Guest Post by Chad Keck, Co-Founder and CEO, Promoter.io

As I’ve said before, if you’re not seeing at least a 10x return on the cost of measuring NPS, you’re doing it the wrong way.

Doing it the right way means that you’re proactively reducing churn, improving your product based on qualitative and actionable feedback, identifying new opportunities and growing your revenue from organic recommendations and referrals each month. All combined, the cost of measuring NPS is a drop in the bucket compared to the results.

As Jason Lemkin has stated, up to 80% of a SaaS company’s revenue is driven by referrals and word of mouth (this isn’t far off for most other industries either).

If you’re instituting NPS incorrectly, solely focusing on the number, or simply not measuring it at all, you could be missing out on the biggest revenue opportunity you have today.

That’s why we say, when done correctly, NPS is a measurable profit-center, not a cost center.

But, what is the right way to measure and implement NPS? How do you know if you’re doing it right?

Worry not young NPS Padawan … it’s never too late to learn the ways of the force.

The guide below is meant to walk you through each step of the process, to ensure that you’re set up for success.

Who should you survey?

Most SaaS companies have both free (i.e. trial) and paid customers. Both groups are incredibly important to measure, but not necessarily together. You should treat them separately.

Why separate the customers (hint: trials are not customers, yet)?

- If you’re using your Net Promoter Score as a KPI, your trial customers are likely to drive that number down. For all intents and purposes, this isn’t a real reflection of customer sentiment, but rather a skewed result. There is little basis for true feedback during most trial periods since the user has had little time with the brand or product.

- While the score isn’t as important for trial customers, the insights are. Trial customers are great at telling you where you need to improve to earn their business or what is not clear to them from a value perspective. When combined with a trend analysis, your product roadmap starts to become crystal clear.

- Paid customers require the most immediate attention, which is best managed when they’re isolated from trial customers.

The best way to set up this process is to create two separate campaigns which run in parallel with one another. This will allow you to create separate survey triggers for each customer segment (which we’ll cover below), as well as unique scheduling cadences.

Alternatively, if you’d prefer to have everyone on the same campaign, you could use attribute filtering to segment your customers after your results are in.

As trial users convert, they can be moved to the “customers” bucket/list for future surveys to keep your data aligned.

Assign attributes to your customers

To put it in simple terms, attributes are the additional data points that help you define each customer. For example, job title, location, plan-type, avg. revenue, number of users, etc.

I can’t stress enough how valuable it is to be able to filter your results down by customer variables and dig into differences in sentiment by various customer segments.

Let me give you an example. Let’s say that you offer 4 different plans that range in price from $25 to $600 per month. Your overall NPS score is 30 (which, for the record, is a pretty good score), but you’re curious how that breaks down.

Using the filters you put in place, you discover that the 50% of your customers that fall into your 3 top plans have a combined NPS score of 50, while the other 50% of your $25 customers have a combined score of 5.

Do you think that is more insightful than your overall score? Can you see how filtering your results by attributes can help you narrow the focus and understand where to dig in further?

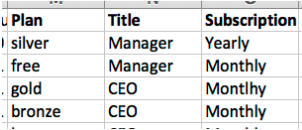

Adding attributes to contact records can be as simple as adding additional columns to your data import or passing those attributes in systematically through our API or another available integration (from your CRM, ticketing system, analytics tool, etc).

If you’re triggering surveys based on events, you’ll want to be sure to send that additional data as part of your integration.

Here’s a step-by-step document that you can follow to help you out.

How should I be sending surveys?

This is one of the most important strategic steps to the NPS process and has several components to consider.

Sending Method

If you’re looking to measure the sentiment of your customers overall experience (true Net Promoter Score), there is no better method than email. It’s personal, non-intrusive, and will provide you with the most holistic insights from your customers.

As a SaaS company, you may be tempted to deliver your surveys in-app. I mean, it seems like a logical place to reach your customers.

If you’re simply after just a score, in-app surveys may serve your needs. If you’re only looking for feedback relevant to what your customer is doing in the moment when they saw your survey instead of their overall brand experience, in-app will work.

Simply put, in-app surveys largely drive transactional feedback while disrupting the workflow of your customers. While you may get a slightly higher level of scoring responses, you’ll get less open-ended insights (which is where the bulk of the value comes from) and it’s hard to determine the accuracy of the scores since some users want to simply dismiss the pop-up.

Check out, Why In-App NPS is a Bad Idea, for further information.

Triggering Surveys

While in-app NPS delivers transactional feedback, email can still be used to trigger surveys based on transactional events. In fact, that’s what you should be doing.

Essentially, there are two approaches to triggering your surveys: 1. Upload a database of your customers and send or 2. Integrate your CRM (or other tools) to trigger surveys based on an event, such as a conversion.

- Uploading a database is a fine approach to begin with, especially if you have a lower number of customers or you have a lower volume of new transactions.

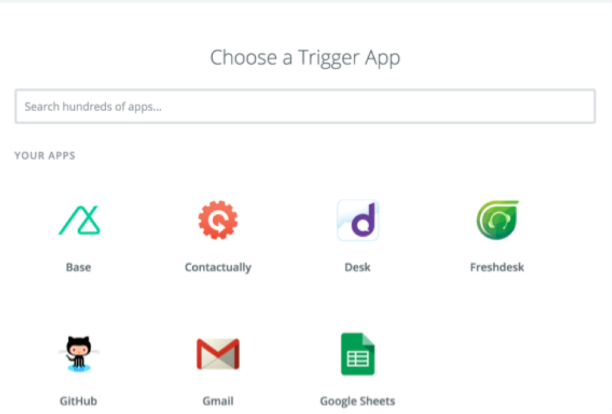

- Triggering a survey based on an event will help build a consistent cadence, not to mention that it’s designed to fit within your current workflow. These can be easily set up with either our API or tools such as Segment and Zapier.

For best results, you’ll want to be sure to set a survey delay for new customers so there is time to form a basis for constructive feedback (this is usually anywhere from 15-45 days for a new customer depending on the product).

Sending Approach

Whether you’re triggering your surveys individually or uploading your contacts all at once, you want to get into the habit of a daily cadence.

Sending all of your surveys out at the same time is a bad idea for many reasons.

The first of which is feedback management. Depending on the size of your customer base, it’s possible that you could be inundated with feedback, making it nearly impossible to respond within a timely manner. The second reason is that sentiment changes rapidly, you want to ensure that you have a constant stream of feedback to stay on top of the pulse of your customers.

If you’re triggering surveys based on an event, you’ll naturally build a frequency into your sends. If you’re uploading a database, be sure to drip your surveys out over an appropriate amount of time, effectively removing any gaps between reoccurrences. Promoter has a built-in option for facilitating drip surveys to make this extremely simple to implement.

Engagement Frequency

As I mentioned above, customer sentiment changes rapidly. Minimizing churn is essential if you’re to succeed as a SaaS product. The only way to stay ahead of unhappy customers leaving is to know when they become unhappy (and why).

The best way to accomplish this is to survey/engage your customers on a recurring quarterly basis. Statistically, anywhere from 30-50% of your detractors will churn within 90 days, but by surveying them once every three months, you’ll have the opportunity to stay one step ahead and step in before a customer has made the decision to churn or worse, spread their negative sentiment to others.

BONUS TIP

To get an additional boost in responses, be sure to send a reminder survey if they didn’t respond to your first attempt. Over the millions of surveys we’ve sent, reminders average a 5-15% increase in survey completions!

—-

Following the approaches I mentioned above will ensure that you’re maximizing the results of your customer engagement process and growth efforts using NPS. Never miss an opportunity to learn, grow your business and build stronger relationships with your customers.

Chad Keck is the Co-Founder and CEO of Promoter.io, the most comprehensive customer intelligence & engagement platform built to drive growth and customer retention using NPS (Net Promoter). Sign up today for free and be engaging with your customers in less than 5 minutes.