– You are at 120% NRR

– And $10m ARR

– And you add just +30% more new customers a yearThat's not crazy new customer growth at all.

But the combo gets you from $10m to $100m ARR in 10 years

Even with just +30% new customers a year

You got this

— Jason ✨BeKind✨ Lemkin #ДобісаПутіна (@jasonlk) April 20, 2021