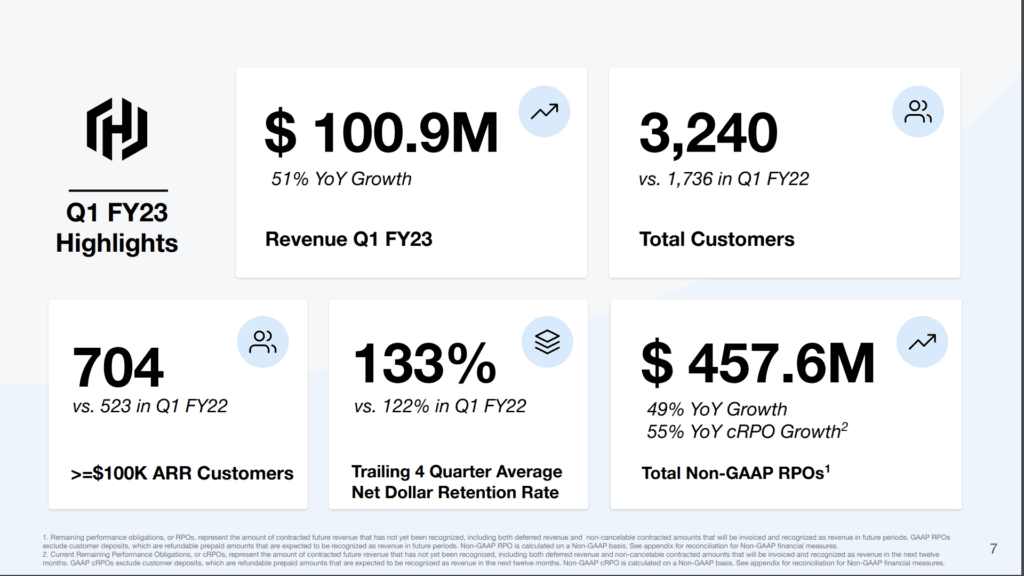

Fewer Cloud devops / commercial open source startups were more respected pre-IPO than HashiCorp — and still are. The product is there, the market is strong, the founders and CEO are great. At an almost $6B market cap, it’s a huge win, with a strong multiple at $400m ARR, growing a stunning 51%.

It was a $10B-$15B+ company in the go-go times of 2021, and even though it’s executed to perfection since then, the markets have caught up even to the best of us. A $6B valuation today sure seems cheap with those numbers, and the ones below. Because almost everything is going so very, very well for HashiCorp.

Most especially, it’s executing with an enviable SaaS Golden Ratio. It’s closing new customers even faster (86%) than its ARR is growing (51%). That, combined with high NRR, is a recipe for many years of high growth.

5 Interesting Learnings:

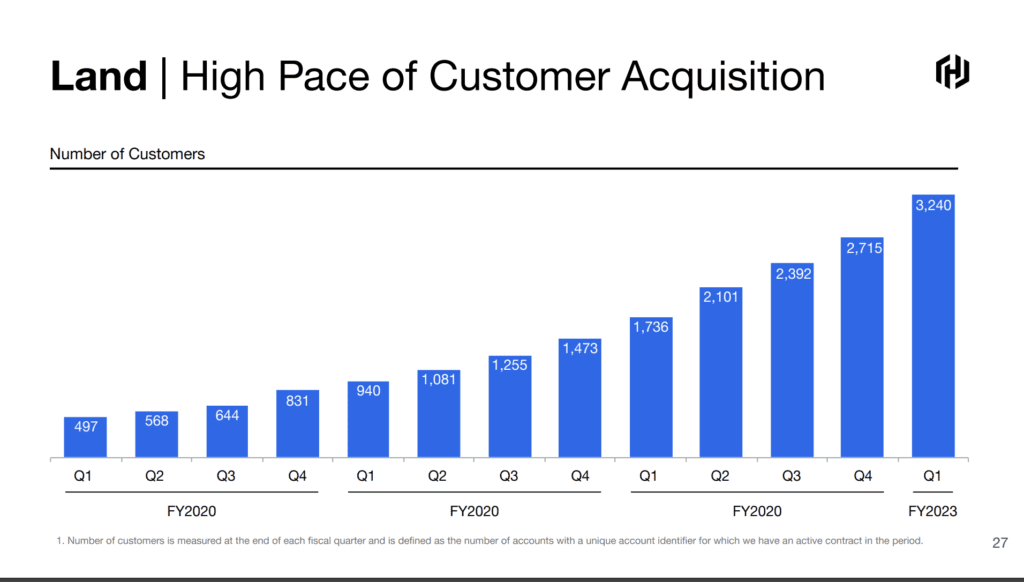

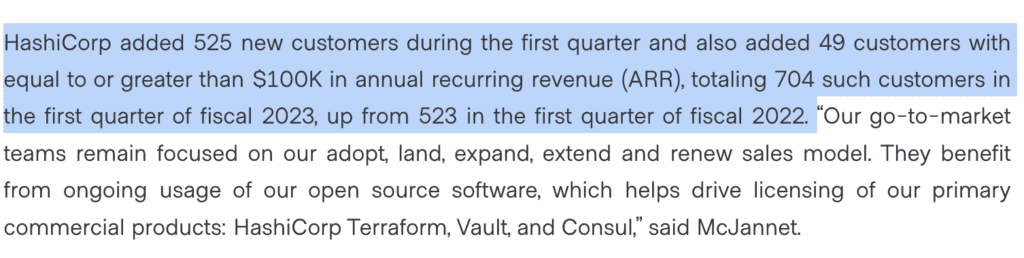

#1. New Customer Count Growing as Fast as Revenue. This is one of the best signs for future longevity and growth. HashiCorp’s customer count grew 86%, from 1,736 to 3,240. Even faster than revenue growth.

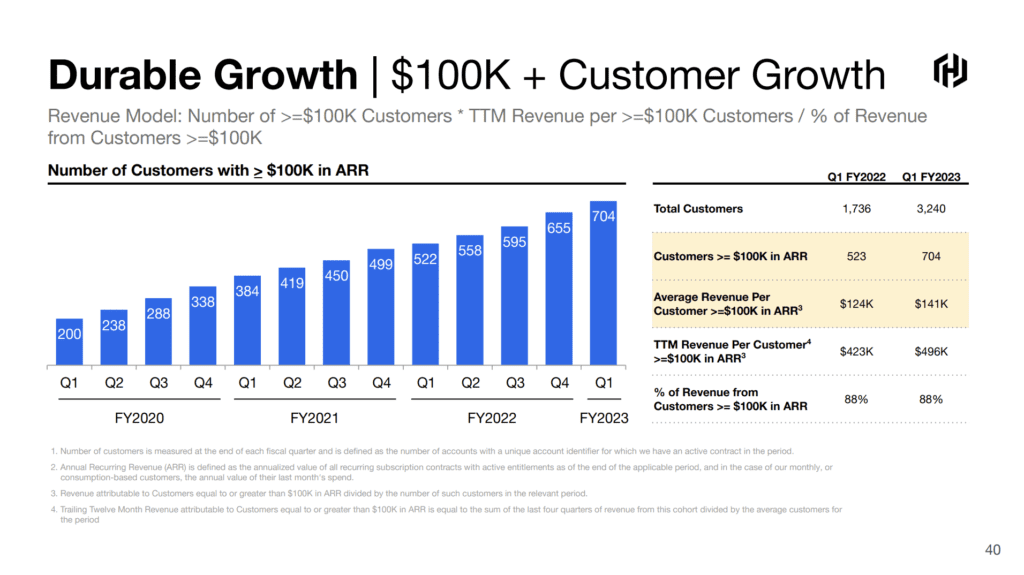

#2. Average deal size going up materially, but not dramatically — from $124k to $141k. A gradual approach to bigger customers, but one that doesn’t cut off its open source and open roots.

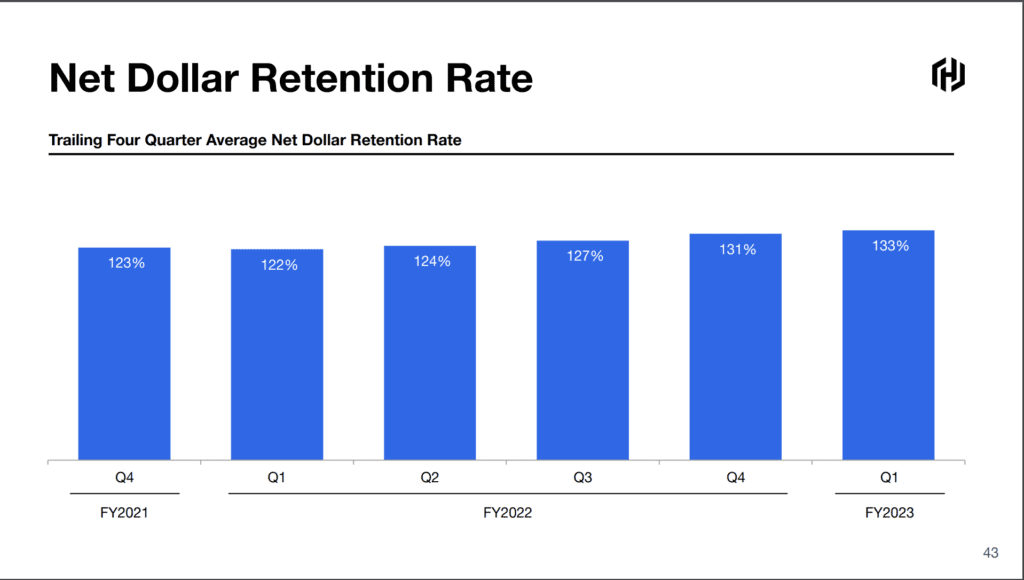

#3. NRR keeps going up as cross $500m ARR, expanded from 123% to 133%. Another key to long, strong future growth. High NRR plus high new customer count is the magic formula for years and years of high growth. And yet another reminder that high NRR can scale almost forever.

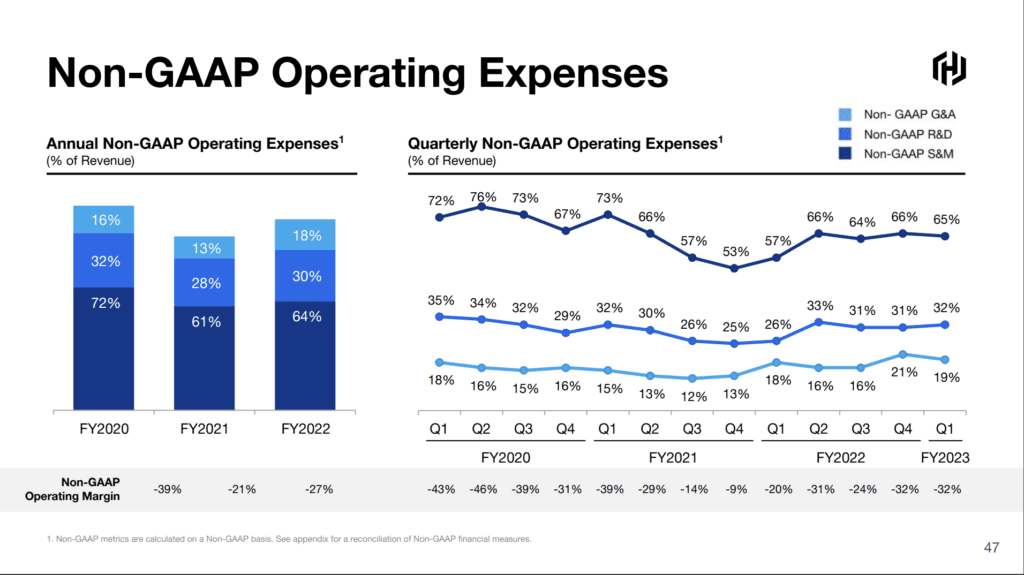

#4. Sales & Marketing still high at 65% of revenue. HashiCorp isn’t getting a huge sales & marketing efficiency boost from having an open-source core. Commercial open source in many ways is a classic PLG strategy, and one might expect lower sales and marketing costs at COSS leaders. But HashiCorp is still spending 64% of its revenue on sales and marketing, higher than the 50% target for most public SaaS companies. This is probably a wise investment, given the incredible growth in new customers and high NRR. But HashiCorp will need to bring it down to generate significant free cash flow as it gets closer to $1B ARR. Operating losses are still growing for now.

#5. Only 20% of customers are over $100k ACV, even with a $141k average deal size. HashiCorp has plenty of room to run in the enterprise, and is a great case study of land-and-expand.

Wow, just amazing execution by HashiCorp. And it’s getting even stronger as it approaches $500,000,000 in ARR, with 50%+ growth and 130%+ NRR. And even more impressive — 86% customer growth. A bright future, indeed.

And a look back at how they got here with CEO David McJannet: