The current economic climate presents new challenges for businesses. In the past, companies could pursue growth at all costs. As inflation rises, resources must be used more strategically since it’s become difficult to estimate to cost of capital. Management teams must determine how to thrive in a downturn to position their businesses for profitable growth.

J.B. Reed and Courtney Dong, Partners at BCG Consulting, sat down to discuss their perspectives on the recent macro shifts in VC investor priorities. They also shared what strategic and holistic actions companies should take to optimize their organization and manage costs.

Shifting focus in a new era

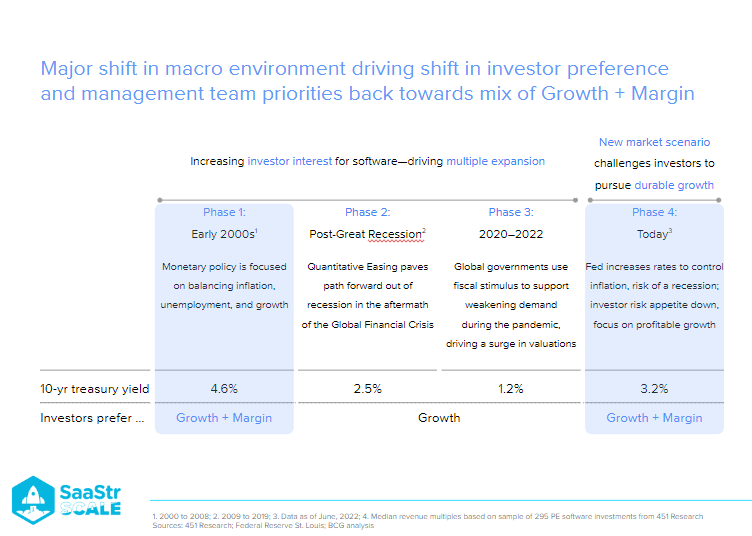

Since 2008, investor preference has largely been growth-oriented due to the artificially low cost of capital and stimulus. However, with rising inflation and interest rates, investor focus pivoted to margin.

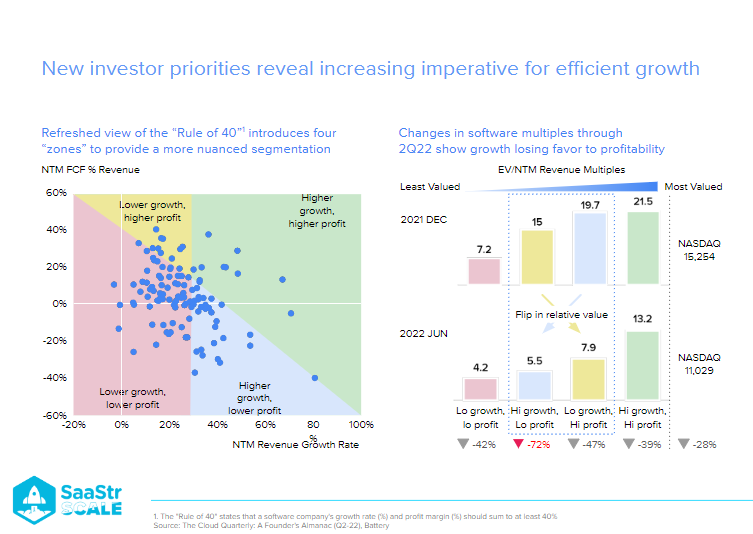

The ‘Rule of 40’ is a valuable metric that can illustrate the degree of shift and what it means for companies fundraising and operating. Companies that operate above 40% revenue growth rate and profit margin stand to generate a sustainable profit, while those operating below 40% may have cash flow or liquidity issues.

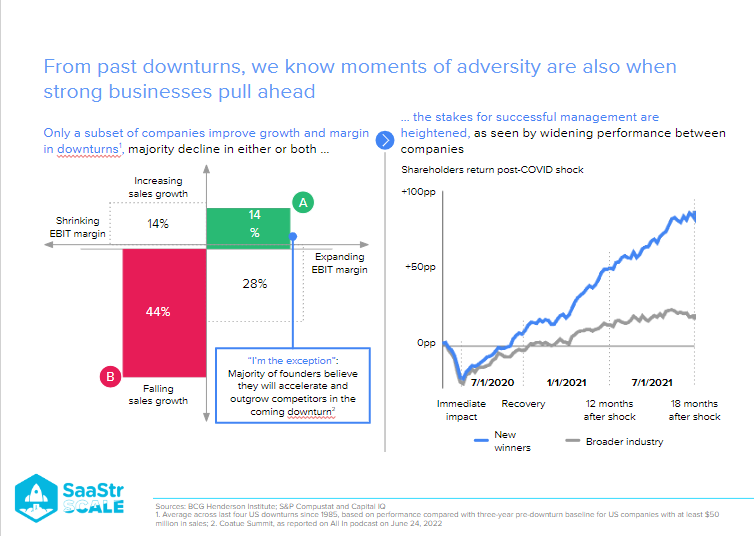

“It’s not just about avoiding a down-round and targeting the most attractive exit options–it’s also how you pull ahead of your competition.”

Data shows a significant shift in company valuations happened from 2021 to 2022. Companies that achieved The Rule of 40 through margin lost less value overall. However, management teams that pursued growth at all costs were punished severely. It’s now abundantly clear: the imperative is to find efficient growth.

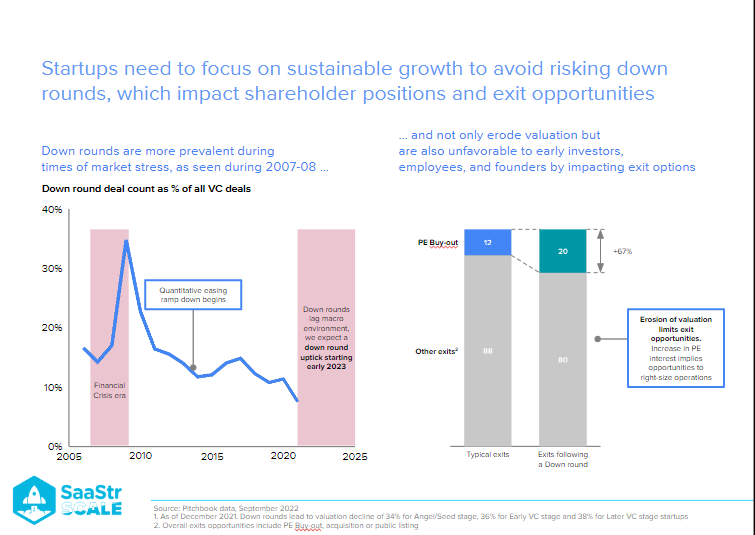

Focusing on growth is key to sustaining during a down-round, particularly since these usually increase during periods of macroeconomic stress. It’s rare for companies to improve both their sales and margin during a downturn. Additionally, companies that take down rounds frequently face less attractive exit options and are more likely to be bought out. For this reason, founders should carefully reflect on their target focus and management style to ensure their business’s future growth and success.

Four options to prolong cash runway & achieve profitable growth

“Redesigning and implementing a winning model is a difficult but necessary exercise to thrive in a downturn.”

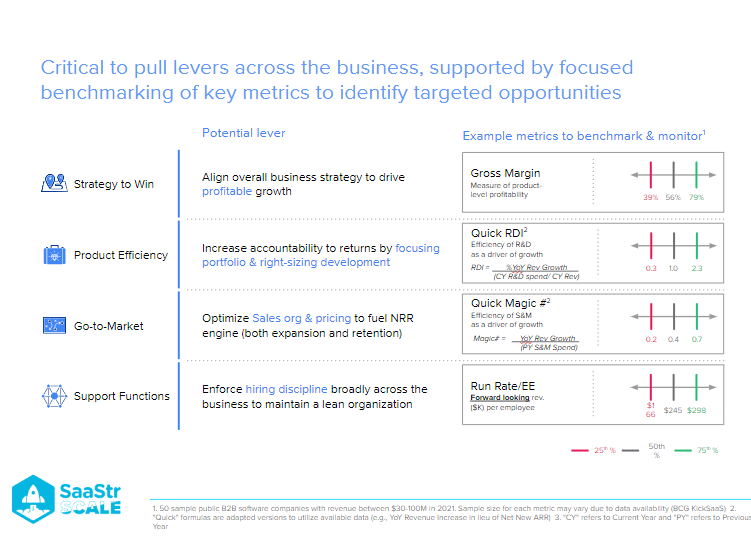

Instead of focusing on low-interest rate regimes, companies can use the following four tangible actions and metrics to thrive in a downturn:

1. Strategy to win

The right strategy to win means reassessing fundamental issues like the product-market fit and centering on the best ICP. For companies in B2B SaaS, it also means understanding to whom they’re selling. Doing so ensures that the ICP is not solely focused on accounts with the lowest CAC but also targeting accounts with high LTV to foster long-term sustainable business and revenue. Putting more emphasis on ICP may seem rudimentary, but it can have tangible benefits, including ensuring healthy gross margins.

Example Metric: Gross Margin – a measure of product-level profitability

2. Product efficiency

The key to product efficiency isn’t moving many investment resources or adjacencies but rather having the right mix of product portfolio and proven cost structures. There is no need to take a slash-and-burn approach or ignore long-term stakes, as this can lead to lasting adverse effects if too much is cut. As a result, it’s crucial to evaluate the right blend of long-term investments and target the core methodically.

3. Go to market

Retention and empowerment of the best talent should be the focus of the sales operating model rather than throwing bodies at the sales funnel. A simple way to achieve this is to align sales compensation with LTV to reward good behavior and disincentivize poor behavior. Teams can improve the sales process by aligning operations across marketing, sales, and success to thrive throughout the customer lifecycle.

Market demand signals should also be taken into account. As funds have become more expensive to raise, demand shortages continue to increase, resulting in inflation-related price increases now being implemented by many companies. However, companies must ensure they’re implementing pricing as a margin enhancer. Developing a strategic pricing model structure aligned with value helps maximize long-term value and near-term yield. Using this approach will help guarantee that the existing base is adequately monetized.

4. Support functions

Costs are higher during periods of economic boom and when companies are pursuing growth at all costs. But in the current economic climate, past bets are less relevant to a company’s future when centering on strategy and ICP. Focus product sales teams instead on core activities that drive value by supporting other resources.

Key takeaways

The current market conditions are unprecedented. This shift will likely persist for some time, making the need to take a calculated approach forward essential. Professionals must rethink their operating style and adapt to the changes.

Focusing on customers, markets, and the implications for product development and go-to-market resources is vital to building a sustainable strategy. When implemented thoughtfully, these actions help reveal the cost reductions required to navigate this period and avoid detrimental events to company efficiency and health.