So much going on in economy right now, from inflation to interest rates

But at end of the day, in Cloud, the question is if CIO and related spend will slow down

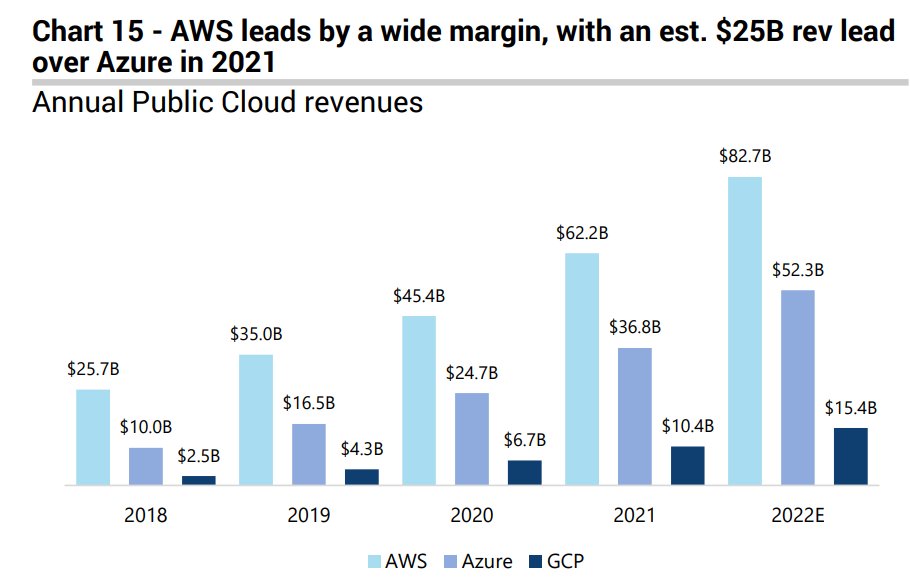

So follow AWS, Azure and Google Cloud

If they stumble, we’re in for a rough patch

For now, they are still on fire

— Jason ✨BeKind✨ Lemkin #ДобісаПутіна (@jasonlk) May 16, 2022

So there’s much angst and even panic with so many SaaS and Cloud public stocks down 50% or more from their peaks. And it is stressful, especially if you invested at those peaks or as founders raised money at relatively high valuations and multiples.

And there’s more than that. Inflation is at a local maximum, and interest rates look to be on their way to the highest rates in more than a decade.

And yet … we have to keep our eyes on the prize. Will things get worse for SaaS products themselves on a day-to-day basis? Stock prices go up and down, inflation will come down, and interest rates won’t rise forever. Let’s look past those and look at what ultimately really matters:

- Are folks buying more SaaS and Cloud products than ever?

- And is buying of SaaS and Cloud products accelerating, decelerating, and/or flattening out?

We can look at individual SaaS stocks and as a whole, we see epic acceleration, from Snowflake to Zscaler to Confluence and more.

But forget about folks “just” at $1B in ARR or so. Let’s look a whole level up to the real canaries-in-the-coalmine: AWS, Azure, and Google Cloud. They are the Cloud. And they are the CIO’s office and the CIO’s spend.

So if they are stumbling and slowing down, that’s a super worrisome sign. And if they are growing as fast or faster than ever — that’s as good a sign as it gets for SaaS and Cloud.

And the answer, at least for now, is they are growing faster than ever, at massive scale in Q1’22:

- Azure grew the fastest, accelerating to 46% year-over-year growth and they’re projecting 47% in calendar Q2’22. Microsoft’s Cloud business overall crossed a stunning $100B run-rate.

- Google Cloud grew 44% last quarter to a stunning $25 Billion run-rate. Not bad for #3!

- And AWS grew 37% at a $74B run-rate, down a bit from 39% the prior quarter but still adding an insane amount of new revenue.

So there’s a lot of stress today in venture and in public SaaS stocks. As perhaps there should be, given the insane run we had during the peak Covid era.

But what really matters is if folks are buying even more Cloud products than ever. That’s the engine we’re all building on.

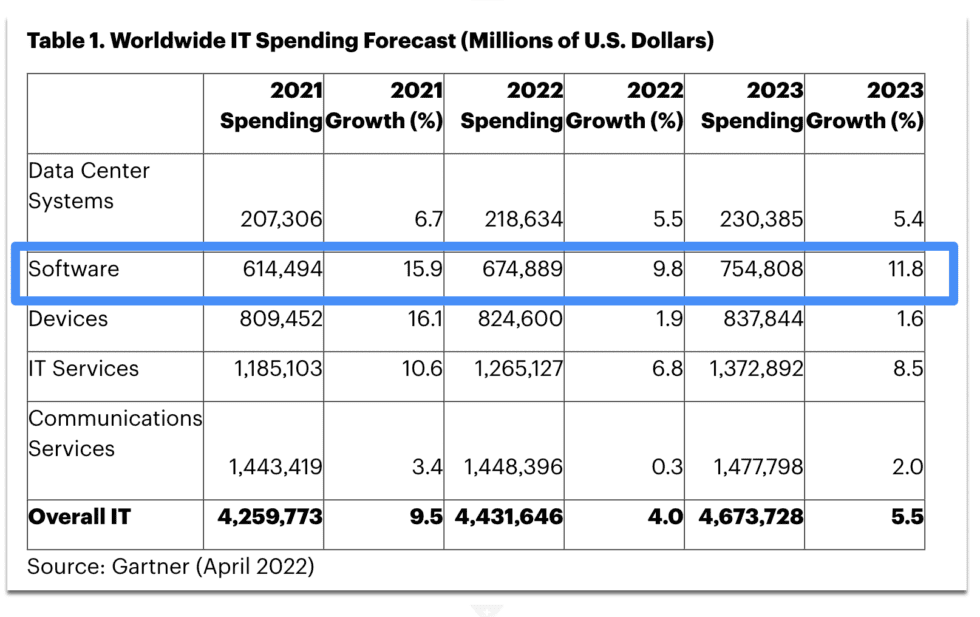

And Gartner is still predicting SaaS purchase rates will accelerate in 2023:

AWS, Azure, and Google Cloud say Yes. These Are Still the Best of Times Ever for SaaS and Cloud.

Let’s see if that changes in the next quarter or two. It could. But so far, there are no signs it will.

Enterprise software spending globally was $529B in 2020, per Gartner.

In 2023, it will be $750B.

That’s a tailwind almost all of us are drafting on.

— Jason ✨BeKind✨ Lemkin #ДобісаПутіна (@jasonlk) April 13, 2022