So Microsoft announced that LinkedIn, which it bought in 2016, has now crossed a stunning $10 Billion in ARR — and growing 27% year-over-year. That’s pretty incredible. And in the last quarter alone, LinkedIn grew 46% (!). (Actually, I’m a bit confused which parts are growing 27% and which 46%, since it’s split between two divisions — but either way, it’s incredible at $10B in ARR).

Now LinkedIn isn’t a stand-alone public company anymore, so we can’t get quite as many metrics and details from them as we used to. But we can get enough.

5 Interesting Learnings:

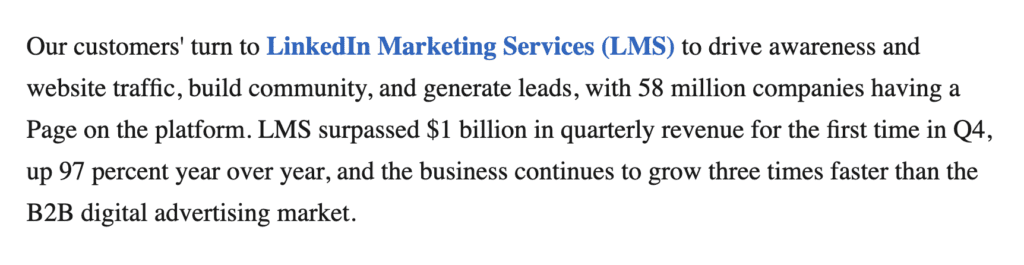

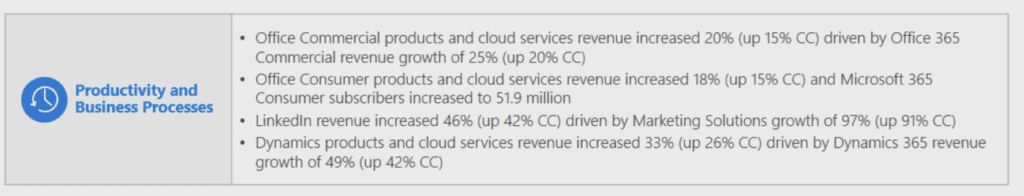

#1. Marketing Solutions is their fastest-growing segment — up a stunning 97%, to $1B in revenue. Marketers are spending a ton since the boom kicked off in Summer 2020. LinkedIn is a direct beneficiary, with its marketing solutions division growing almost 100%. B2B market is on fire. Because SaaS and Cloud are. With B2B companies spending ~40% of their revenues on marketing, it only makes sense the leaders that provide marketing services and platforms should be growing like crazy.

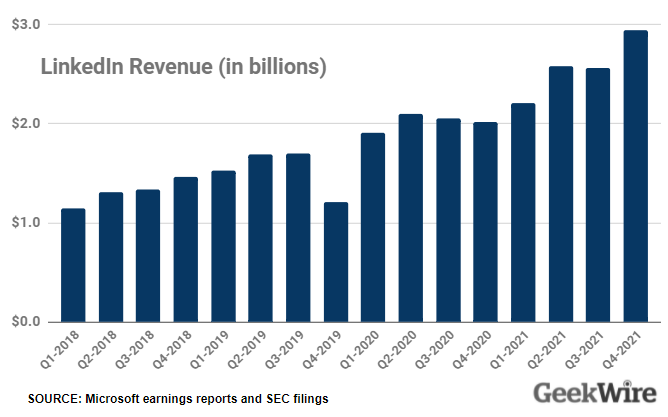

#2. Revenue tripled since Microsoft acquisition in 2016. This is a vivid reminder of the power of compounding revenue (although for sure, a lot of LinkedIn’s revenue isn’t truly recurring). After a slow patch after the acquisition, LinkedIn hit its new stride and tripled from $3B to $10B ARR from ’16 to ’21.

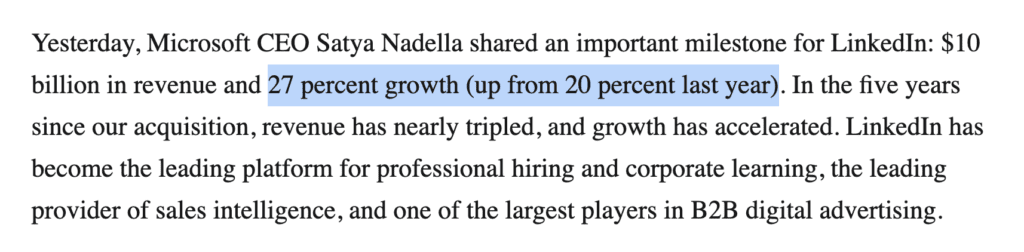

#3. Growth is accelerating — dramatically. LinkedIn grew 20% last year, but now is growing 27% year-over-year. That’s incredible acceleration at scale. At $10B ARR. Like we never saw in the past. Cloud is an awesome force.

#4. Sessions were up 30%, Revenue 27%. Just a reminder that usage and engagement matter. Roughly speaking, revenue grew about the same as usage of LinkedIn the product.

#5. Members “only” up 70%, while revenue up 300% since 2016. A bit of a B2C metric I guess (members), but still a visceral example of making more money from your base. LinkedIn’s user base hasn’t gotten that much bigger since 2016. But it sure has gotten better at marketing to it, and monetizing it. A lot better.

LinkedIn sold to Microsoft in 2016 for $26B. It would probably be worth $260B today as a stand-alone company. Now, 2016 was a different type. SaaS and B2B wasn’t as hot, and 2016 in particular had a “SaaS Crash” when multiple fell into free fall. A lot of folks panicked a bit. No one thought this was a bad deal at the time.

It’s just — go long when you have something good. Even at $1B in ARR it compounds. Now we can see from LinkedIn, Salesforce and more that even at $10B ARR — it still compounds.

Ok at $10B ARR, growing 27%

As a stand-alone company, LinkedIn would be worth … $300 Billion? $250 Billion?https://t.co/o4fbKokwkw

— Jason ✨BeKind✨ Lemkin ⚫️ (@jasonlk) July 28, 2021