There’s a trend that’s accelerated in the past year or so with companies I meet with, advise, track, mentor, have invested in, etc.

The trend is that I have no idea what their revenues are 🙂

What I mean by that is that in an effort to present all different types of revenue as “recurring”, the whole meaning of MRR has been corrupted. On the one hand, I’ve seen many startups start to include non-recurring revenue in “MRR”. Hmmm. Which of course you can’t, since the the second R means Recurring. On the other hand, I’ve seen companies not give themselves enough credit for all their revenue streams. And really worst of all, I’ve seen so many startup craft new metrics I simply can’t understand. XYMRR. This-AND-ThatMRR.

There’s nothing wrong with any of this, as long as you do one key thing:

Start with real, recognized, GAAP revenue. In other words — just tell me, tell everyone, how much money you made last month and last quarter. Period.

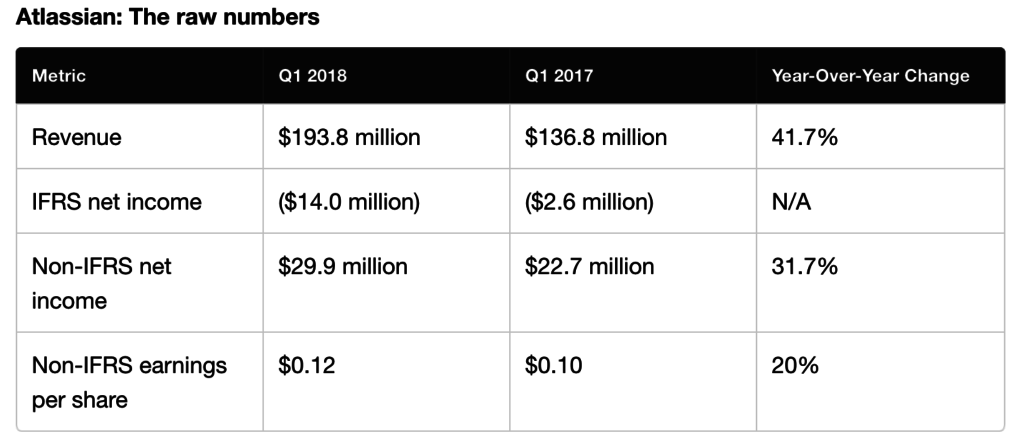

As a case study, let’s look at SaaStr Annual 2018 and 2016 speaker Atlassian (see our deep dive with President Jay Simons here). Atlassian just blew out the last quarter, and its market cap topped $10 billion as result! How did Atlassian do?

$193 million in GAAP revenue last quarter. Revenue. And $62 million of free cash flow. Cash. Not too shabby!

Start there. Always start with the very top line and the very bottom line and make sure they are right. Real, honest, GAAP revenue. And real honest cash out-the-door (or in Atlassian’s impressive case, in-the-door).

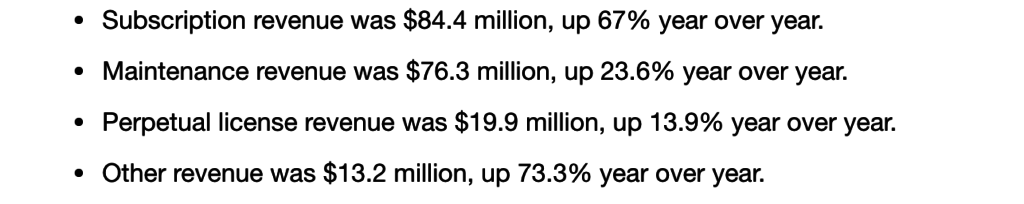

Now if you don’t know Atlassian well, it gets more interesting. Atlassian’s growth has been turbocharged by its move to the cloud and recurring revenue. This segment of its revenue is growing 67% year-over-year, and the other segments are growing much more slowly. But its roots are “on prem”, and a huge chunk of its revenue is still from perpetual licenses, installs, and services revenue:

Has that hurt Atlassian? Doesn’t seem like it. Yes, Wall Street (and thus VCs and thus press) wants recurring revenue. Recurring revenue is more predictable, and done right, more profitable. But it doesn’t have to be all recurring revenue.

Many trends are giving rise to more types of mixed-revenue in SaaS and SaaS-ish companies:

- Many startups have a hardware component. Is that MRR? No. But it’s revenue.

- Many of you of course will have services revenue. Should you hide that in the numbers? No. It’s real revenue.

- And more and more of you use dynamic, pay-as-you-go-pricing. It’s not bad. Slack and Twilio do it 🙂 But is it MRR? Well. Maybe. If you have an 80%+ likelihood it recurs, it’s generally deemed recurring. If not — it’s simply variable revenue. It’s still money-in-the-door, and it’s still great. Indeed, there’s much more variable revenue in SaaS business models these todays.

What’s more important is if these other sources of revenue are low or zero margin. Services revenue done “right” often have 40%+ gross margins. The same with hardware as part of a service. If they are give-aways, by contrast, the gross margins are often zero or negative.

In any event, report it all.

But start with one key metric — Revenue. And please, keep it simple. Make sure everyone in the company and every investor knows exactly how much money you bring in each month.

Then, break it down into clear, simple segments. Hopefully, Recurring Revenue and “MRR” is your largest segment. Yes, MRR is King. Recurring revenue drives the highest multiples and the most investor interest. But Revenue and Cash are what really matters at the end of the day. Whatever it is, just break it down and stack them up like Atlassian does.

It’s OK. What isn’t OK is if no one really understanding how the business works. That just confuses everyone, and in the end, will drive you to outcomes and expenditures that aren’t the right ones, or at least not the ideal ones, for your business. Keep the made-up-acronyms for secondary analyses. Don’t use them as core metrics.