Q: Why Would Microsoft Buy Wunderlist and Later Just Shut it Down?

Because it was just a bet. And maybe even almost an experiment.

Buying Wunderlist for $150m sure sounds like a lot to me and you. But the reality is, it’s 0.1% of Microsoft’s market cap.

For a Really Big Tech Company, any acquisition of less than about $1b is somewhere between an experiment and a bet. Sometimes, a very big experiment. But an experiment.

In 2015, Microsoft wanted to help accelerate its SaaS / Cloud strategy and made a bunch of bets. They didn’t all have to work out.

And in the end, have too many products is a distraction. You have to eventually close one down if it’s not a winner. Once Office 365, Azure, etc. took off, and Microsoft’s Cloud strategy became clear … a new task manager wasn’t important enough. Better to put that energy into products that would move the needle in Cloud in 2019–2025 and beyond.

It seemed possible at the time it might help their productivity application strategy. But the bet just didn’t pan out.

And Microsoft has made many other bets.

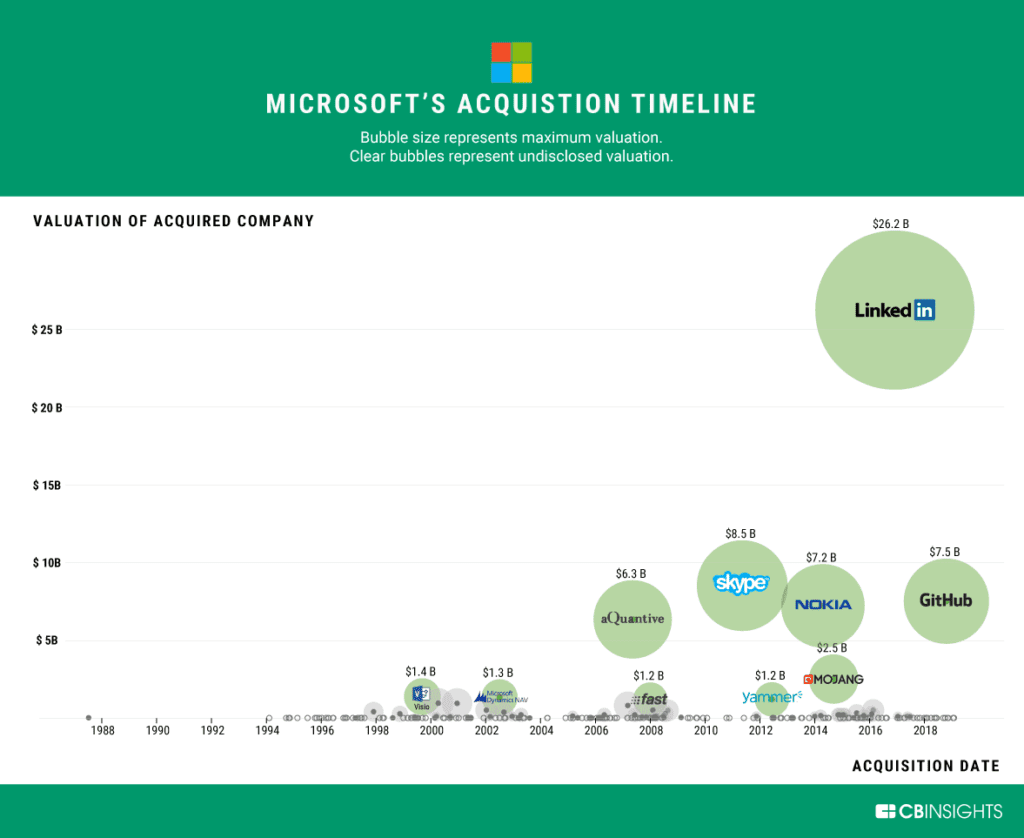

The big ones, though. The big ones like LinkedIn for $25b+ or GitHub for $7.5b … there’s a bit more pressure there.

But even there, they sort of let Skype and Yammer go for a while. Even there, those deals were only so big relative to a $1 Trillion market cap.

They are bets.