Almost every category of SaaS exploded during the lockdown, but three saw just crazy boosts:

- Zoom went from $1B to $3.5B in a year!

- Shopify accelerated to 110% growth at $3B ARR!

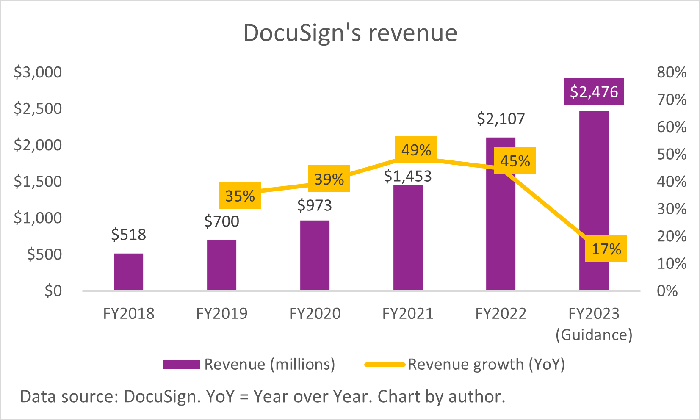

- DocuSign’s billings growth accelerated to 61% at %1.5B ARR!

Incredible boosts, and their stock prices went on a tear. We’d never seen revenue acceleration like this ever in B2B software.

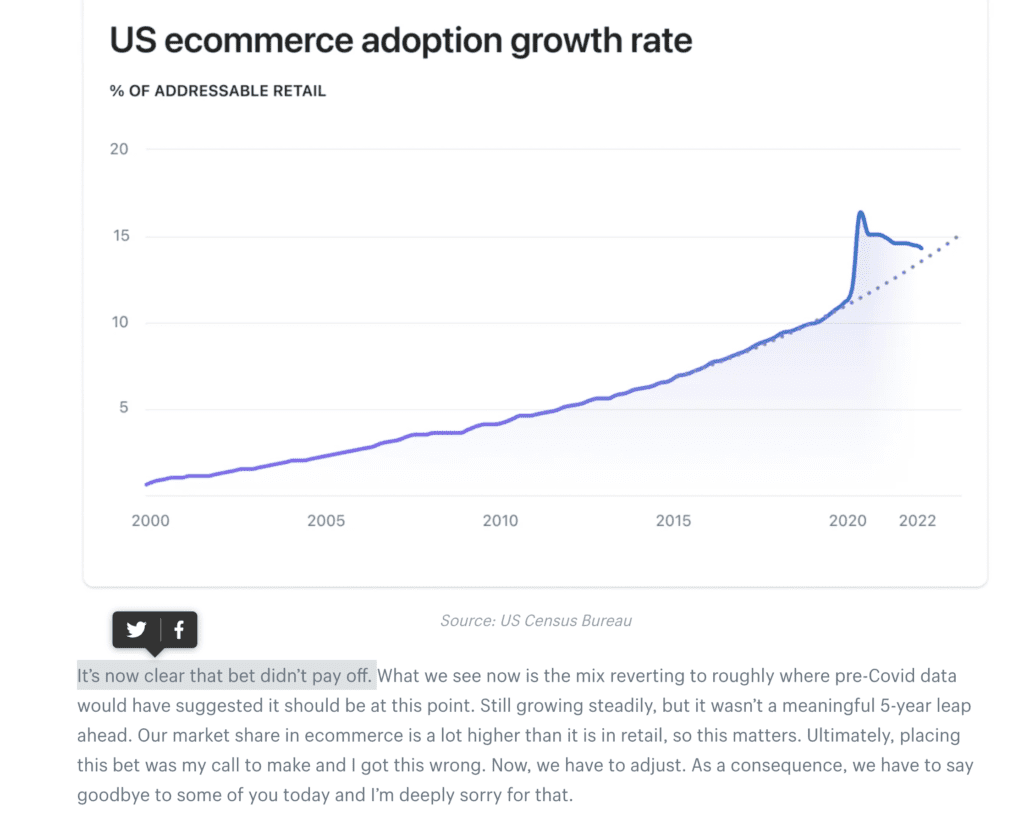

But, while all 3 are epic companies, in unique categories, it didn’t last. It couldn’t last. In fact, all 3 were clear in their public announcements that the Covid boost was already over by the end of 2020:

Fast forward to today:

- Zoom’s growth at $4B has slowed to 12% (with enterprise accelerating nicely)

- Shopify’s growth at $5B slowed to 22%, still impressive but a fraction of its Covid peak

- DocuSign predicts 7%-8% Billings growth in 2022

Other categories were hit less dramatically. Collaboration software (Asana, Smartsheet, etc) appears to have sustained a more permanent Covid boost. Others like Box leveraged the times to broader their platform and grow faster than ever:

But one has to wonder if so many SaaS leaders would have been better off without a Covid Boost at all. It merely created a disruptive blip in revenue in many cases.

And probably worse, it forced many SaaS leaders to reckon with issues they could have put off. Zoom and DocuSign’s revenues mainly come from 1 core product. Accelerating so quickly forced more saturation in those core products, more quickly, than more linear growth would have. And Shopify’s whiplash from every tiny store adopting Shopify during peak lockdown, to in many cases dropping it or walking back from an online presence didn’t help in the end at all.

In some categories at least, the Covid Boost in the end was probably not just a mirage. But worse, a big headache, with no net boost in the end.

Still, in the end, SaaS is growing faster than ever, and Cloud budgets are at all-time highs. Still the Best of Times in SaaS and Cloud. Just not playing out exactly how we might have thought at the market’s peak.

Still, in the end, SaaS is growing faster than ever, and Cloud budgets are at all-time highs. Still the Best of Times in SaaS and Cloud. Just not playing out exactly how we might have thought at the market’s peak.