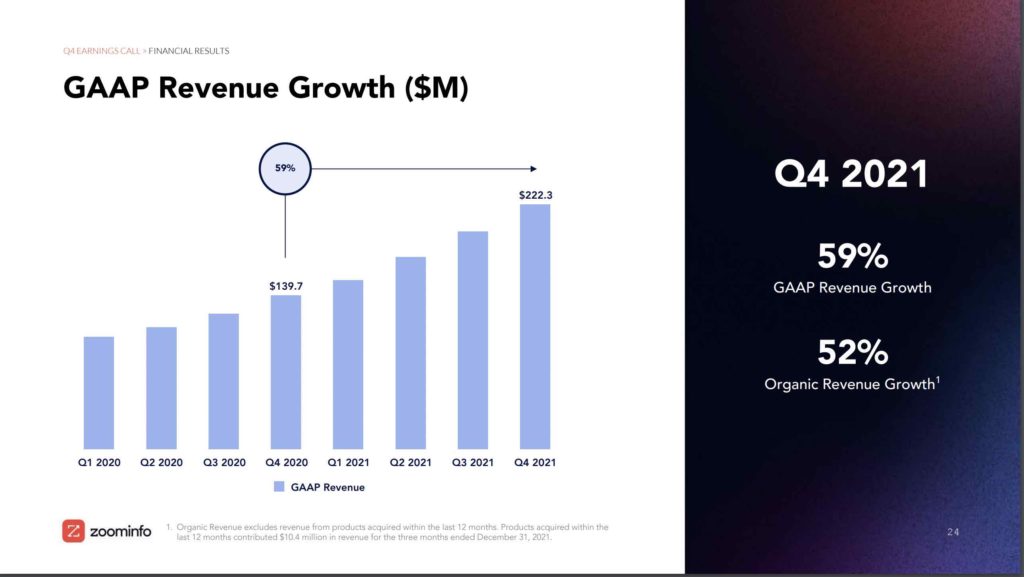

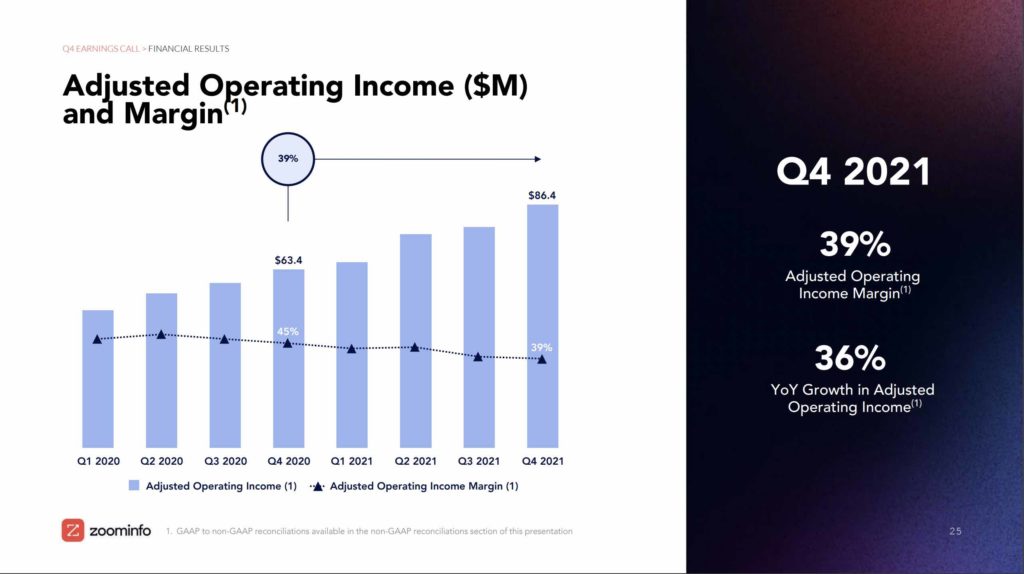

As we write this, ZoomInfo is coming off an incredible quarter — a stunning $890m ARR run-rate, growing an epic 59% year-over-year. That’s up from 57% the quarter before! And it’s highly profitable, with a 39% operating margin. That’s just stunning.

ZoomInfo is a sort of quiet leader in SaaS data. Your sales and marketing teams probably use its data, especially to track down contact and other info for prospects and customers constantly changing roles, but you may not know as much about the company itself.

Let’s take a look at 5 Interesting Learnings:

1. 25,000 total customers, but their 1,450 $100k+ customers are their core revenue engine. ZoomInfo has gotten stronger and stronger in $100k+ deals over the years, and this is now their core.

2. Highly profitable as it approaches $1B ARR — and has been for years. Selling data really works at scale, as ZoomInfo shows. With 39% operating margins and 37% free cash flow, ZoomInfo is a SaaS cash-generating engine. All while still growing 60% a year!

3. 116% NRR from all customers, blended — a Good Yardstick for $100k+ Data Sales. And up from 108% the quarters before. I would not expect data sales to marketers in particular to have truly crazy high NRR, because marketers will cancel programs and vendors that don’t perform. Data is both more valuable and less sticky than pure B2B workflow apps. But ZoomInfo has very strong NRR — 116% blended, including SMBs, and much higher from enterprises (120%+). And that’s up from 108% previously. Good yardsticks to try to meet if you are somewhat similar to ZoomInfo.

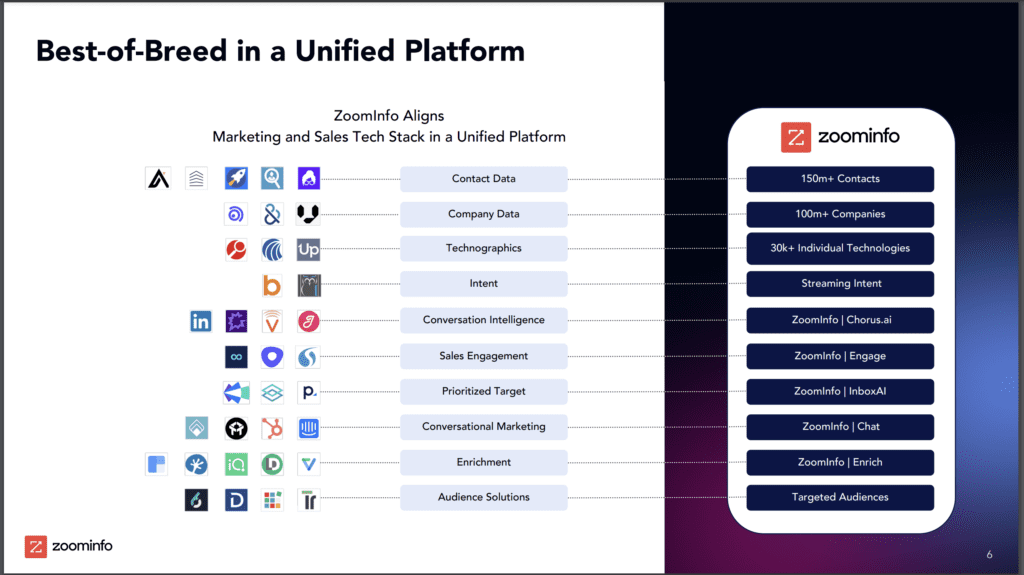

4. Aggressively expanding its product portfolio — both organically and through acquisition. ZoomInfo was built on top of an early acquisition of a competitor, and CEO Henry Schuck has expanded far beyond its original product in cleansing sales data. From the acquisitions of Chorus and RingLead recently, and aggressive product expansion, ZoomInfo is building out a true suite for the sales professional. One that starts from a core of data vs. a workflow like most others. Almost everyone needs to go multi-product after $100m ARR. ZoomInfo is doing it in more of a platform approach than most.

5. International Revenue is “Just” 11%. Data doesn’t always cross borders as records and workflows do. ZoomInfo took a while to build up its international presence, but now is investing aggressively here. But that’s far later than traditional B2B workflow apps which often see 30%-40% of their revenue outside the U.S. well before $100m in ARR.

Wow, ZoomInfo! An incredible story. And take a look at this A+ SaaStr session CEO Henry Shuck did on his top 10 mistakes building ZoomInfo: