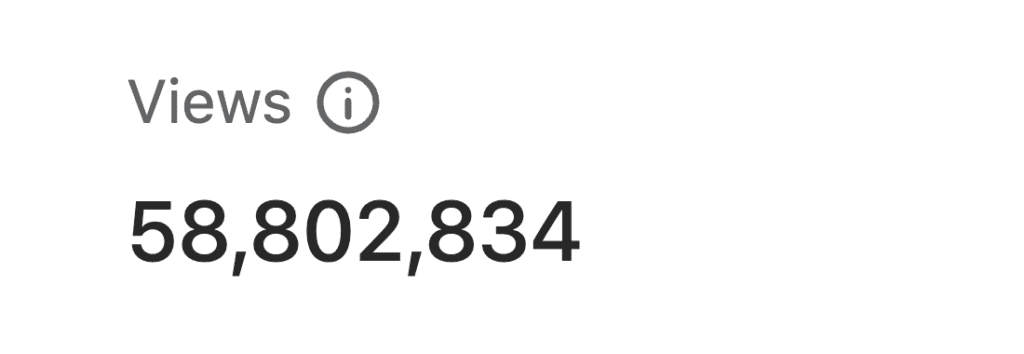

After almost 60,000,000 views on Quora, the top #2, #4, #14, and #17 answers are all about how much money CEOs and founders make. And not just “exit” money but salary.

Salary is a means to an end for great founders, nothing more.

Money matters of course. But it’s not a good enough reason to start a start-up.

Basically every start-up almost fails. The odds are against you (although odds are just odds). You have to break the odds. You have to break the pattern. You have to go further, harder, longer, more than everyone else.

- If you are doing it for the money … go work at Google or Facebook or Salesforce. Risk-adjusted, it’s a better deal.

- If you are doing it for the money … you’ll quit. It’s too hard after years 3, 4 and 5.

- If you are doing it for the money … you’ll fail. Because someone who wants it even more will crush you.

But

Money does matter:

- First, pay yourself a market salary — once the company can afford it. Once it doesn’t hurt the company. More on that here.

- Second, know that if you do get to $10m ARR growing nicely, investors will often offer to buy some of your shares at a nice price. “Secondary liquidity”. Never easy to get there, but if you do, you can put a few nickels in the bank. More on that here.

And if you build something huge and important, you should make good money. Focus on that. Make your founder stock valuable. Bend the odds to your will.

(note: an updated SaaStr Classic answer)