Analyzing the Big Successes in an industry is important, and critical. But they are lenses into the past as well. Often deep into the past. Box was founded in 2005. Salesforce in 1999. NetSuite in 1998.

The bar to success for new market entrants keeps changing, but I’d suggest today, technology and engineering is back with a vengeance in SaaS. Why (the heck) was Quip purchased for $750m by Salesforce? It wasn’t for ~$1m in ARR from a word-processor. It was for one of the best, most cutting-edge engineering teams, and one of the top engineering leaders, in the world. Most don’t realize the founder and CEO of Quip was the CTO of Facebook. Who’s first company (FriendFeed) was Mark Zuckerberg’s first strategic acquisition. B2B just lags B2C by 4-6 (or more) years. Same epic acqui-hire, same story, really. Just adjusted for the slower pace of B2B change 🙂

The bar to success for new market entrants keeps changing, but I’d suggest today, technology and engineering is back with a vengeance in SaaS. Why (the heck) was Quip purchased for $750m by Salesforce? It wasn’t for ~$1m in ARR from a word-processor. It was for one of the best, most cutting-edge engineering teams, and one of the top engineering leaders, in the world. Most don’t realize the founder and CEO of Quip was the CTO of Facebook. Who’s first company (FriendFeed) was Mark Zuckerberg’s first strategic acquisition. B2B just lags B2C by 4-6 (or more) years. Same epic acqui-hire, same story, really. Just adjusted for the slower pace of B2B change 🙂

Here’s what I’ve seen at least:

In the ‘05-’07 generation, the biggest challenge most SaaS start-ups faced was the SaaS markets were just too small for everything but CRM and a few other core, established spaces. This “Box” generation (which I was a part of at EchoSign) all grew relatively slowly for quite some time (by 2016 standards) until about 2010 or so. Then the markets grew and caught up with us. The good news was, there weren’t that many vendors. So you could still survive. And the products didn’t even have to be very good, or that complex. Because often, nothing really existed before to do the job.

From ‘08–’11 or so, most new SaaS apps were Too Simple. More entrepreneurs wanted to do SaaS, but the MSPs and MVPs were just too simple. The markets and products had begun to get more sophisticated. The hackey products of the prior generation no longer cut it. You had to do more — a lot more. A lot more functionality. And you needed real insights into how the org was working and the ROI delivered — true dashboard-level visibility of the enterprise. And mobile threw a wrench into everything. The best start-ups quickly took advantage of the rise of mobile (e.g., Dropbox), which really, was unexpected in its strength and transformation. Those that didn’t take advantage were often left behind, even if mobile wasn’t the core interface for their end users. And marketing and capital raising began to make a bigger and bigger difference here than ever.

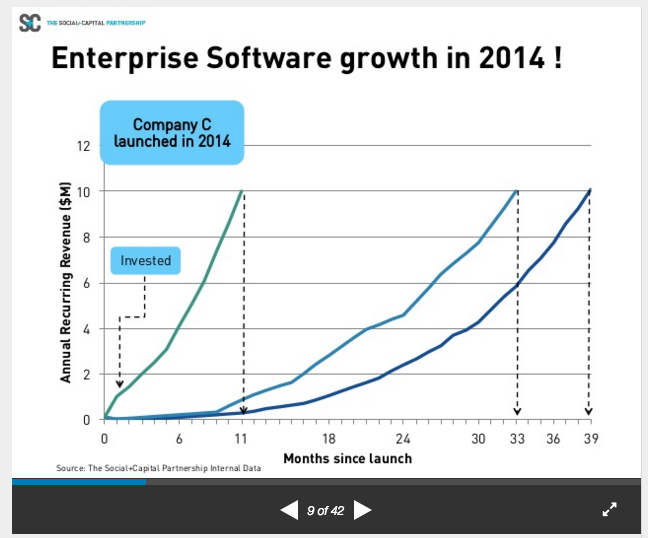

From ‘12–’15 or so, Traction Ruled the World. Now that the SaaS markets were so much bigger, we could see companies like Slack, Intercom, Talkdesk, and many others grow at faster rates than any comparables before. And all 3 of those examples were actually “second generation” SaaS products, that were displacing prior SaaS products, at least to some extent. SaaS was finally big enough, and established enough, that the first generation of leaders could be displaced.

From ‘16-, the Tech Bar has Gone Way Up. Again. Machine Learning, AI, and IoT may be trite terms. But the underlying theme is that a rich, nuanced, workflow-rich app is no longer good enough to break into the enterprise. Now, you need a fairly insane engineering and data science team to deliver the insights and value the enterprise is expecting. A dashboard — even the world’s richest, prettiest, most insightful dashboard — isn’t enough anymore. Many of the best SaaS start-ups have 10+ accomplished engineers from Palantir and Google on their Day 1 team. The hackey-MVPs and MSPs are going to have to be a lot more clever to compete today.

Ultimately, I believe this will lead to the rise of more of the best SaaS companies having engineers as CEOs. The “business CEO” was the logical outcome when the core technology was layers and layers of basic (if Rube Goldberg-esque) workflow software. The “business CEO” would then recruit the best CTO she could. But as more and more Facebook-grade technology becomes table stakes in SaaS, Day 1 technology .. the best engineer-CEOs in SaaS have a big leg up in getting to that first $1m in ARR.