Dear SaaStr: Will a VC Agree To Wait 5-10 Years For a Very Profitable Exit?

Easily.

There are a lot of myths around venture capital. One of the top ones is that VCs will push you to sell early, or something similar.

VCs are paid to wait.

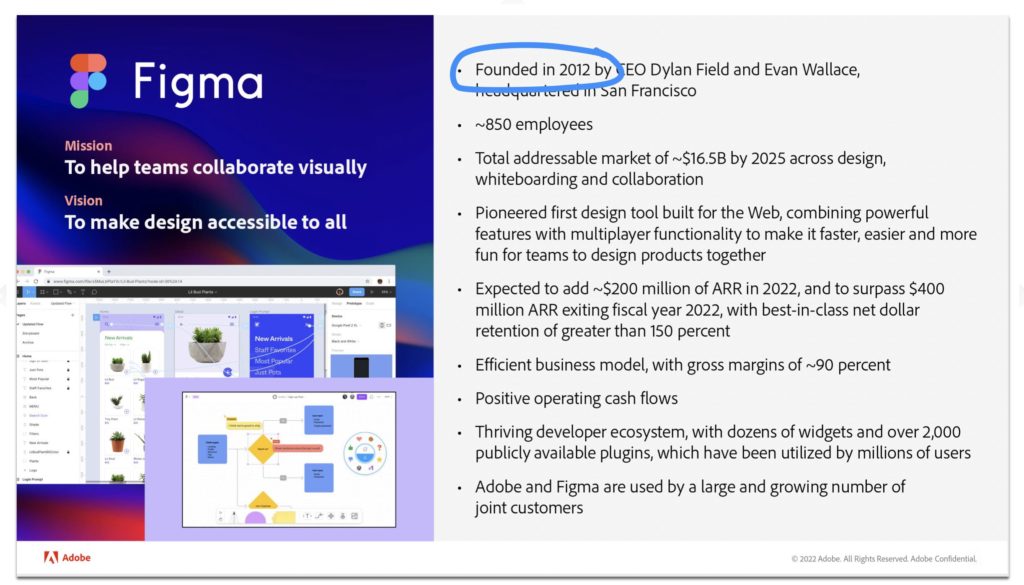

They waited for Figma. The first investors invested in 2012. The payoff? A $20B acquisition … 10 years later. In 2022.

VC firms are mostly structured around a “2/20” structure, where the VC partners keep 20% of the gains, and, importantly, also get 2% of the total fund as fees each year.

(Sometimes the terms are better, and the 2% of fees is credited against gains usually, but let’s ignore nuances here to keep it simple).

For a larger fund, that really means VCs are paid to be patient. They are paid for 10-12 years in fees to … wait for the biggest exit possible. Within reason.

Imagine a $500m fund, with 2% fees and 20% carry, that in the end, does 2x (i.e., doubles its money on a net basis after fees and costs).

- The fund receives $10m a year ($500m x 2%) in fees to spend as it sees fit, including on partner salaries. Each partner can easily make $1m+ in salary in a fund of this size. And if they are partners in 2+ funds at the same time, that can really stack up.

- The fund eventually — probably 10+ years out — will receive $100m in “carry” or gains in a 2x fund ($500m profits on a $500m fund, x 20% carry/gains kept by the partners).

- $100m in gains is a lot, but that’s over 10 years. So annualized, that’s $10m a year. The exact same amount as the fees. So in a 2x net $500m fund, the partners may make exactly as much simply by “waiting” as they make from their eventual exits. (Yes, I am simplifying math).

Now … imagine in year 10, one of those investments turns out to be a real rocketship. It is currently valued at $1b (amazing) — but has a chance to be worth, say, $5 billion or even more like Figma. And the fund owns 20% of that investment. And Google or Salesforce offers to buy it for $1b.

What do you do? You roll the dice. You go for $5b or more. You already have the $10m in annual fees locked up that you can’t lose. But by going longer, and growing that $1b value into $5b, the fund makes another $800m!! (+$4b x 20%). And that’s another $160m to the VC partners themselves. That’s where you make the crazy amounts of money in venture. By pushing on in the rare investments that not only get to $1b in value — but blow past it.

So tiny funds, struggling funds, and the like may push you to sell early. They don’t have a lot of fees, and they can run out of time.and indeed get some pressure from their own investors (LPs) to show some cash returns. And even a $50m-$100m sale in a tiny fund can be material for the partners.

But the bigger funds that have been around for decades have a strong incentive to quietly do the opposite. Look at the math above. If you have a shot to be truly huge, they’ll probably never want you to sell.

Why it's just so hard to make money in venture

Sometimes even a Figma isn't enough pic.twitter.com/ZJrjspEfPg

— Jason ✨Be Kind✨ Lemkin (@jasonlk) October 8, 2022