In the first quarter of 2023, global venture funding fell to $59 billion, down from a peak of $181 billion in Q4 2021. Deal sizes are falling, late-stage rounds are down by 45%, and funding rounds are taking longer to complete.

Despite the challenges, there is still some good news: founders who launch companies in this market may be rewarded with a specific set of advantages. Managing Partner at Zelkova Ventures, Jay Levy, believes starting a business now presents a unique opportunity: “It is a great time to launch a company…talent is more accessible, competition is reduced, and frankly, you’re forced to focus on economics and building a sustainable enterprise.”

Founders embarking on seed or early-stage funding rounds in this competitive market must pay special attention to investor relations, the art and science of communicating with and managing your investors. In a special workshop session, Jay Levy shares insights into successful founder-investor relationships and why they are so crucial to the success of your startup.

SaaStr Workshop Wednesdays are LIVE every Wednesday. Sign up for free.

Investor Relations: The Data

As you consider your investor relationship strategy, it’s critical that you focus on two basic goals:

- Setting your company up for success

- Reducing potential conflict

Early-stage companies must understand how important this is, but unfortunately, it’s overlooked. Levy explains, “Startups don’t seem to give too much credence and weight to investor relations, and I think this is, unfortunately, a missed opportunity.”

To begin to understand how essential investor relations are, consider the following data:

- 60% of startups have more than six investors.

- 13% of startups have more than 26 investors.

That is a large number of stakeholders with an interest in the success of your company. As Levy says, “You’re going to have a lot of stakeholders and it will grow over time, so having a process in place to manage this and to work with them will be in your best interest.”

Part of this process must include regular communication and updates with investors. But, unfortunately, founders and investors don’t always seem to be on the same page.

- 75% of founders feel that their investors are sufficiently updated, but only 50% of investors feel the same way.

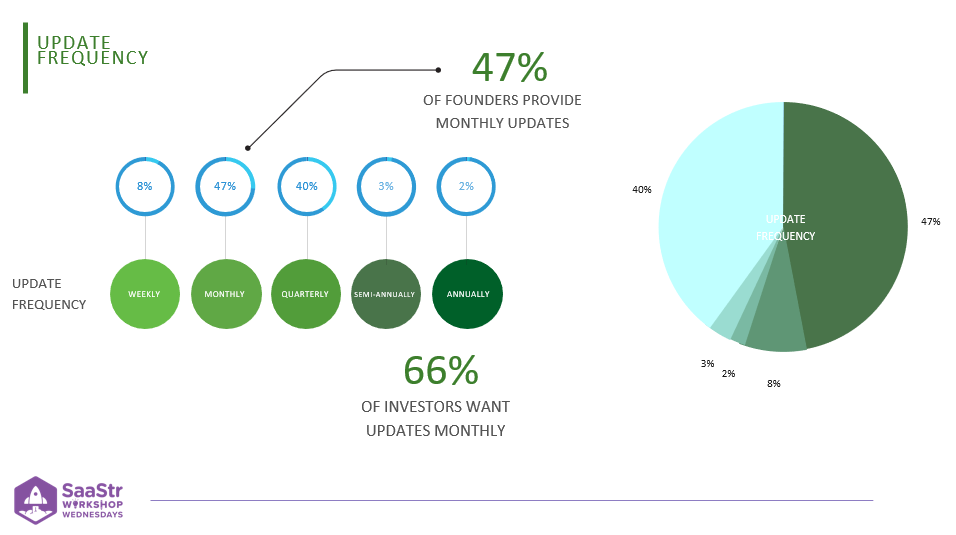

- 47% of founders provide monthly updates, but 66% of investors want monthly updates.

- Founders feel that only 66% of investors understand the business.

So it is obvious that there is a lack of communication between startups and their investment partners, and it is quite common. Fortunately, there are ways to correct this.

The Why: 5 Reasons For Investor Relations

- Get More Out of Your Investors: If all you got from your equity sale was money, then you got ripped off. Investors have a lot more than capital to offer, including experience, support, and introductions and networking opportunities.

- Future Re-Investment: Up-to-date investors are 200% more likely to re-invest, so keep communication lines open.

- Avoid Trouble: Regardless of how big or small they are, investors have rights. Strong relationships and clear communication may help avoid lawsuits or legal disputes.

- Updates are Self-Serving: They provide founders with an opportunity to reflect on the past, think about the future, and be more open and honest.

- It’s the Right Thing to Do: Your investors spent their time and money on you because they respect your vision and believe in you. Be sure to return the respect and show them you value them by making them a part of your journey.

Looking to the Future With Your Investors

Creating a template can be a helpful way to easily and efficiently keep your investors in the loop. Start by including the following:

- Monthly Highlights: Share the highs and lows of the month.

- KPIs: While developing some KPIs with investor input can be helpful, it’s important that you use the indicators that actually help you run your business.

- Investor Requests: Levy recommends placing this near the top of your report.

- Department Updates

- Press Updates

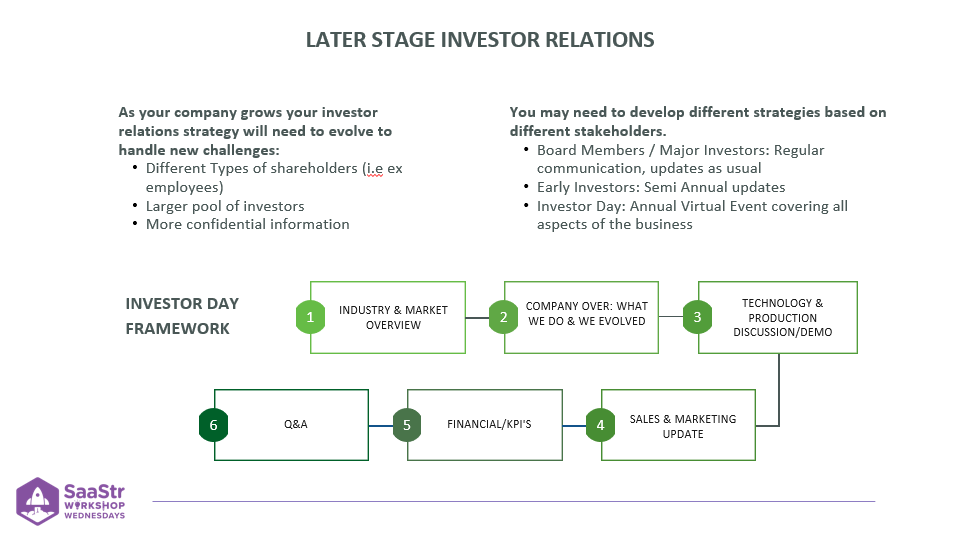

As your company grows, your investor relations strategy will need to evolve to handle new challenges like a larger variety of stakeholders, a bigger pool of investors, and more confidential information. Therefore, you may consider different relationship strategies for different stakeholders.

- Board Members and Major Investors: Regular communication and updates as usual.

- Early Investors: Semi-annual updates

- For everyone: Consider holding an annual investor day that informs and updates all your stakeholders on every aspect of the business.

Key Takeaways

- Investor relationships are critical to the present and future success of your business.

- There is a common disconnect between how often founders include and update their investors, and it’s critical to be aligned.

- Updating investors regularly increases the likelihood of re-investment in the future.

- Prepare to adjust your investor communication as your company expands.