One thing you hear a lot is how great it is to get a Quality VC into your company. Take Quality Money, at a lower price, they say, over Crummier Money at a higher price.

Certainly, there’s a lot of truth in this. The last thing you want is an investor that isn’t up for the 7-10 year journey that is SaaS.

And it sounds exactly right, qualitatively.

But …

If you end up with a choice between a seemingly Tier 1 VC, and their fancy reputation … and a Tier 1.5, or whatever VC, that is still quality, at a materially better price … in SaaS, at least, I think you should almost always take the higher price (x) if your burn rate is material and (y) you still believe in the partner.

Why? It’s not so much the dilution per se. I personally don’t care if the price per share is $0.82 or $0.88 and you probably shouldn’t either. Yes, there’s a difference, and every share is precious at some point. But since success is mostly binary in start-up, it doesn’t matter much, price alone. I’m happy to take a somewhat lower price, in isolation, to have a better partner. You only get a few shots at getting a truly great partner onto your cap table.

The thing is, though, it’s not just the dilution. It’s also how much capital you can raise, for the same amount of ownership, in the same transaction, in the same event. And more capital in SaaS can make a huge difference.

Let’s do the math:

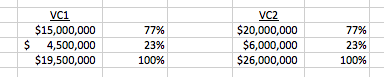

- Let’s assume VC1 offers you a $15m pre. And VC2 offers you a $20m pre.

- Let’s assume both basically offer you a deal based on 23% dilution.

- Then, you can raise $6m from VC2 for the same dilution as $4.5m from VC1.

You can do so, so much more at this phase of the company with this extra $1,500,000. You can hire 10 more great engineers. A dozen more sales people. You can build out another entire team. Etc., etc. That’s an epic difference at this phase. Epic.

This extra capital — spent wisely — in SaaS at least, indeed it likely will make a difference.

>> As a founder, you’re not being cheap, or greedy, or over-optimizing, picking VC2. You’re diluted exactly the same in both scenarios. You own the same. It’s just with VC2’s higher price and a commensurate increase in the capital raised — you’ve substantially de-risked your venture.

And that’s a big deal.

So if I had a choice, I wouldn’t take crummy money. I certainly wouldn’t take money from a VC I didn’t trust (which is a high bar). That literally is never worth it. I wouldn’t take money from a VC without a SaaS track record. I wouldn’t take money from a VC that can’t afford to lose it. Simply put, I wouldn’t take a higher valuation with a higher raise, if the V2C firm was much riskier than the VC1 firm. I’m not suggesting that.

But if I had choices … in SaaS at least … and I wasn’t cash-flow positive … then more $$ = substantial de-risk and/or faster growth if you do it right. That’s the smart play if other things are even close to equal.

(note: an updated SaaStr Classic post)