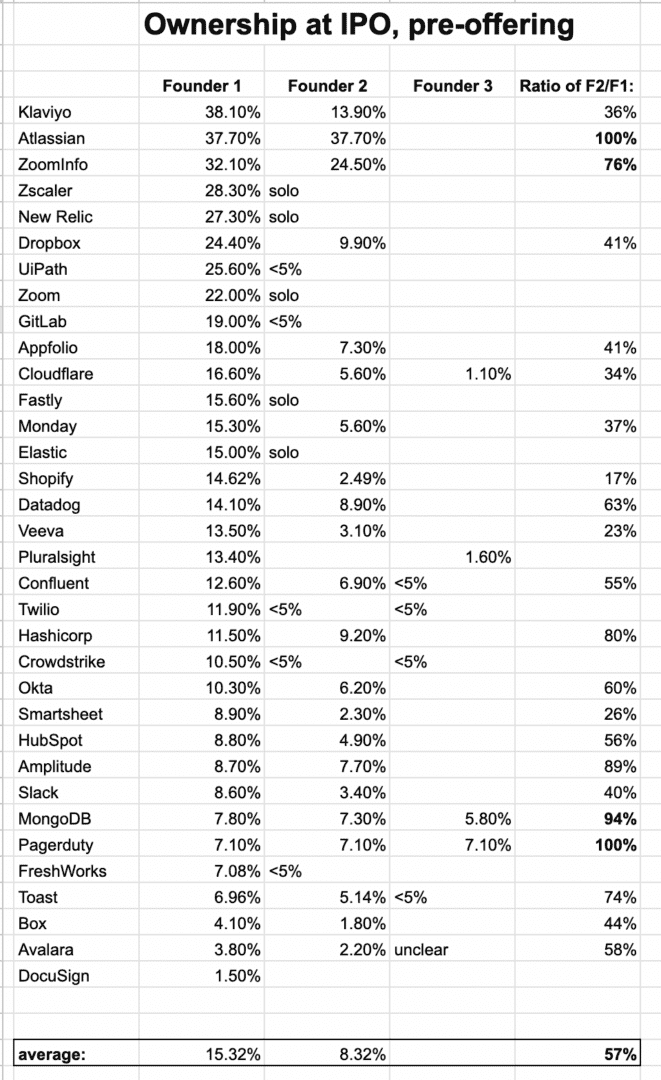

I was curious a ways back how many Cloud and SaaS IPOs had founders that were equal co-founders from an equity perspective. That was how I was brought up (the first start-up job I had, the founders were equal shareholders). And I generally thought that 50:50 was the default, albeit with many exceptions.

Well, I was wrong.

Only 3 of the most recent ~35 SaaS/Cloud IPOs I looked at had truly equal founder ownership at IPO, Atlassian, Pagerduty and (close enough) MongoDB. ZoomInfo, Toast and Amplitude weren’t far off, too, so maybe we can call it 5-6 of them:

(One note / disclaimer: some of these companies may have more co-founders than I listed who aren’t large enough shareholders to show up in the S-1 cap table. For purposes of thinking about equity ratios, I just focused on trying to identify folks with >= 5% ownership or who were named officers or directors, so we’d have real numbers to show. Other founders just don’t show up in an S-1. Happy to make any changes, and companies that are listed as “solo” may have other co-founders with small equity stakes. Also, in many cases, stock option grants aren’t included in these numbers, and thus ownership numbers may be a bit higher).

Overall, I learned a lot from this exercise:

- Only 3 of the top recent Cloud/SaaS IPOs had equal co-founders in terms of equity. And all 3 of those were developer-focused (B2D) companies.

- 5 had solo founders, or close to it.

- The average ratio was about 2:1 for co-founder equity. This makes a lot of sense to me.

- Many of them diverged a bit above 2:1 as later “CEO grants” were made to the CEO founder who stayed CEO. This is pretty common. E.g, the CEOs of Slack and Box both were granted subsequent CEO grants, with new, longer vesting schedules, to incent and retain them.

- The average CEO founder had ~15% pre-IPO (more than I thought).

- Co-founders as a group, on average, owned about 23% pre-IPO. Let’s call it 25% if we add in small equity holder co-founders that don’t show up in public filings.

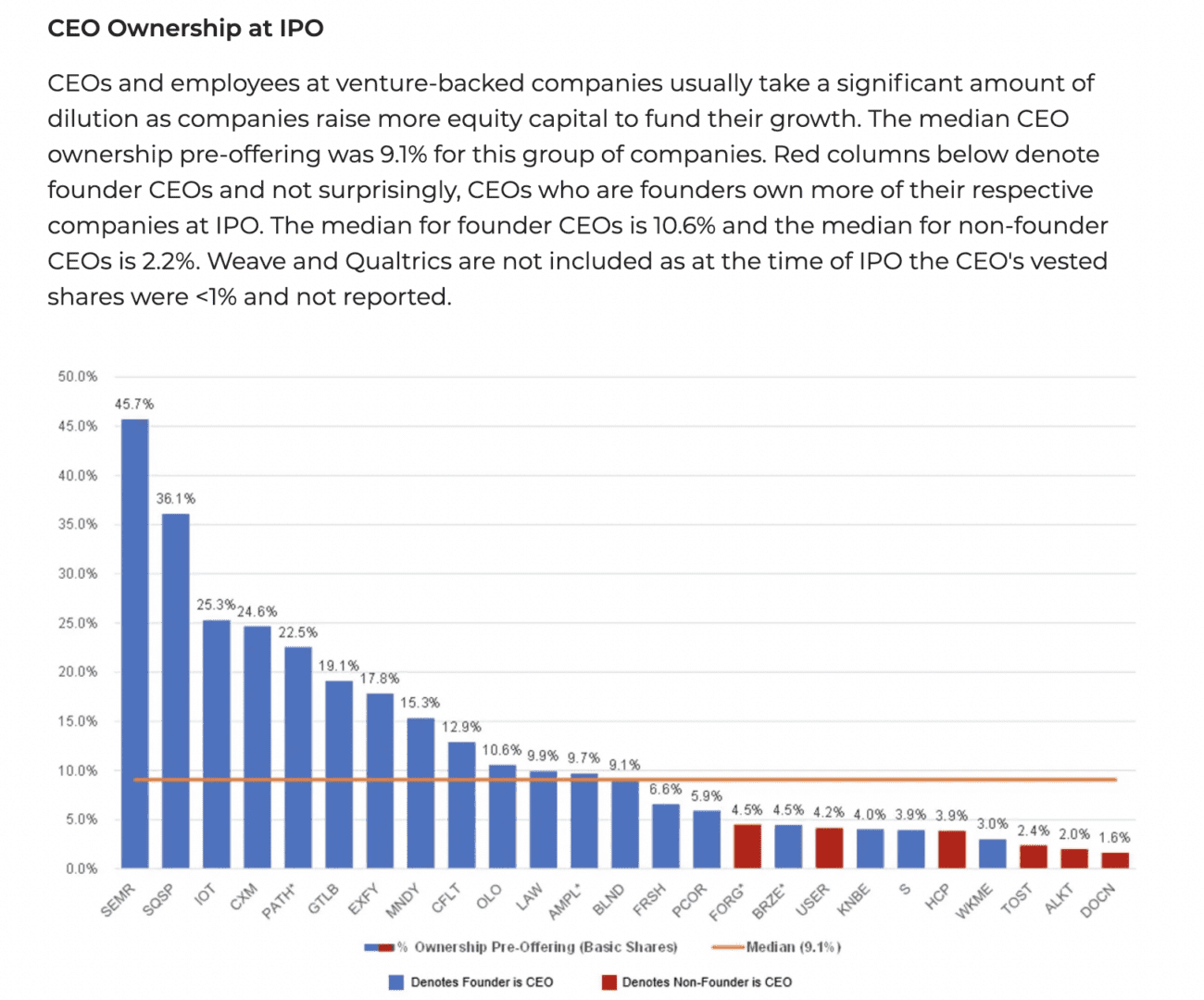

Some interesting benchmarks here for you to think about. Meritech Capital also did a look at some of the more recent SaaS IPOs and found of the most recent batch, median Founder CEO ownership was 10.6% — so a bit lower than the historical averages above.

As time has gone on, it’s been more and more clear to me that co-founder contributions are rarely equal. And that equal in many if not most cases actually may not be “fair”.

One founder often puts in more time and more capital, and more value, early on. 2:1 makes a lot of sense to me as a default in a typical co-founder relationship, at least as much as 1:1. It’s interesting to see that’s just about the most common scenario.

Also, an interesting related post here: