So C3.ai is one of those enterprise software companies ($2m customers on average) you hear about and see their billboards but are never quite sure what they do. The founding story is fascinating. Tom Seibel is the grandparent of CRM. He founded Siebel, the dominant CRM before Salesforce, and sold it for $5.85 billion to Oracle. (Which seemed like a huge price, back then).

An amazing exit at the time, but one that happened as Siebel was clearly losing to the Cloud transition that Salesforce came to own.

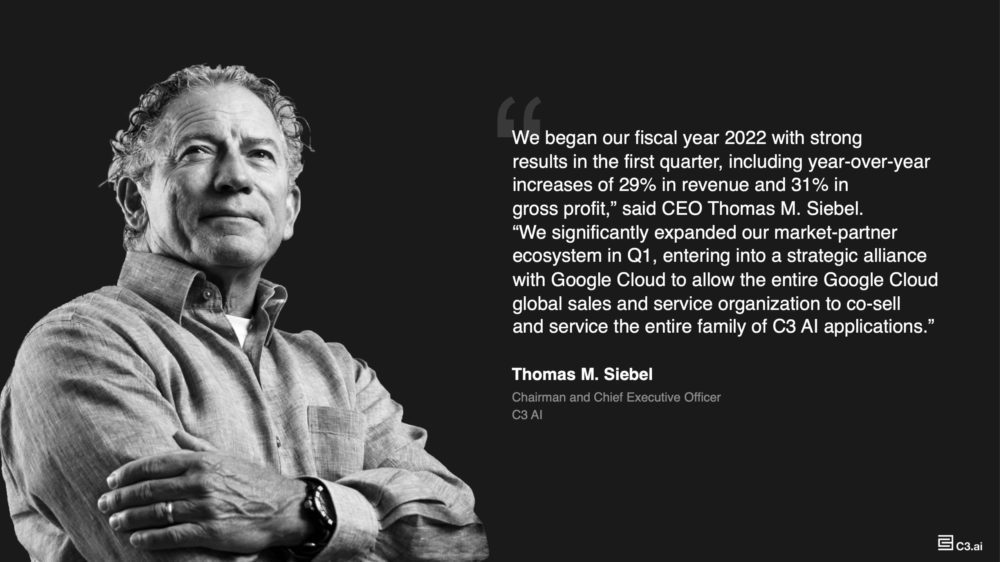

But Tom dusted himself off and came back with a next-generation platform, C3.ai, that somewhat mysteriously does “Enterprise AI”. It IPO’d to now a $5 Billion valuation and is now at $200m+ in ARR, growing at 29%.

5 Interesting Learnings:

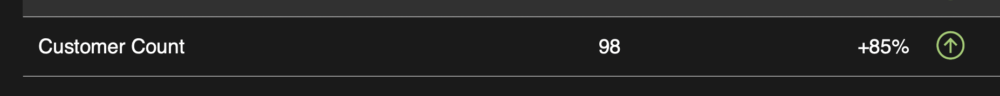

#1. 100 customers paying about $2m each a year on average — using 100 apps. C3 is a very classic enterprise structure, with mainly F500 customers paying on average $2m a year and expecting a lot of specialized functionality for that $2m. Still, with just 50 customers at IPO, they’re getting more diversified.

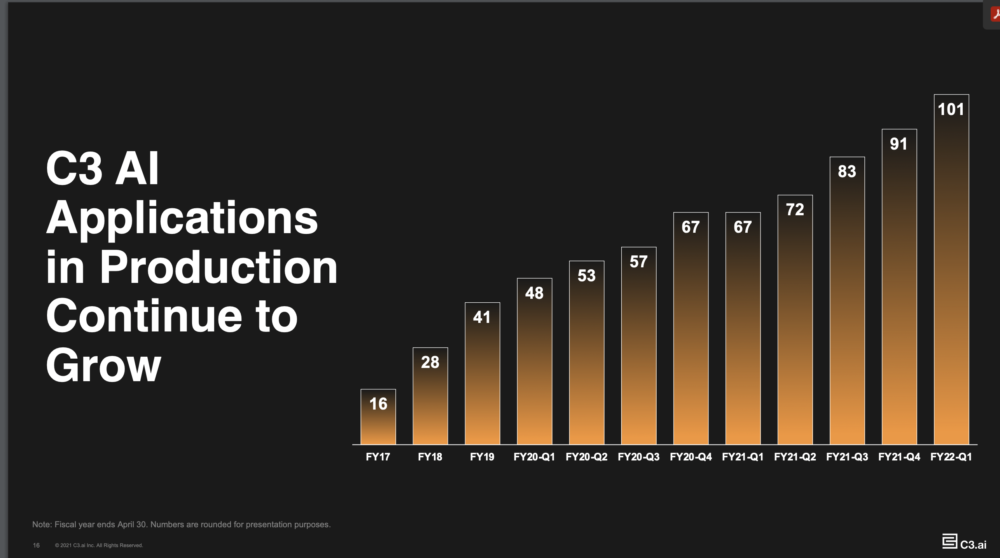

#2. C3’s deployment is work. To support their 100 customers, they have over 100 apps — up from 67 just a year ago.

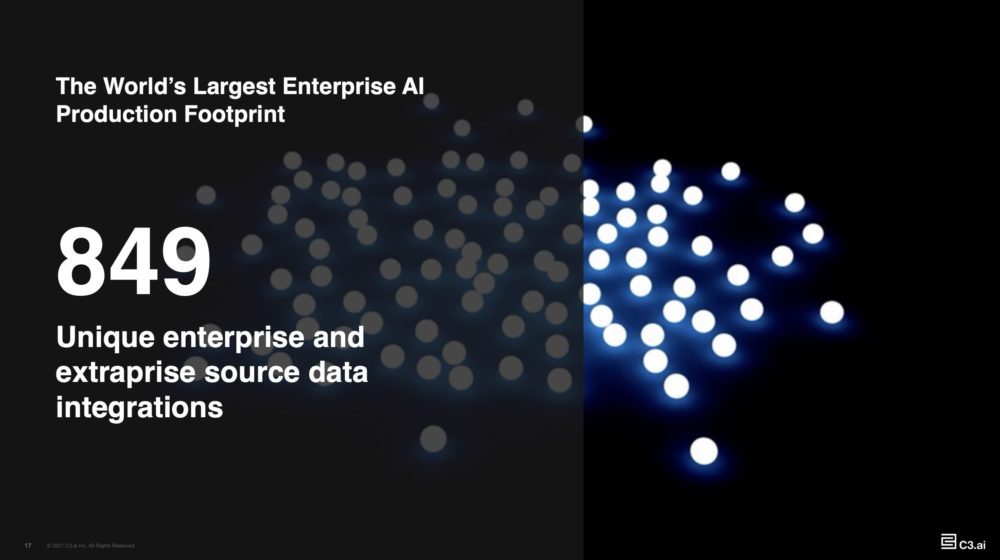

#3. 849 integrations to support 101 customers.

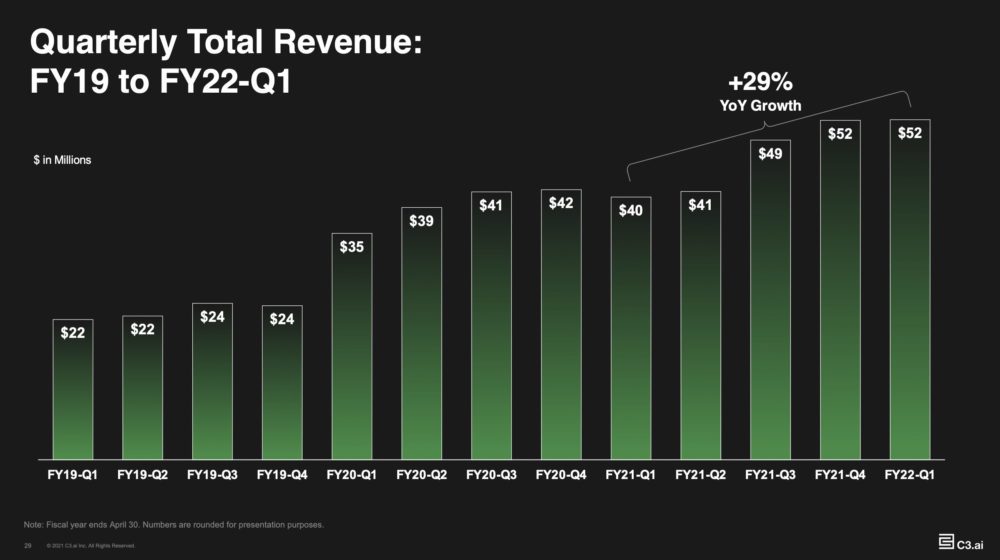

#4. Reaccelerated growth to 29% after a rough 2020 of 4+ flat quarters. Many Cloud leaders took an initial hit from Covid, but C3 had a tough 2020 overall. But they came back in 2021 strong. Never quit!

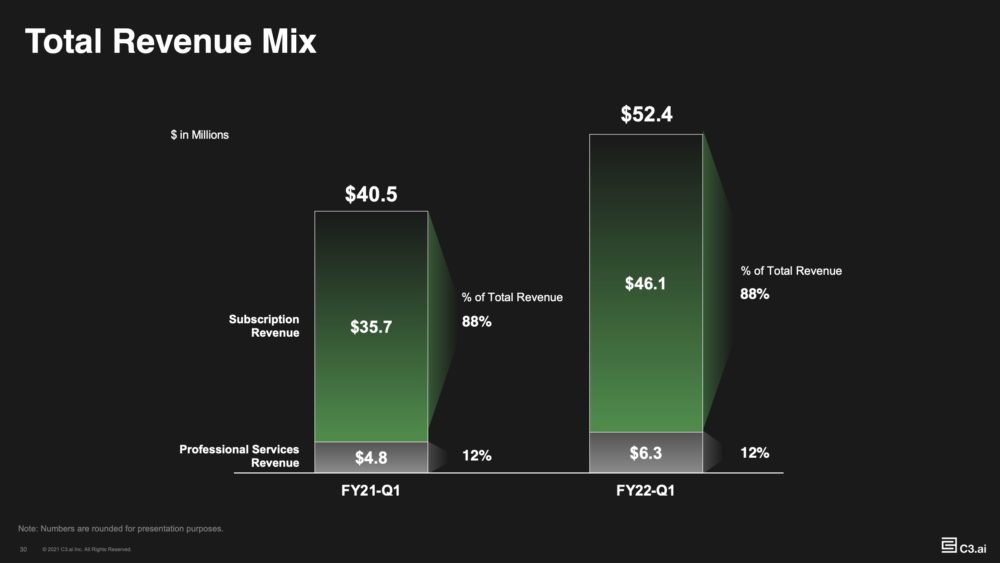

#5. Only 12% service revenue, despite being so enterprise. I would have expected high, but service providers and partners presumably do a lot of the heavy lifting in deployment.

And a few bonus notes:

#6. Partners are key — Baker Hughes (a customer and partner) makes up a massive 30% of revenue, and claim Microsoft Azure has contributed $200m in total bookings. Re: Baker Hughes, oil and gas is its largest vertical.

#7. Half their revenue is from “application software”. The other half is presumably from more custom functionality.