In the early days of SaaStr we put together a strawman First Sales Rep Comp Plan. Use it, modify it (or of course, ignore it) as you see fit.

In the early days of SaaStr we put together a strawman First Sales Rep Comp Plan. Use it, modify it (or of course, ignore it) as you see fit.

If you use a sales comp plan like ours, you’ll get one big benefit for planning purposes — you’ll know with a decent sense of precision what % of first year ACV (annual contract value) you are going to spend on sales. Without this, you’ll be lost because what you’ll need to spend on sales will be a bit of a black hole. If you don’t use a comp plan like ours — use at least some plan that can clearly predict how much of each $1 coming in you’ll really be spending on sales. One where you can truly predict cost of sales, in every deal, every month, like clockwork.

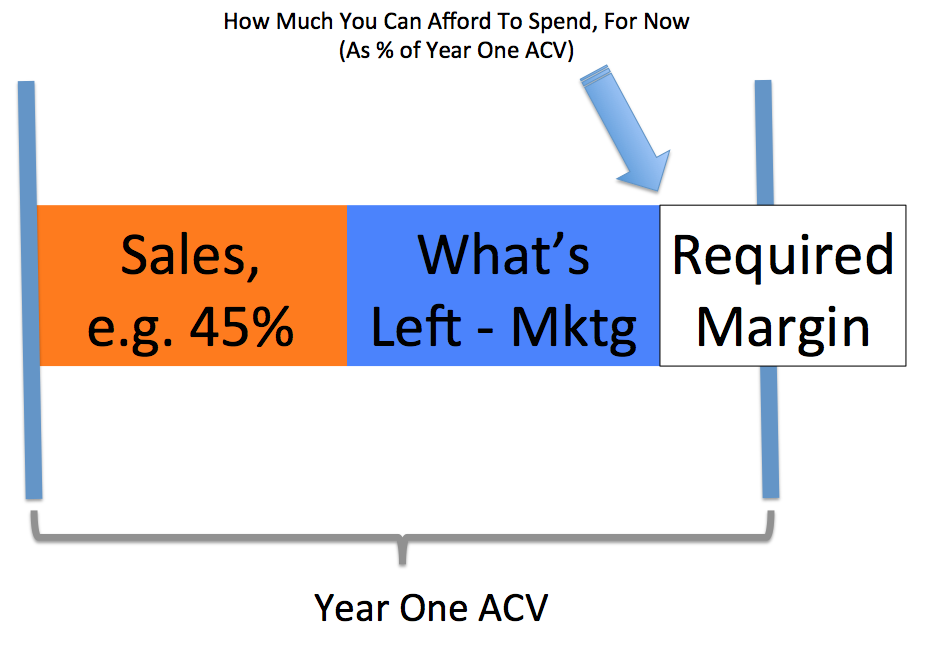

Once you know your Cost of Sales as a % of ACV … then do your full sales and marketing spend model. If your sales comp plan results in 25% of ACV going out to the reps; then add in whatever “overhead” you are going to have — VP Sales, sales ops if you need it, etc. … so maybe that gets you to 30-35% of ACV spent on sales on a burdened basis. Maybe more.

Great. Because now we know exactly how much we can spend on marketing. It’s just whatever’s left in your budget for each new dollar of ACV you bring in. Because at the end of the day, your sales rep expenses are what they are, once they are optimized. Once/if the reps are performing at a high level, you’ll know exactly how much of each $1 that comes in has to be paid to them to make it all work.

Now to figure out how much you can really spend on marketing, there’s a quantitative aspect … and then a more qualitative one, an almost counterintuitive one, that I want to share with you.

First, once you know your Predictable Cost of Sales … figure out what % of ACV you can really afford to spend on marketing. You’ll have to build a real model here:

- Many VCs and blog pieces will talk about a good metric being to spend about your first year ACV on Sales + Marketing. A “Magic Number” of 1. That’s great — when it works, and when you have enough capital to fund it. But the problem is, if you don’t have a lot of capital, you won’t be able to afford to spend that much, at least not until maybe $5m-$10m ARR or so when renewals and scale kick in. But if you have capital, and especially if you are well funded — you can probably afford to spend more if your NRR is 100% or greater. Because the lifetime value of a customer with 110%+ NRR is just jaw-dropping. Back in the day, when I had capital from our seed round, I spent about 100% of ACV on Sales and Marketing at first, and then once we hit about $3-$4m in ARR, I dialed it back to about 80% to make us Cash Flow Positive. Today, that probably would be too conservative — but in any event, the math made it simple to engineer.

- So for us, for example, once the model worked, we could spend about 35-40% of First Year ACV on “Marketing”, i.e. acquiring that customer. Whatever your number is, figure it out once you hit Initial Traction at least.

- The truth is you should spend more if you can and your NRR is high. Because of second-order revenue, your enterprise customers especially are worth a lot more than you think. So you want to spend on anything that even remotely works … which brings us to the next point …

Second, no matter what the model says … you should spend $1 in marketing programs to make $1 in ACV wherever and whenever you can. And maybe even a lot more than that.

Huh? I thought we just said spend $0.35-$0.40 in marketing in your model, or something like that in mine, to get $1 in ACV? Well, we did. But here’s the thing where the blogs and such will confuse you: that’s an average.

The real world doesn’t work that way. There are no B2B marketing programs that predictably cost you $.43923492 to acquire $1.00 in customer ACV. In B2C, there are. SEM volumes are much, much higher there. There are lots of high-volume programs in B2C. In SaaS and B2B … less so. E.g., SEM doesn’t scale in SaaS. There just aren’t enough searches.

You are going to end up with three types of customers:

- Customers you get from your mini-brand, virally, from word-of-mouth, etc. These customers cost $0 to acquire. Now you still have to market to them — that does have a cost. But it’s going to end up being pretty low, maybe 10% of ACV max.

- Customers you get from partners and channels. It’s often hard for these to scale too big in SaaS, but whatever you get, is still pretty cheap. You’ll typically pay partners anywhere from 10% (for a barely qualified lead) to 30% (Apple, Salesforce, etc.) to 50% (for someone they close on their own paper) of the ACV to get a customer. But that’s OK. The marketing cost is almost always cheaper than anything you can acquire yourself.

- Customers you pay to directly acquire. Very expensive. Seems to break the model. SEM. Trade shows (if they are to acquire leads). Purchased lists. City tours. Whatever. All this stuff you are going to find is extremely expensive. In fact, it may even take a full year for you just to get $1 in ACV for each $1 in marketing spend — and that’s before you pay sales commissions. That sounds like a terrible deal.

But it will work out. First, again because of second-order revenues, most of your enterprise customers are going to be worth $6+ for every $1 you spend. So think Long. But even more so, the cheaper categories will help balance things out. The cheap and free leads will balance out the expensive ones, once you have a mini-brand at least. And as we’ve discussed, you want to get the Incremental Customers to really kill it. You want every customer you can possibly get as you are scaling.

So what I learned, in the end, at least for us — once you can control and truly predict sales costs — we could afford to do anything we wanted in marketing, as long as that program, that spend, that initiative had some real return. Even a very low return. Once you added in the free and lower cost leads, it was OK to have some expensive programs. And also because most things in marketing that yield even a handful of customers, you end up getting better at. It’s the goose eggs and the zeros that hurt you. It all worked out in the end, on average.

Add in the cheap leads, and in fact, we could spend on an unlimited basis in any program that delivered some revenue — and still be cash flow positive once we hit about $6m-$8m in ARR. Now for you, there may be more of a ceiling. But I suspect it will still be higher than you think.

I know it may seem illogical from your model. Build your own. And once you do, my advice is understand it, practice it, live it. And also put it aside when you are deciding on a specific, individual new marketing program. If you think you can make even $0.50 off that marketing program that costs $1 … I say … go for it if your core engine is working. If your core customers are cheap to acquire. Getting those incremental customers? It will pay off.

If a marketing program or channel performs, but is expensive

Well, that's because it works

Keep doing it

— Jason ✨Be Kind✨ Lemkin 🇮🇱 (@jasonlk) December 15, 2020

(note: an updated SaaStr Classic post)