Last night, David Hornik of August Capital was kind of enough to invite me to speak with him on a Technology and Law class at Stanford. After the event, an entrepreneur I had been emailing with but hadn’t met yet came up to me. While his company is in a different space, I was struck with in many ways how similar its pre-launch operational and timing challenges in 2012 are to EchoSign circa 2005.

Last night, David Hornik of August Capital was kind of enough to invite me to speak with him on a Technology and Law class at Stanford. After the event, an entrepreneur I had been emailing with but hadn’t met yet came up to me. While his company is in a different space, I was struck with in many ways how similar its pre-launch operational and timing challenges in 2012 are to EchoSign circa 2005.

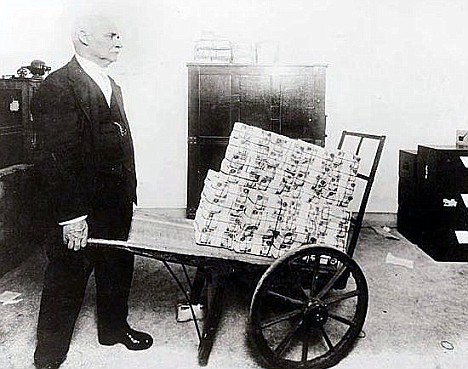

The biggest difference? Their pre-product pre-money was $12m in ’12. Ours was $6m in ’05. 100% inflation, in some sense.

So I started thinking of all the inflation I’ve been observing lately:

- Seed/Series A valuations seem to have grown about 100% since 2005. Today, if you’ve got a team with some previous success, the pre-money of seed/A rounds are all double digit millions.

- Come to think of it, Series C valuations have grown about 100% as well. Today, hot companies are doing rounds as 10x next year’s ARR. Back in the day, it was more like 6-8x this year’s GAAP revenues.

- The rent on our old office in downtown Palo Alto since 2005 has grown from $3.00 to $6.50 NNN per month, or more than 110% rent inflation in downtown Palo Alto at least since ’05. Exact same office. This is pure identical-asset inflation, like tracking the price of milk.

- Engineering salaries have also grown a lot. On the ‘low’ end, junior engineers salaries seem to be up 20-30%, but with rockstars, it seems more like 40-50% on the cash side. More relevantly, on the equity side, top engineers at an early stage seem to get about 100% more equity than in 2005.

Yes, the Cloud has made some things cheaper. But on balance everything else is so much more expensive, it seems like start-ups can actually be almost 2x the price to get to a similar amount of time. I really wonder what you can do in SaaS these days on a $2m Series A round. It was hard enough back in the day.

The good news? The SaaS world is 10-20x bigger than it was in 2005. So, in a sense, that’s deflation. It means companies can get bigger, faster, justifying the inflation on the hard costs. So on balance, I think it’s a good deal. People, offices, companies — they’re all worth more if the markets and opportunities are much larger.

But AWS, Heroku, and all the rest apart — sure that’s cheaper — but all other fixed costs seem to have massively inflated since 2005. Many have basically doubled.