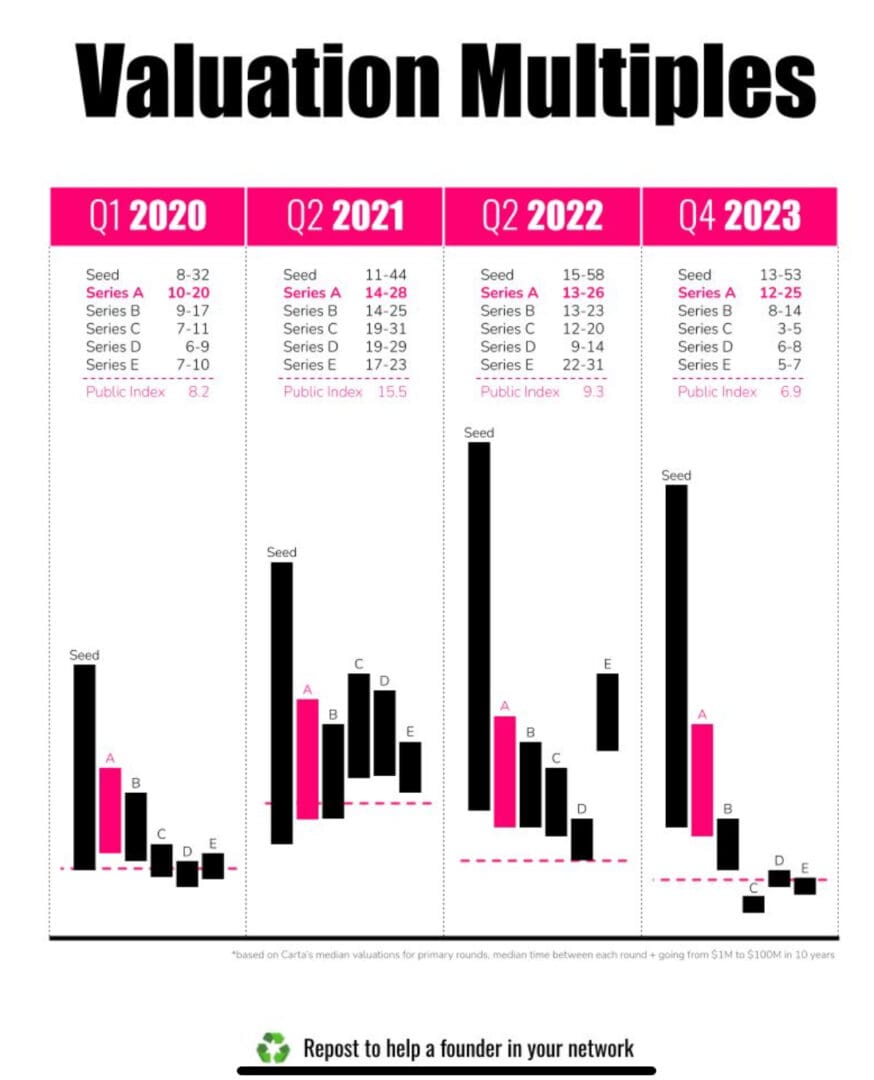

So Michael Ho did a visualization here of Carta data that IMHO illustrates the changes in valuations over multiple rounds in a way so many founders … miss. And misunderstand.

At the end of the day, SaaS companies that get all the way to IPO end up trading at “standard” public company ARR multiples, even if they raised at higher multiples while private. Today, on average that’s about 6x ARR at IPO. Not great, but it is what it is. But they don’t start there.

Pre-seed and Seed rounds can’t really be done at 6x ARR typically. A startup doing $300k in ARR is rarely valued at $1.8m post-money these days. If they raised $2m, that would be a – $200k pre-money valuation!

So ARR multiples are in a sense inflated in the earlier stages. This is justified both by the fact they are higher growing (or should be) than public SaaS companies. And also by the fact they are really a bet on the future, and not the present.

But many founders sort of think those high ARR multiples will play out into all the future rounds, too. At some point though, the multiples have to compress and equal those at IPO.

OK, but how does this look in practice? Here’s the chart, and it really visualizes the point (and issue) well:

You can see that not only have valuations always come down in each round, but it’s even more accentuated these days.

Why? A combination of the fact that so much seed capital in the market is keeping multiples close to all-time highs there — at least for the hottest seed and pre-seed startup. But also by the fact that public valuations are back to the lows of many years past. Far lower by most counts than any of the past 5+ years.

So what you see is the steepest decline in ARR multiples by stage that I’ve ever seen in my career investing or as a founder.

Multiples start off high, and then plummet in each round.

Are there exceptions? Sure. Hot AI deals are breaking a lot of the classic rules. But not that many.

At least if you do raise VC capital, understand the chart above very well. It also means the next round is often even harder that most founders realize.

More here.

And a related post here: