Workday: “There’s no slowdown at all”

Salesforce: “We’re finally seeing slowdown now in our commerce, media, telecom, and SMB segments”

It’s still a tale of multiple worlds out there pic.twitter.com/dRPuWG5iZe

— Jason ✨2022 SaaStr Annual Sep 13-15 ✨ Lemkin (@jasonlk) August 26, 2022

So when Salesforce announced its last quarter, everything was still humming. While the stock price was hit along with everyone else, the business wasn’t. Benioff noted he just wasn’t seeing any slowdown.

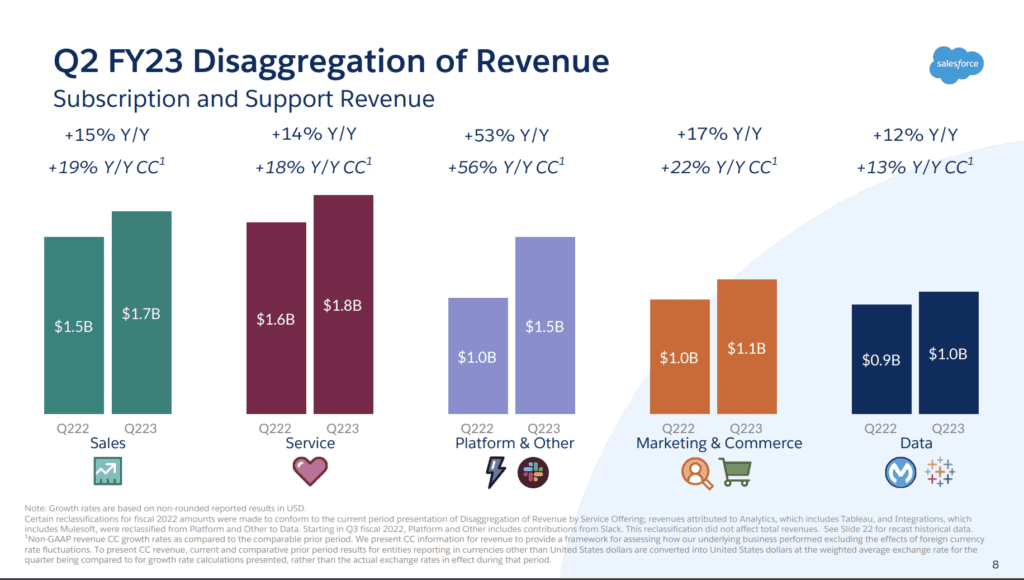

Well, now he is. Salesforce had another blow-out quarter. hitting almost $31 Billion in ARR and growing a still stunning 22% at this scale. Breathtaking.

But, it’s gotten a bit harder, in some segments at least:

Salesforce saw demand from SMBs slow, and demand slow in retail, consumer, and communications / media. But support and sales clouds remained strong, with little impact on demand. And it saw Slack accelerating to $1.5 Billion in revenue. A great barometer that collaboration software remains on fire, with little downturn there (see also, Monday, Asana, etc).

Salesforce really now plays in all key categories, from commerce to infrastructure, from sales to support, and more.

Perhaps it’s a good look at what’s happening overall:

- Tech infrastructure spend like Snowflake and Datadog and Cloudflare appear to have no downturn at all.

- Workday announced it was seeing no downturn at all.

- And at the other end of the spectrum, folks at the intersection of commerce and SMB like Shopify have taken the biggest hit to post-Covid growth. More on that here.

- And while Zoom’s enterprise business remains in strong growth mode, its SMB business is flat / shrinking for now. More here.

It’s good for everyone to track Salesforce. Even if you don’t use it, partner with it, or develop on its platform, Salesforce at $31B ARR is about 15% of all the $200B of pure SaaS revenue (using one Gartner estimate). That means, in many ways, Salesforce is SaaS. It’s our #1 largest vendor, and it’s in so many categories.

So they are a great canary in the coal mine. And Salesforce says collaboration software and infrastructure remain on fire. But e-commerce, media / comms, and SMB are under pressure.

We sort of knew that. But Salesforce confirms it.

Salesforce Growth:

2023 $31B (guidance)

2022 $26.5B

2021 $21.25B

2020 $17.1B

2019 $13.2B

2018 $10.5B

2017 $8.4B

2016 $6.7B

2015 $5.4B

2014 $4.1BThank you Ohana! ❤️ pic.twitter.com/dKEU3M2RDH

— Marc Benioff (@Benioff) August 24, 2022

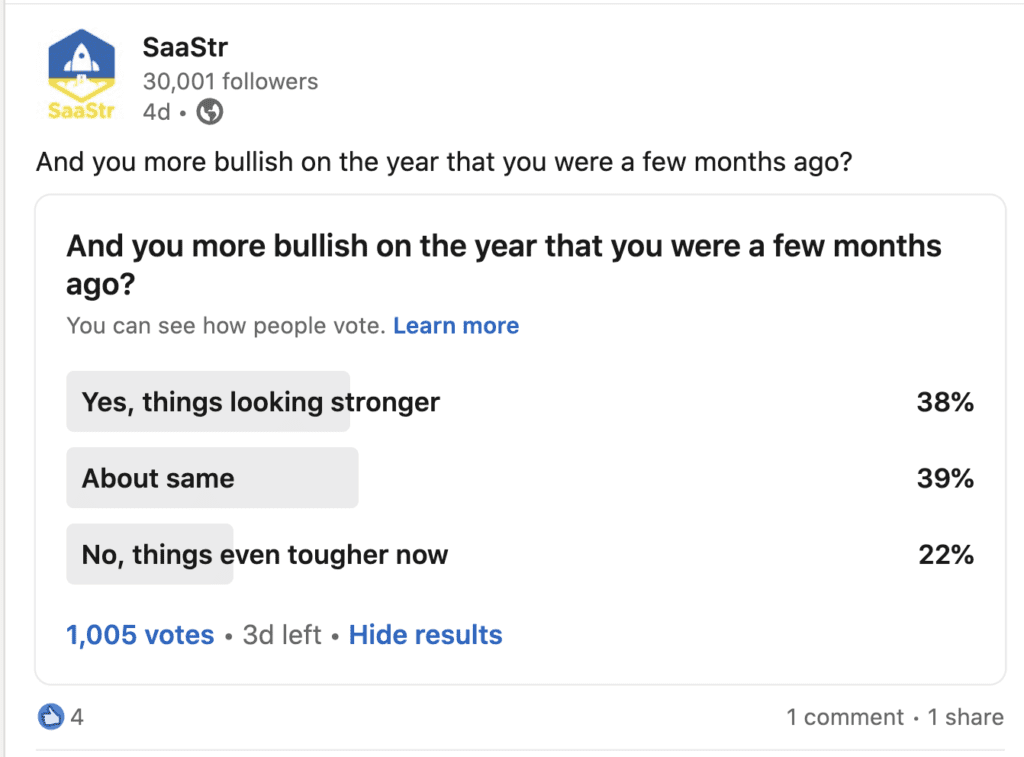

And how about you? Over 1,000 of you answered our survey. Only 22% of you thought things were tougher than a few months ago. 38% said stronger / better, and 39% said about the same: