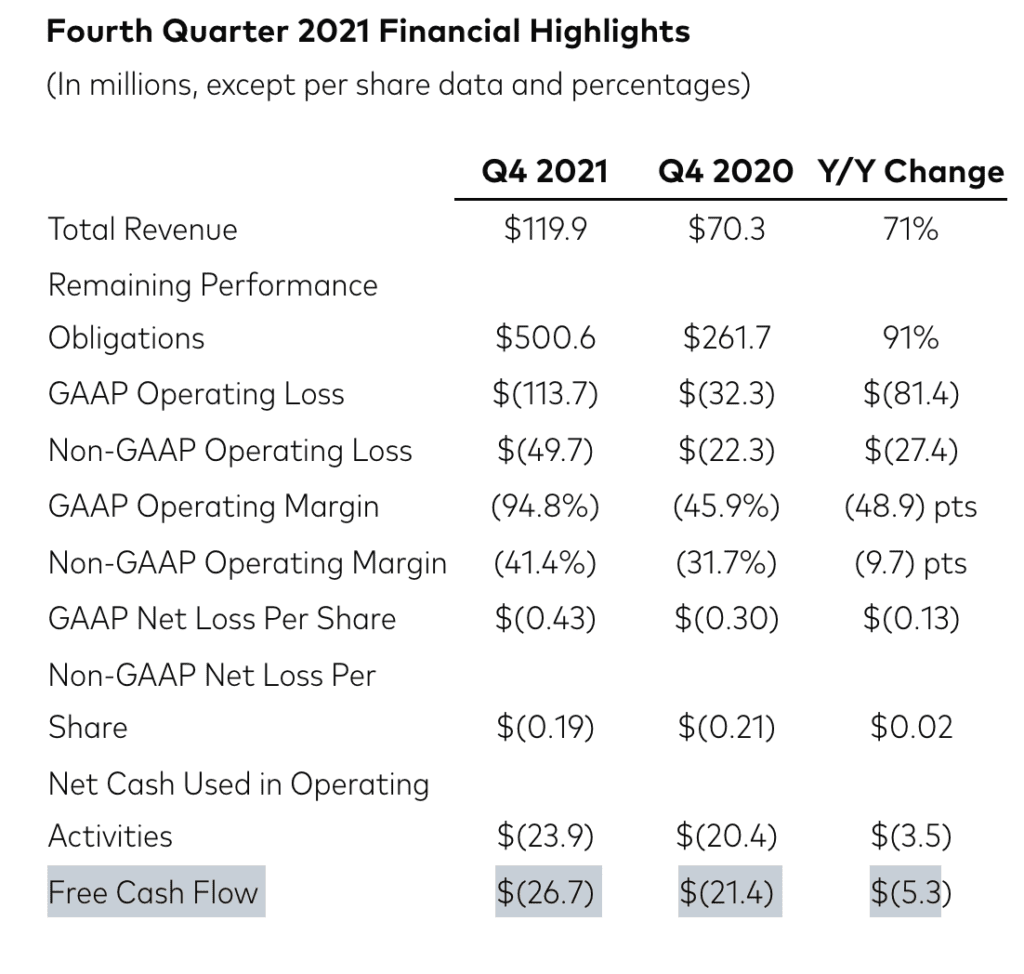

Confluent is a leader in the Commercial Open Source Market, with the founders of Apache Kafka reimagining it as a managed service. It worked. It’s growing a stunning 71% at a $500m run-rate … and accelerating.

Confluent has been one of the top Cloud IPOs of the past year or two, crossing a $10B market cap at a $500m run-rate and importantly, holding up well during the multiple compression we’ve seen in 2022.

Put differently, Confluent is just the type of Cloud IPO the markets want right now.

5 Interesting Learnings:

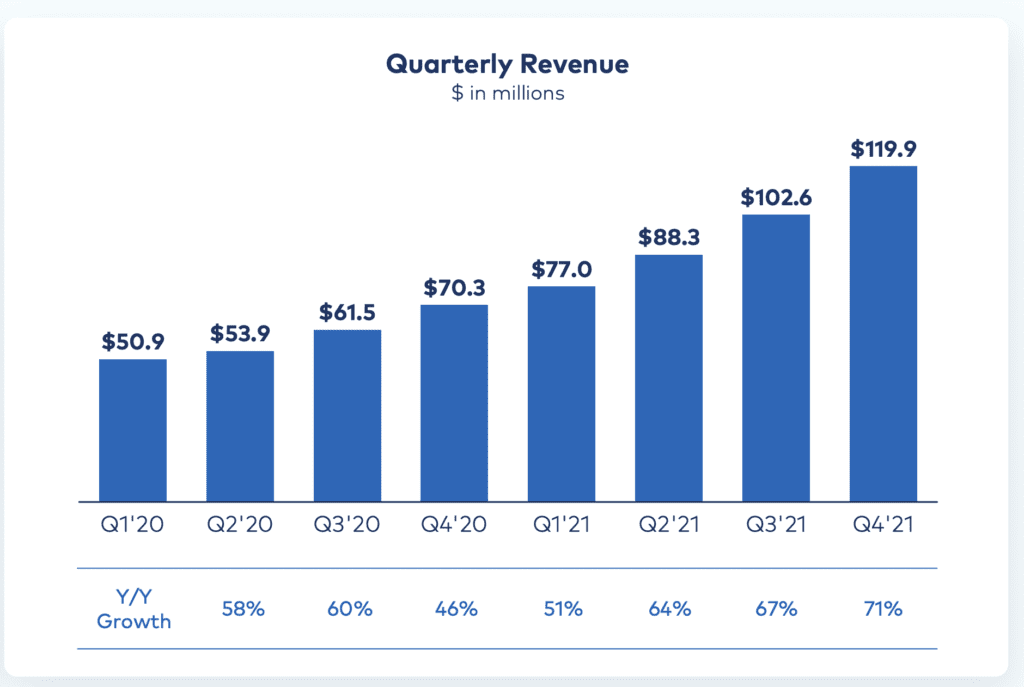

#1. Growth Accelerating on the Way to $1B ARR. While Confluent isn’t the only Cloud leader accelerating post-IPO (something we never used to see), the chart below shows just how incredible their acceleration really is. From 58% growth at $200m ARR to 71% at almost $500m in ARR.

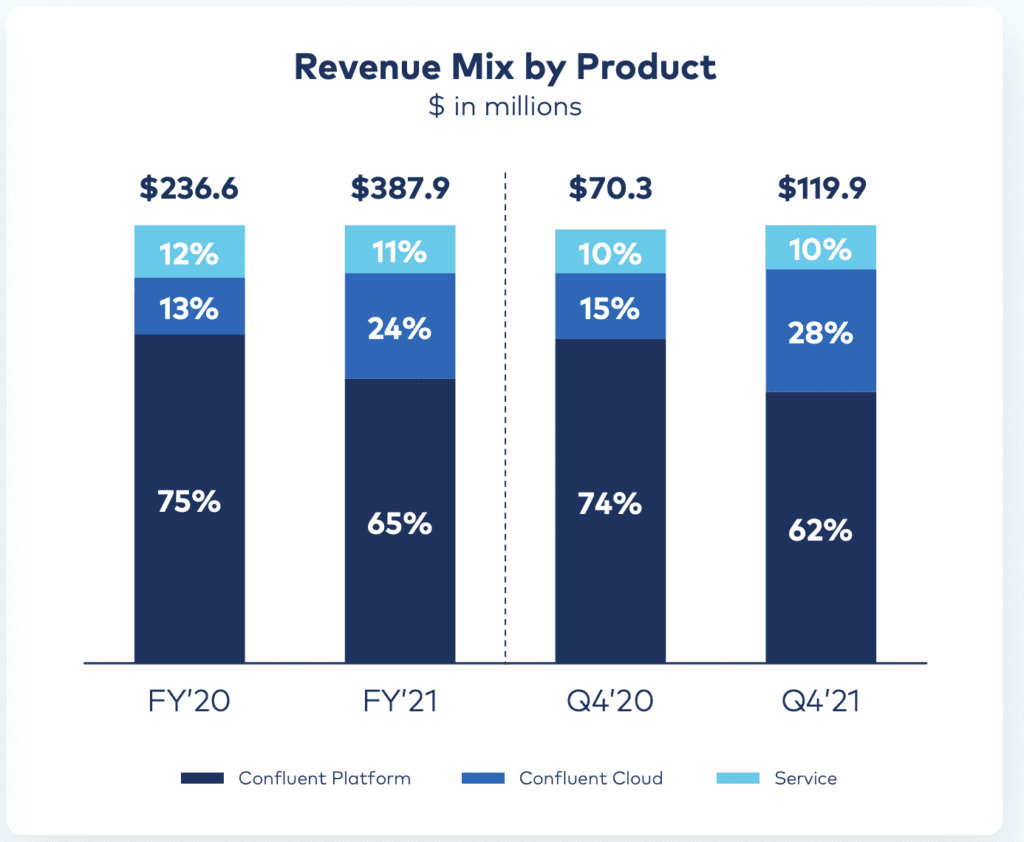

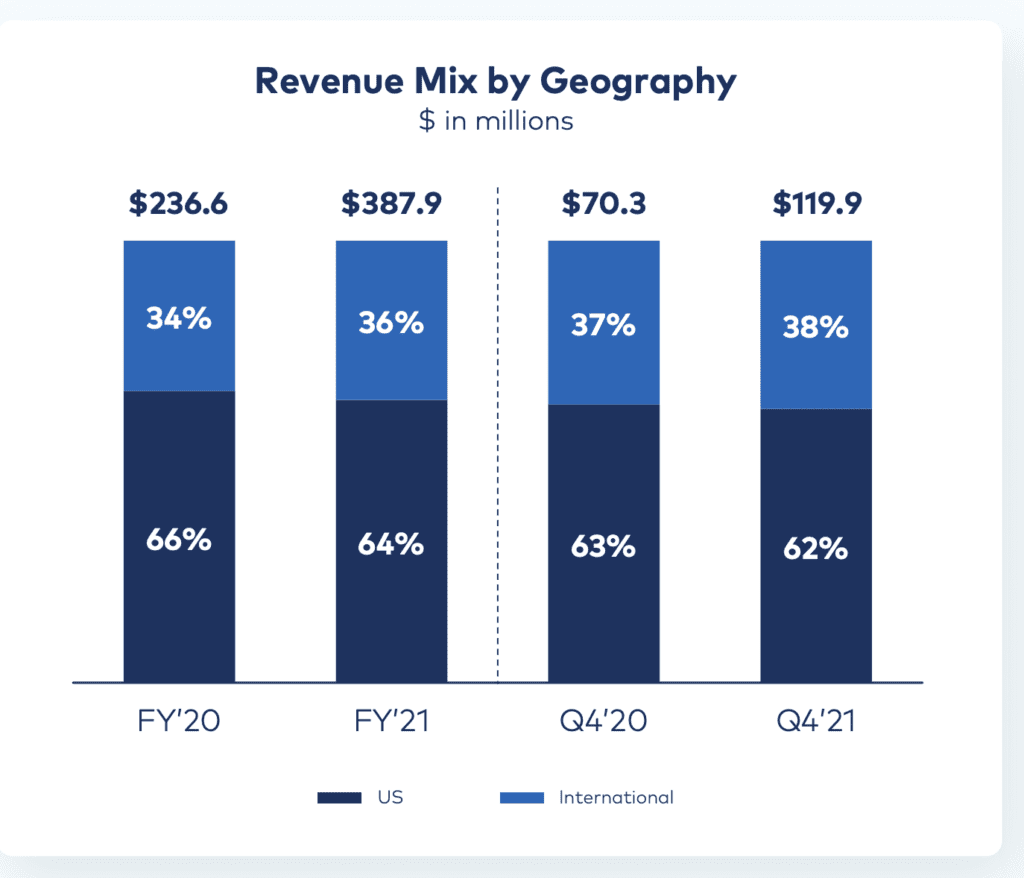

#2. Most customers still run Confluent on their own compute, but Cloud rapidly growing. Like GitLab and other enterprise leaders for developing software, a lot still runs on private clouds, servers, and more. But that’s changing, and Confluent is a visceral example of that. From 13% Cloud revenue in 2020 to 28% today, just 2 years later.

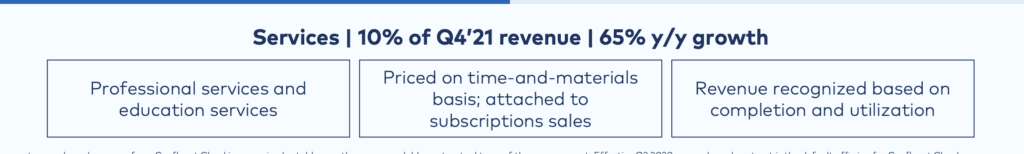

#3. Professional Services are About 10% of Revenues — And They Almost Break Even on Them. We’ve seen a variety of approaches here to Cloud companies at scale, and most (although not all) try to keep services under 10% of their revenues or so, including Confluent. Some like Qualtrics price services to still make money. But Confluent’s approach is perhaps the most common. They are running a -5% to 0% gross margins the past few years, i.e., pricing their services to just about break even.

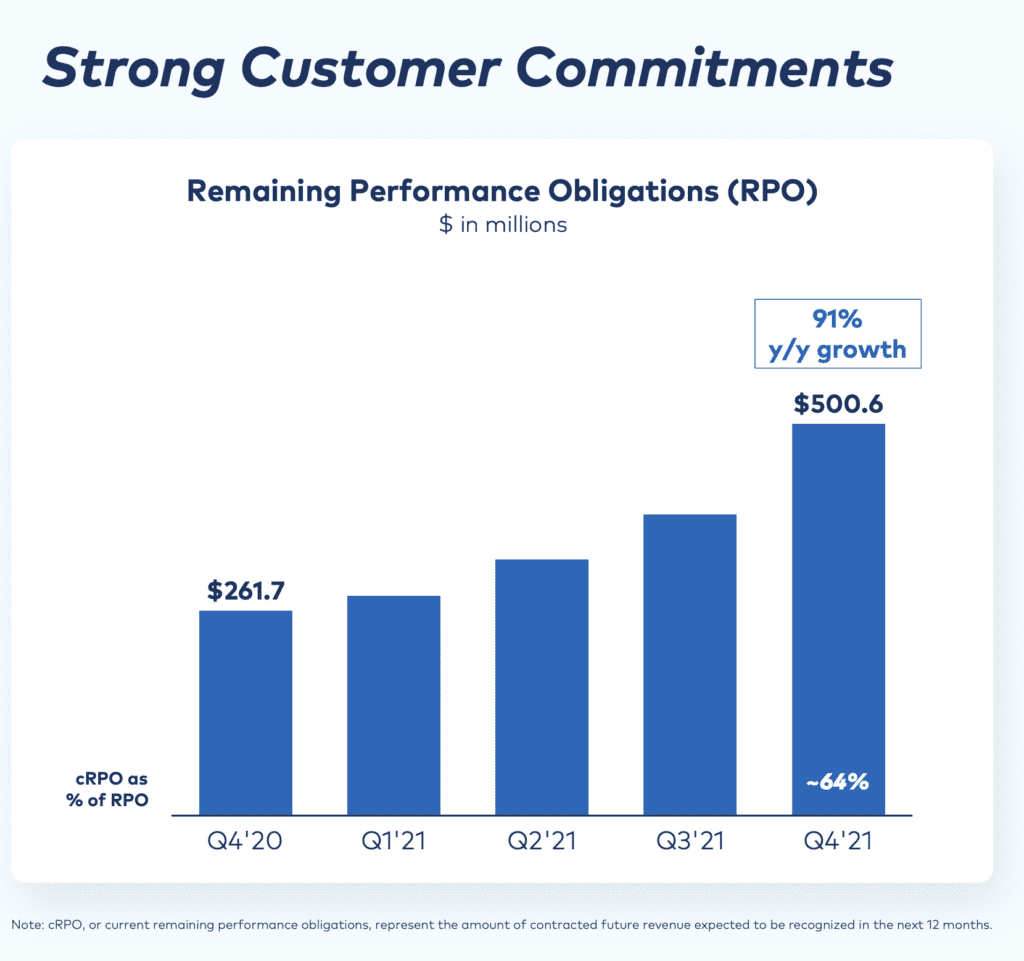

#4. RPO up 91% year-over-year. RPO is all future revenue commits. This is becoming a more and more important KPI for all public and later-stage SaaS companies. Investors want to see your RPO higher than your annual growth rate. If it is — everyone gets excited.

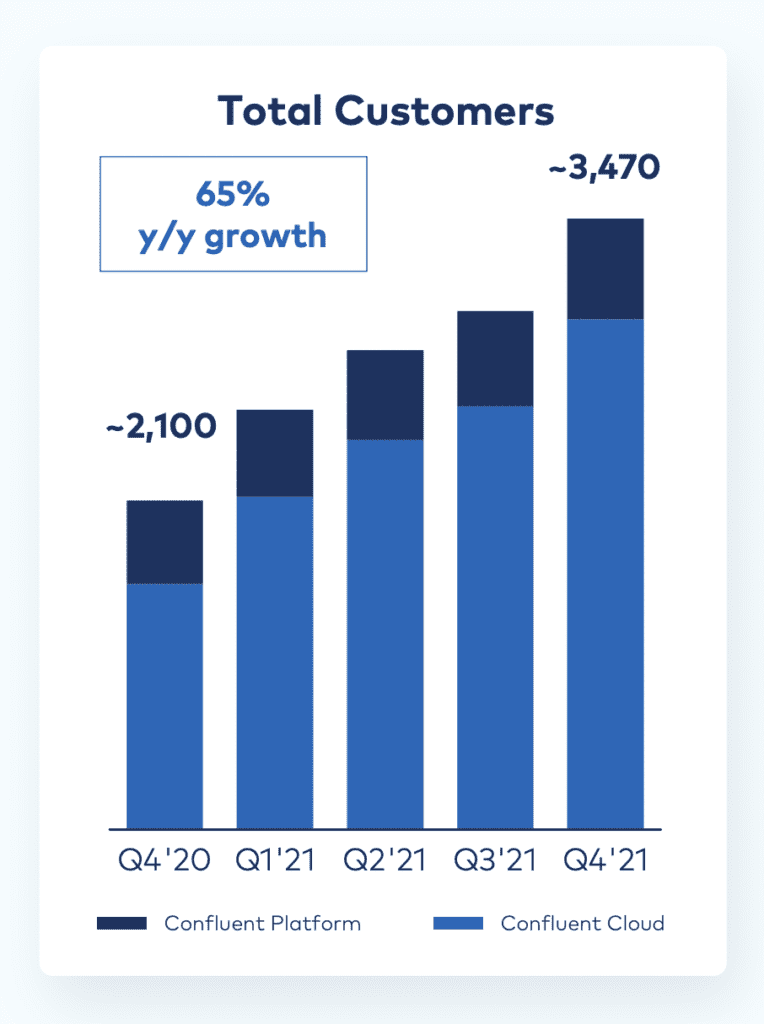

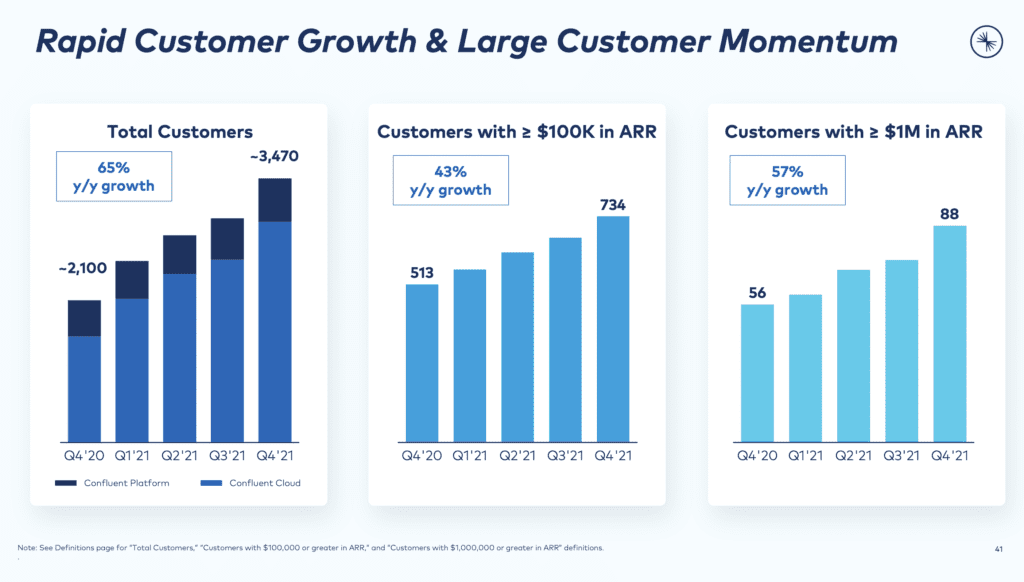

#5. 65% growth in customers paired with 71% revenue growth. This truly is the golden ratio. If your NRR is > 120% or so and your customer count growth is almost as high as your revenue growth, that’s when the true magic of compounding sets in. As your customer count growth falls below half your revenue growth — that’s a sign of relying more on your existing customer base than on new ones to scale. And a sign in a few years, growth may stall.

And a few other interesting learnings:

#6. International slowly growing from 33% to 40% of revenue. This is fairly consistent with what we see with other SaaS and Cloud leaders that started in the U.S., but whose products can easily be used by businesses everywhere. Invest here if that’s you.

#7. ~2,000 employees or about $250,000 in revenue per employee. This is pretty standard for high-growth Cloud companies, although not terribly efficient. $300,000-$350,000+ is relatively efficient for a sales-driven model. But they need the headcount to grow this quickly.

#8. Not free-cash positive yet. Confluent is still investing in hyper-growth, and may, like Snowflake, not end up generating significant free cash-flow until $1B in ARR or so. Having said that, burning a net $100m a year isn’t that huge given the company is adding $400m in new bookings. With $2B in cash on the balance sheet, it makes sense to invest as much here as the public markets will allow, given the torrid growth:

#9. Once again, going upmarket is key to hypergrowth at scale. $1m+ ACV customers are growing 57% a year. And interestingly, $1m+ customers are growing even faster than $100k+ customers. You often see that when a sales team starts to get really, really good at closing big deals. Still, overall customer count is growing the fastest at 65%, so Confluent isn’t leaving the small folks behind. Confluent is still sticking with its developer-focused, self-serve, and PLG motions to get going. That’s good to see. Customers also start with and stick with a primarily consumption-based model.

#10. A PLG+ Sales Motion, at least in part. Like MongoDB and other leaders with similar models, many customers start with free or pay-as-you-go plans and sales monitors usage. They engage once they see metrics that cross a certain threshold:

“This is often done with free credits or in a pay-as-you-go model that lets them start quickly and with low risk. In 2021, the traction of our self-service cloud adoption helped us grow our customer base 65% year-over-year to approximately 3,470 customers. Our sales team engages early in the customer life cycle to help customers that are progressing towards production to ensure their needs are met.”

#11. NRR of 130%. Impressive, although fairly consistent with other somewhat similar core consumption-based B2D models. So about what we’d expect. Even more impressive, they are committing to keeping NRR at 130%+. Another reminder top-tier NRR can scale just about forever in SaaS and Cloud.

“Driven by strong gross retention and expansion across both of our product offerings, NRR was comfortably above 130%. This marks the third consecutive quarter of exceeding both our near-term target of greater than 120% and our long-term target of greater than 130%”

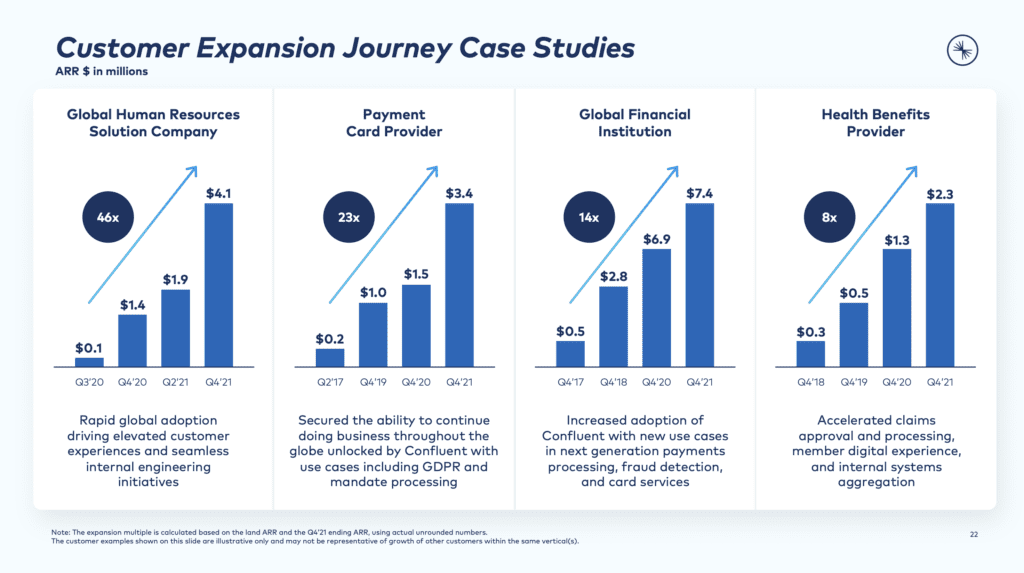

I also really like this visualization of the power of select customer account expansion over the years:

Wow, what a story!