Dear SaaStr: What’s The Best Way to Retain Control of Our Startup Once We Start to Raise Outside Capital?

Sell less of the company. And in particular, raise fewer venture rounds. Let me give you my learnings on the SaaS side.

At Adobe Sign / EchoSign my answer was only to raise $8m, get to cash-flow positive with much of the money still left in the bank, and sell for an exponential multiple. But although it was lucrative, I would not do that again. With hindsight, it was too conservative.

We did an analysis of how overall dilution impacts some of the most successful portfolio companies that have also raised a lot of cash a ways back.

The uber-learning was that notwithstanding all the dilution of many rounds — total employee ownership actually went up once the companies hit post-Scale and say, $100m+ valuations, no matter how much capital they raised post $100m valuation.

How is this possible?

Well, for the best companies, that perform well — you have to add to the pool, and add subsequent grants. You have to.

Net the two out together, and the employees as a group (not individuals, but a group) added to net ownership of all the top companies over time, measured from the ~$80-$100m valuation date. This also was true at EchoSign. I received additional grants over time as CEO and also everyone on the management team that was there for multiple years and delivered got multiple grants as well. Those grants turned out to be lucrative and material.

So the learning is don’t fear dilution in isolation. If you’re a founder or close to it, knock the ball out of the park, and don’t quit … you may even end up with more ownership at IPO or M&A than you had at say, Series C. Less than Day 0, of course, but more in the end than you might think. Or at least, the dilution may not be so linear.

But control is a bit different. To the extent control matters, it’s usually lost bit by bit as you raise each round.

You can either stop raising, raise tiny amounts (if possible), or often the best choice is just to pick your VCs carefully. Ones that value you and your long-term commitment. Then deliver. If you do both, dilution won’t be as big of a deal as you think.

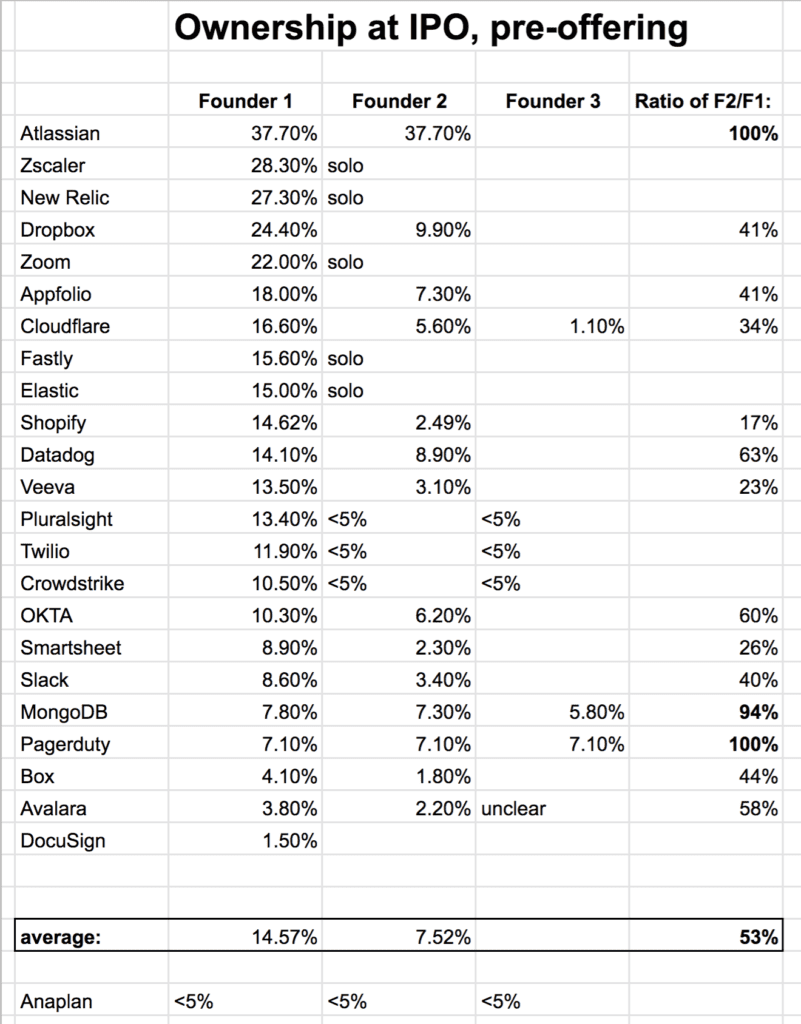

More on how cap tables look for founders at IPO here: